Why Bitcoin Fees Matter for Your Business 🏦

Imagine you run a small bakery downtown, where every penny counts towards your success. Entering the digital currency world, like Bitcoin, opens a new avenue for customer payments, but it’s not just about saying “Yes” to Bitcoin. Here’s the kicker: every Bitcoin transaction comes with a fee. Why does this matter? Think of it as the cost of moving money on this digital highway. Unlike traditional banks with their set fees, Bitcoin fees can vary based on how busy the network is or how quickly you want the transaction to settle. This means, during peak times, it could cost you more to receive a payment for that mouth-watering chocolate cake. Here’s a real kicker: understanding these fees can significantly impact your bottom line. By getting smart about this, you can save on expenses and keep more dough in your bakery. And who doesn’t want that? Take a look at the table below, breaking down a simple comparison:

| Transaction Type | Traditional Bank Fee | Bitcoin Fee Range |

|---|---|---|

| Credit Card Payment | 2-3% | $1-$5* |

| Wire Transfer | $15-25 | $3-$10* |

| International Transaction | $35-50 | $5-$20* |

*Fees can vary based on network congestion and transaction speed priority.

This comparison highlights how Bitcoin fees can fluctuate but also potentially offer savings over traditional banking fees, making it a vital piece of knowledge for your business finance strategy.

Decoding How Bitcoin Fees Work 🧬

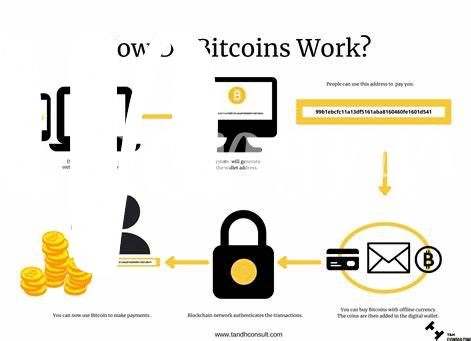

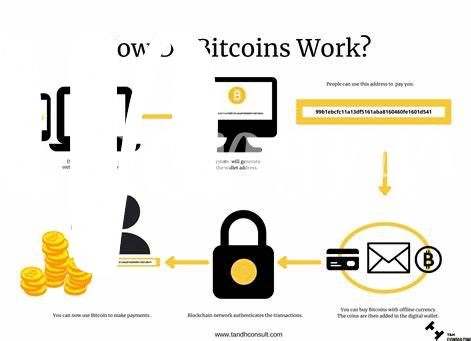

Understanding how much it costs to send and receive Bitcoin can feel a bit like figuring out a puzzle. But once you get the hang of it, it’s really quite straightforward. Imagine every Bitcoin transaction as a mini-package of information. This package needs to travel from sender to receiver, and for its journey, it needs a courier – in the Bitcoin world, these couriers are called miners. Miners use powerful computers to confirm and secure transactions on the blockchain, the technology that underpins Bitcoin. They don’t do this for free, though. The fee you pay is essentially a tip to encourage them to pick up and deliver your package quickly.

The size of this “tip” varies. It’s not determined by how much Bitcoin you’re sending but rather how much data your transaction takes up in the blockchain ledger. During busy times, the blockchain gets crowded, and just like rush hour traffic, everything moves slower unless you pay a bit more to get priority. It’s a marketplace of sorts, where you decide how fast you want your transaction to go by the fee you’re willing to pay. Understanding this can help small businesses plan and save on transaction fees. For a deeper dive into security and efficiency in Bitcoin transactions, a helpful resource is https://wikicrypto.news/secuity-and-anonymity-in-bitcoin-transactions.

