🧭 Understanding the Basics of Bollinger Bands

Imagine you’re walking through a mysterious forest, and you have a magical map that shows you the safest paths, the dangerous areas, and the hidden treasures. In the world of trading, Bollinger Bands are kind of like that magical map, but for navigating the waves of market prices. Created by John Bollinger in the 1980s, these bands are simple yet powerful tools. Picture a moving average – which is just the average price of an asset like Bitcoin over a specific period – with two tracks running along either side. These tracks or “bands” widen or narrow based on how volatile or bouncy the market is. When the band widens, it’s like the market is shouting, “I’m moving a lot!” and when it narrows, it whispers, “I’m taking a break.” By reading these signs, traders can get clued into potential price movements before they happen.

| Component | Function |

|---|---|

| Moving Average | Shows the average price over a specific time period, acting as the baseline. |

| Upper Band | Indicates a higher price range, widening in times of increased volatility. |

| Lower Band | Signals a lower price range, narrowing when the market calms down. |

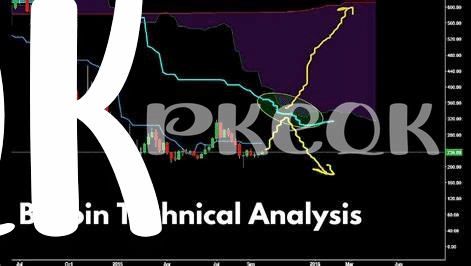

💰 Bitcoin’s Dance with Market Volatility

Bitcoin, much like a dancer moving gracefully yet unpredictably, waltzes through the highs and lows of market volatility with a rhythm that can be both mesmerizing and nerve-wracking for investors. Its value can shoot up, making your heart race with excitement, or plummet, leaving you anxious about the future. This roller coaster is part of what makes Bitcoin an interesting player in the financial world. Understanding its movements is crucial for anyone looking to step into this digital currency space. Just as a dancer must respond to the music, Bitcoin responds to various factors including economic events, investor sentiment, and technological advances. Each movement, whether up or down, tells a story of supply and demand, of fear and greed. Embracing this volatility, rather than fearing it, can be key to spotting potential opportunities for profit in the ever-changing crypto market landscape. For those looking to dive deeper into Bitcoin’s role in the broader economic picture, a closer look at https://wikicrypto.news/exploring-the-truth-behind-bitcoins-environmental-impact can provide valuable insights.

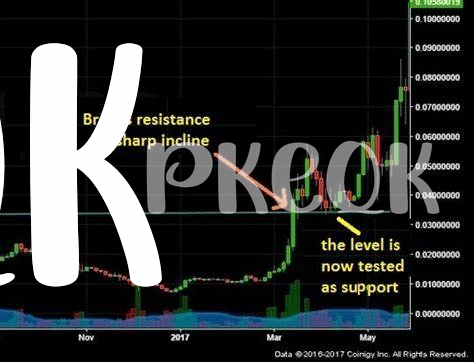

📈 Spotting Profit Opportunities with Bollinger Bands

Imagine you’re on a boat in the middle of the ocean. The waves represent the ups and downs of Bitcoin prices. Now, Bollinger Bands are like your compass, helping you navigate through these waves to find treasures – the profit opportunities. 🚣♂️💰 Bollinger Bands work by showing you when the Bitcoin sea is calm and when it starts getting stormy. When the sea (or the price) starts to calm down, it’s like the band squeezes together, telling you that it might be a good time to sail out and buy. On the other hand, when the waves get bigger, and the bands expand, it’s a sign that the sea is getting rough, and a price shift is coming, possibly a good time to sell and secure your treasure. 🌊🔍 The trick is in learning how to read these signs accurately, avoiding mirages of false signals, and not getting lost at sea. By mastering this, you can make the most of the volatility in the ocean of Bitcoin.

🚦 When to Buy or Sell: Clear Signals

Imagine trying to catch the best waves to surf – that’s akin to finding the perfect time to buy or sell Bitcoin. Bollinger Bands, like a savvy surfer’s keen eye, can signal when the crypto sea is just right. When the bands tighten, it’s like the sea going calm, hinting that a big wave (or price move) might be brewing. Conversely, if the bands spread wide, the big wave might have already crashed, suggesting it might be time to wait for the next one.

In the midst of navigating through the choppy waters of Bitcoin’s price changes, understanding the nuances of market movements becomes crucial. Whether you’re planning your next move or just curious about how Bitcoin and its prices interact with real-world events, diving into insights on bitcoin and inflation explained could offer valuable perspectives. Steering clear of common missteps, such as acting on impulse without reading the signals properly, ensures your trading journey is both profitable and enlightening.

🙈 Common Mistakes to Avoid with Bitcoin Trading

Diving into the world of Bitcoin trading, it’s easy to get swept up by the excitement and potential for profit. However, a few common slip-ups can turn an optimistic venture into a cautionary tale. First off, letting emotions guide your trading decisions is a big no-no. Whether it’s the fear of missing out (FOMO) driving you to buy at a peak, or panic selling when prices dip, emotional reactions are often a trader’s worst enemy. Another oversight is neglecting to do your homework. Understanding the ins and outs of the market, and how external factors can influence Bitcoin’s value, is crucial. Perhaps you’ve skipped setting stop-loss limits, inadvertently exposing yourself to bigger losses than necessary. Or maybe you’ve put all your digital eggs in one basket by not diversifying your investments, amplifying your risk.

Here’s a quick look at some of the pitfalls to avoid:

| Mistake | Description | Impact |

|---|---|---|

| Emotional Trading | Allowing fear or excitement to drive decisions. | Can lead to buying high and selling low. |

| Poor Research | Not staying informed on market trends and news. | May result in missed opportunities or ill-timed trades. |

| Neglecting Stop-Loss Limits | Failing to set a maximum loss threshold. | Increases potential for significant financial loss. |

| Lack of Diversification | Investing too heavily in a single asset. | Risks amplifying losses if that asset underperforms. |

By steering clear of these pitfalls, traders can better navigate the tumultuous waves of Bitcoin trading, aiming for a more secure and profitable journey.

🔄 Adjusting Strategies in Fast-paced Crypto Markets

In the lightning-quick world of cryptocurrency, where Bitcoin’s value can dance to the rhythm of market sentiment, staying on your toes with adaptable strategies is key. Picture this: you’re surfing on the high waves of the crypto ocean, where conditions change faster than weather in spring. To not only stay afloat but also catch the best waves, your approach needs flexibility and a keen eye on market trends. Embracing change and being ready to pivot your trading methods can mean the difference between riding a majestic wave of profits or wiping out into the sea of missed opportunities. It’s essential to keep learning, too. For example, delving into the truths and busting the myths about Bitcoin can offer fresh insights, enhancing your strategy toolkit. A great resource for broadening your horizon is looking into detailed explanations like those found in bitcoin for small businesses explained, offering a treasure trove of knowledge. Remember, in the fast-evolving crypto markets, your best bet is to be as adaptable as the technology itself, always ready to adjust your sails to catch the next big wind of opportunity.