What Is Inflation Anyway? 📈

Imagine going to the store to buy a loaf of bread, only to find out it costs more than it did last month. That’s inflation in action – a sneaky force that slowly but surely eats away at the value of money. 📉 It’s like a silent thief, lessening how much bang you get for your buck over time. What causes it? Well, it can happen for a few reasons – from the government printing more money than usual to the prices of goods going up because there’s more demand than supply. 🌍 In simple terms, inflation means what you can buy with a certain amount of money today might not stretch as far tomorrow. Here’s a quick view:

| Year | Buying Power* |

|---|---|

| 2021 | $100 |

| 2022 | $95 |

| 2023 | $90 |

*This is a simplified example assuming a 5% annual inflation rate.

Introduction to Bitcoin: Digital Gold 🪙

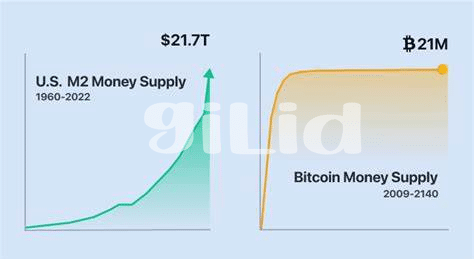

Imagine a world where your money is digital – secure, fast to transfer, and not controlled by any single government or bank. That’s the world of Bitcoin, a kind of digital money or “cryptocurrency” that’s been making waves since 2009. Just like you might consider gold a safe place to store value away from the ups and downs of the stock market, Bitcoin has earned the nickname “Digital Gold.” This isn’t just because it’s a digital asset, but because, like gold, there’s only a limited amount of it to go around, making it rare and valuable.

Bitcoin operates on a technology called blockchain, which is like a ledger or record book that’s spread out across thousands of computers. This means no single person or group has control over Bitcoin, making it a unique kind of money. And because you can send Bitcoin directly to someone else without going through a bank, it’s sort of like digital cash. If you’re curious about how Bitcoin keeps adapting and evolving, check out https://wikicrypto.news/navigating-bitcoin-software-updates-what-you-need-to-know for an insightful read on advancements in Bitcoin’s security and usability.

How Inflation Affects Your Pocket 🚀

Imagine going to the store and discovering that the price tag on your favorite chocolate bar has suddenly jumped higher than last week’s. This isn’t just a bad dream; it’s the reality of inflation. Inflation happens when money buys less than it used to, making everything from groceries to gas more expensive. 🚀 It’s like a silent thief, sneaking into your wallet when you’re not looking, and every time you get paid, it feels like your money is running through your fingers like water.

Now, think about saving money for something big, maybe a vacation or a new car. You’ve tucked away some cash, hoping it’ll grow over time. But here comes inflation again, nibbling away at the value of those savings. Getting that car or dream trip feels like it’s moving further out of reach, doesn’t it? That’s inflation at work, quietly eating into your pocket and making it harder for your money to keep its value over time. 🛒📉

Bitcoin’s Role as a Safe Haven 🛡️

Imagine you’re looking for a sturdy box to keep your valuable things safe from a storm. In the financial world, when the storm—aka inflation—threatens to wash away the value of your money, many turn to Bitcoin as their box. It’s like a digital fortress, designed to be secure and unaffected by the usual ups and downs that can erode the value of traditional money. This digital fortress gains more trust, especially when people see their purchasing power going down the drain because the cost of living is climbing up.

Within this digital haven, there’s a smart way to ensure your treasure stays extra secure: cold storage methods for securing your bitcoin explained. It’s a bit like burying your treasure chest underground, where it’s away from prying eyes. The idea is, even as prices of things keep going up (hello, inflation!), your digital gold stays put, not just intact but often growing stronger. This modern-day treasure doesn’t just sit pretty either; it offers a beacon of hope for many seeking shelter from the unpredictable waves of the economy. 🌊💼

Comparing Bitcoin and Traditional Inflation Hedges 💱

When looking at how to protect our money from losing value, folks usually turn to things like gold or property, but now there’s also Bitcoin, a new digital player on the scene. Imagine having a shield to guard your savings against the invisible monster that is inflation; traditionally, gold has been that shield for centuries, trusted for its value-holding capabilities. Now, think of Bitcoin as the modern, digital shield. It’s like protecting your savings in a digital fortress, inaccessible to the pesky monster. But how do these two compare? Well, gold is the old, wise warrior—its value is as stable as a rock, tried and tested through time. On the other hand, Bitcoin is the new kid on the block, volatile and unpredictable, yet, offering the allure of potentially higher returns. Both have their merits, with Bitcoin providing easier access and gold being the symbol of timeless value. The choice between them is like deciding between a traditional, sturdy safe and a modern, high-tech security system. Here’s a quick glance at their features:

| Feature | Gold | Bitcoin |

|---|---|---|

| Stability | High | Low |

| Accessibility | Medium | High |

| Potential Returns | Steady | High |

| Hedge Against Inflation | Strong | Potential |

Whether you opt for the traditional security gold offers or the exciting, digital frontier that Bitcoin represents, both serve as tools in your fight against inflation, each with its unique strengths and weaknesses.

The Future: Bitcoin and Inflation Trends Ahead 🔮

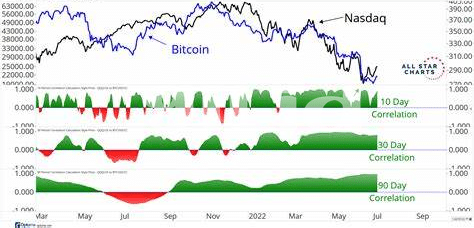

Looking into the crystal ball 🔮, trying to predict how Bitcoin and inflation will dance together in the future could be similar to forecasting the weather in a notoriously unpredictable region. But let’s venture a guess. As digital currencies become more intertwined with our daily lives, Bitcoin could potentially play a bigger role in the global economy. Imagine a future where instead of tucking away gold bars or stashing dollars under the mattress, people turn to Bitcoin to protect their wealth from the sneaky thief that is inflation 🚀. With advancements in technology and increasing acceptance, Bitcoin might just become a mainstream method for safeguarding purchasing power. However, the road ahead is not without bumps. The volatile nature of Bitcoin, amplified by events such as the history of bitcoin prices and what drives changes explained, poses questions about its stability as a safe haven. Yet, the underlying technology continues to evolve, perhaps leading to a more mature and stable digital currency era 💱. Only time will tell if Bitcoin can truly become a digital fortress against inflation, but it’s an exciting possibility that has many looking towards the future with anticipation.