Calculating Bitcoin Fees for Everyday Transactions 💰

When thinking about including Bitcoin in your everyday business dealings, a bit of math is needed to understand just how much you’ll be spending or saving. You see, the fee for sending Bitcoin can change, based on how busy the network is and how quickly you want the transaction to go through. Imagine it as a busy highway; the more cars (transactions) there are, the more you might have to ‘pay’ to get ahead quickly. To figure this out, there are handy tools and calculators online that let you input how much Bitcoin you’re sending and how fast you need it to get there. They use this info to give you a fee estimate. 🚗💨 Remember, these fees are paid in Bitcoin, so when its value goes up, your fees in dollar terms do too. Plus, timing can be everything; sending transactions during less busy times can save you some coins. So, with a bit of planning and smart tools, managing these fees becomes just another part of your business routine, ensuring more of your money stays in your pocket. 🧰💡

Strategies to Minimize Bitcoin Fees for Savings 🛠

When diving into the world of digital currency, understanding how to save on transaction fees can be like finding buried treasure. One appealing method to reduce costs is by timing your transactions wisely. You see, the Bitcoin network can get pretty busy, and just like rush hour traffic, more congestion means higher fees. Sending your transactions during off-peak hours can help you save on fees, almost like choosing a less crowded road to avoid traffic jams. Moreover, using a Bitcoin wallet that lets you customize the fee you pay can be a game-changer. This allows you to strike a balance between how fast you want your transaction to be processed and how much you’re willing to pay for it.

To navigate these waters safely, a deeper understanding of the ins and outs of Bitcoin transactions is crucial. For those looking to expand their knowledge on not just Bitcoin, but also the wider world of digital currencies, including NFTs, make sure to check out bitcoin and nfts explained. This resource can be your compass in the ever-evolving landscape of cryptocurrency, guiding you through complexities and helping you make informed decisions. Remember, in the digital sea of possibilities, knowledge is your most valuable currency.🚢💡

Real World Examples: Bitcoin Fees in Action 🌍

Imagine you run a cozy coffee shop in the heart of the city, where people pay for their coffee using Bitcoin. One day, a regular customer pays for his usual espresso, and the transaction fee is surprisingly low, just a few cents. The following week, the same customer comes in, and this time, the fee is noticeably higher for the same transaction. What’s happening? Well, Bitcoin fees can change a lot depending on how busy the network is. When lots of people are sending Bitcoin, the fees can go up because there’s more competition to get transactions added to the Bitcoin ledger. This fluctuation is a perfect real-world glimpse into how Bitcoin fees operate on a day-to-day basis, affecting both small businesses and customers.

To give you a clearer picture, let’s dive into an example of an online bookstore. They’ve decided to accept Bitcoin as payment for their wide range of books. Over time, they notice a pattern:

| Time of Year | Average Bitcoin Fee |

|---|---|

| January (Holiday returns and sales) | Higher |

| July (Slower retail period) | Lower |

This isn’t just coincidence. During busy shopping seasons, not only does the bookstore see more sales, but the Bitcoin network sees more transactions. This leads to higher fees in peak times. Understanding this pattern helps the bookstore and its customers make smarter decisions about when to use Bitcoin for transactions, showcasing a strategic approach to navigating the ever-changing world of Bitcoin fees.

Future of Bitcoin Fees: What to Expect 🚀

As we look towards the future, it’s clear that understanding the dynamics of Bitcoin fees will be increasingly crucial for small businesses engaging in digital currency transactions. Imagine a world where the fluctuating costs of transactions don’t catch you by surprise because you’ve got a solid grasp of how these fees are evolving. With advancements in blockchain technology and greater adoption of Bitcoin across the globe, we can anticipate a landscape where fees become more predictable, thanks to improvements in transaction efficiency and scalability solutions like the Lightning Network. This doesn’t just mean potential savings for your business; it also opens up opportunities for engaging with a global customer base more easily and affordably. Additionally, staying informed about these changes can help businesses make smarter decisions when integrating Bitcoin into their payment systems. For a deeper dive into how these transactions work and the role of public ledgers in the mix, check out bitcoin and public ledgers explained. This blend of forward-looking insights and practical strategies could be the key to not just surviving but thriving in the rapidly evolving digital currency ecosystem.