Unpacking the Basics: Bitcoin Vs. Traditional Money 💼

Imagine two friends wanting to send pocket money to each other: one uses a nifty digital coin (Bitcoin), and the other relies on good ol’ cash or bank services. Bitcoin, a type of digital money, is like a virtual coin you can send through the internet, contrasting with traditional money that involves physical cash or digital transactions through banks. So, what makes them tick differently? For starters, Bitcoin operates on a technology called blockchain, a secure chain of information that’s tough to tamper with, offering a futuristic twist on sending and keeping money. Meanwhile, traditional money’s journey involves banks or services like Western Union, known and used for years, with a more hands-on approach to security and regulation. Here’s a snapshot to give you a clearer picture:

| Feature | Bitcoin | Traditional Money |

|---|---|---|

| Technology | Blockchain | Banking Systems |

| Physical Form | No | Yes |

| Regulation | Decentralized | Regulated by Governments |

| Security | High (due to encryption) | Variable (depends on institutions) |

While Bitcoin shines with its cutting-edge tech and freedom from traditional banking constraints, it’s a whole new world compared to the familiar terrain of conventional money transfers—each with its unique pros and cons. This clash of digital vs. traditional paints a vivid picture of the choices we have in moving money today.

How Fast Is Your Money Moving? the Speed Test 🚀

When you send money to a friend across the globe, how quickly does it reach their wallet? With traditional banks, it might take days, especially if you’re weaving through the weekends or holidays. But here’s where things get interesting – enter Bitcoin. Imagine sending money as easily as sending a text message, and voila, it’s there almost instantly, no matter the time or day.

Now, if you’re curious about diving deeper into how Bitcoin is shaking up the finance world, especially against traditional giants, you might find this intriguing: https://wikicrypto.news/central-banks-vs-bitcoin-a-2024-adoption-showdown. This exploration is not just about speed but understanding the changing tides in how we view, use, and transfer our money in a digital age. Fasten your seatbelts; we’re in for a swift ride!

Safety First: Assessing the Security of Your Funds 🔒

When it comes to keeping your money safe, the digital world offers new doors but also new challenges. Think of Bitcoin as a fortress with advanced locks – your funds are encrypted, meaning they’re turned into complex codes that are tough to crack. On the other hand, traditional banking systems have their own guards and walls, with years of experience in protecting money. Yet, they are not immune to the sneakiness of modern-day digital robbers who have learned to breach even the toughest of vaults.

The difference really shines through when we consider how these methods react to unauthorized access. Bitcoin operates on a ledger that is public, yet extremely difficult to alter without alerting the whole network, making fraud a tough job for hackers. Conversely, traditional systems rely heavily on personal information, which can be a double-edged sword. If this info falls into the wrong hands, it’s like giving a thief the keys to your treasure chest. Heading into 2024, our approach to securing our funds must be as dynamic as the technology around us.🔍🌐🛡️

Crunching Numbers: the Cost of Sending Money 💸

When it comes to the cost of sending money, the landscape is changing rapidly 🌍💸. Traditional banks have long ruled the roost, often charging a pretty penny for international transfers, not to mention the hidden fees that sneak up on you. Then there’s Bitcoin, stepping in with the promise of lower costs. But it’s not just about the fee you see upfront; it’s about the overall cost efficiency. For example, using Bitcoin for international transfers can sidestep many of the pesky bank charges, making it a potentially cheaper option. However, it’s essential to stay informed and understand the nuances of using cryptocurrencies like Bitcoin. A great starting point is how to engage in bitcoin futures trading in 2024, which can offer insights into cost implications and more. As we look to the future, the cost of sending money, whether through traditional means or new platforms like Bitcoin, will continue to be an essential factor for users worldwide 🚀🔍.

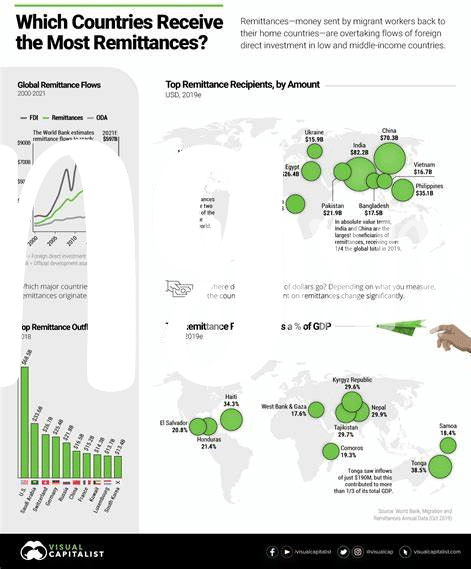

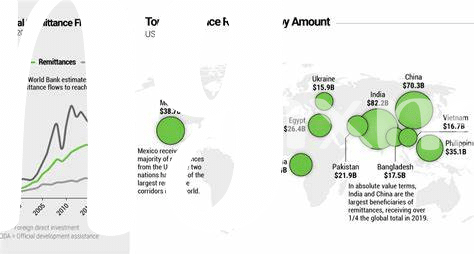

Borderless Transactions: Sending Money Worldwide 🌍

Imagine you have friends or family living in another corner of the world. You want to send them some money, maybe for a birthday or to help out in tough times. In the past, you might have had to deal with banks or money transfer services that charge high fees 🚀 and sometimes make you wait days or even weeks. Now, think about doing the same thing but faster, cheaper, and without worrying about where they are. This is where modern methods shine, making the world smaller and bringing us closer together 🌏.

Let’s take a look at how these methods stack up in a simple comparison:

| Feature | Traditional Methods | Modern Methods |

|---|---|---|

| Global Reach | Limited by networks and partnerships 🚶♂️ | Almost anywhere with internet access 🌐 |

| Cost | Often high due to fees and exchange rates 💸 | Lower, thanks to reduced overhead 🛒 |

| Speed | Can take days 🐢 | Often instant or within a few minutes ⚡ |

As we step into 2024, it’s clear that sending money has evolved. And with each passing day, the world isn’t just becoming a smaller place; it’s becoming more connected, making kindness and support just a click away.

Embracing the Future: Trends in Money Transfer for 2024 🔮

As we gaze into the crystal ball of 2024, we see the landscape of money transfer evolving with an exciting mix of technology and innovation. The wave of digital currency, led by Bitcoin, is not just knocking at our doors but has started reshaping how we send and receive money across the globe. With the introduction of newer, faster, and more secure technologies, sending money to a loved one half a world away or settling an invoice has never been easier or more cost-effective. Traditional barriers like high fees and long wait times are starting to crumble, making way for instant, borderless transactions that promise a world where financial inclusion is not just a dream but a reality. The spotlight on digital currencies also shines brightly on the importance of staying informed about significant events such as Bitcoin halving, which have a profound impact on the crypto landscape. For those curious about how these events align with central banks’ viewpoints on digital currency adoption, diving into the details is crucial here. As we embrace these changes, 2024 is poised to be a year where the lines between traditional and digital money transfer blur, offering us a glimpse into a future where the way we think about money is fundamentally transformed.