🍕 the Day Two Pizzas Made History

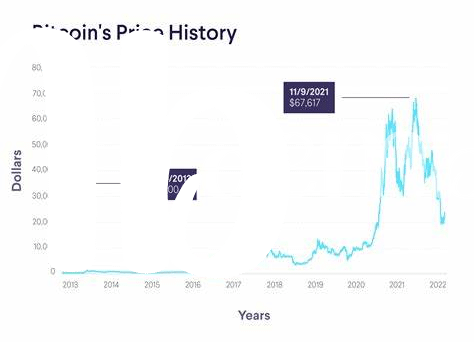

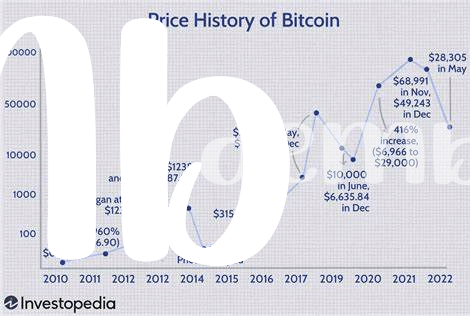

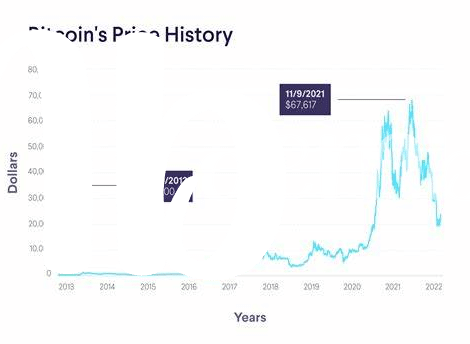

Imagine a world where your dinner could turn you into a millionaire. Sounds like a fairy tale, right? But back in 2010, something just like that happened. A guy named Laszlo Hanyecz decided he wanted some pizza and offered to pay 10,000 Bitcoins for two of them. Yes, that’s right – 10,000 digital coins for what seems like an everyday meal. At that time, Bitcoin was a curious new thing, barely worth a few cents. Nobody really thought much of it, and certainly not as something you could use to buy dinner with. Yet, someone took up Laszlo’s offer, making this the first-ever recorded purchase of a good with Bitcoin. This quirky tale isn’t just a fun pizza party story. It marks the moment when Bitcoin began stepping out from the shadows of the internet into the real world. People started to see that this “internet money” could actually be used for real-world exchanges. Let’s just say that if Laszlo had held onto those Bitcoins, he’d be sitting on a fortune today. Here’s a quick peek at how much Bitcoin’s value has evolved since that fateful pizza day:

| Year | Value of 1 Bitcoin |

|---|---|

| 2010 (Pizza Day) | ~$0.004 |

| 2021 | ~$60,000 |

Crazy, right? From a couple of pizzas to millions in value, Bitcoin’s journey started with a simple, yet historic, purchase.

📈 First Leap: Bitcoin’s Breakout Moment

Imagine a time when something as digital and intangible as Bitcoin began to catch the eyes of the curious and the daring. This moment wasn’t just any ordinary day; it was when the world started to believe that Bitcoin could be more than just internet money. It was a period filled with excitement and a bit of mystery, as people watched the value of Bitcoin climb from mere pennies to significant dollars. The buzz around it grew louder as it made its first major leap in value, marking its entry into the world of serious financial conversations. People who had never before considered investing in digital currencies started to pay attention, wondering if they too should dive into this novel ocean of potential wealth. It was a time that left a permanent mark on the timeline of financial revolutions, teaching us that sometimes, the most unlikely contenders can become champions in the global economy. To delve deeper into how innovation continues to shape the financial landscape, especially in the realm of digital currencies, check out how the inclusion of hydroelectric power is making Bitcoin mining greener and more sustainable at https://wikicrypto.news/the-role-of-hydroelectric-power-in-green-bitcoin-mining.

🚀 Hitting $1,000: Crossing the Four-digit Mark

Imagine opening your computer to find out that a digital coin, mainly known among tech enthusiasts until then, had suddenly jumped in value, crossing a line many wouldn’t have believed possible just a few years back. This wasn’t just any line; it was the move past the $1,000 mark, a momentous occasion that took the world by storybook surprise. It felt like witnessing a rocket launch, except this rocket was made of complex computer code and dreams of a financial revolution.

This leap wasn’t just a number change—it was a symbol that Bitcoin was becoming something big, something that could no longer be ignored. People who had been collecting or trading Bitcoin in the shadows of the internet started to see their patience pay off, and the world began to take notice. Onlookers, skeptics, and enthusiasts alike were glued to their screens, watching the price dance. This was more than a financial milestone; it was a chapter in a larger story about how we view and deal with money itself, pushing us to question the very nature of value and exchange in the digital age.

💥 2017: the Rollercoaster Year Explodes

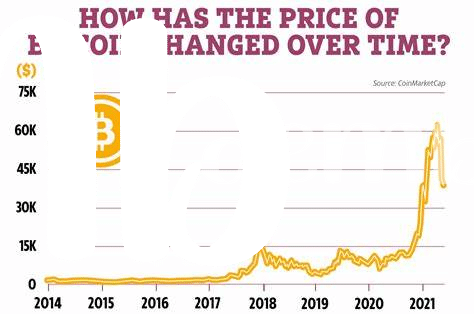

Imagine a rollercoaster that starts slow, teasing you with calm ascents before plummeting you into a thrilling descent, and then, just when you think you’ve got a handle on it, it shoots you up into the sky at breakneck speeds. That’s a bit like what happened in the world of Bitcoin in 2017. The year kicked off with Bitcoin already making noise, but what followed was beyond anyone’s wildest dreams. Prices soared, smashed barriers, and reached heights that left even the skeptics gawking. At one point, Bitcoin flirted with the $20,000 mark, turning digital wallets into goldmines overnight. It was a year that not only minted millionaires but also marked a significant shift in how cryptocurrencies were viewed. Beyond just a speculative asset, Bitcoin was suddenly being talked about in the same breath as gold, a digital safe-haven for investors around the globe. Amidst this frenzy, the conversation around Bitcoin’s technology, the blockchain, gained more attention, sparking discussions on its potential beyond just powering cryptocurrencies. It was during this electrifying time that the importance of preparing Bitcoin for future challenges was highlighted, leading to interesting conversations like how to safeguard it against emerging threats, such as quantum computing. To dive deeper into this topic, check out how experts are preparing bitcoin for quantum computing threats explained. The journey through 2017 was not just about the highs, though; it taught the Bitcoin community valuable lessons on volatility, investor sentiment, and the importance of technological adaptability.

📉 the Great Dip: Learning from the Falls

Even when everything seems to be going down, there’s always a lesson to be learned – just like during a time when the value of Bitcoin took a nosedive. Imagine, after climbing to the top of the hill, suddenly sliding all the way back down, only to find there are trampolines at the bottom to bounce you right back up. That’s a bit like what happened. This period, often called a reality check, wasn’t just about the decrease in numbers. It was a moment for everyone interested in Bitcoin to really understand what they were investing in – not just a digital coin, but the idea and technology behind it.

The interesting thing about this fall was not just the dip, but what happened afterwards. People began to look more into what makes Bitcoin tick – the blockchain technology. This curiosity and understanding helped lay the foundation for a more informed and resilient community. As we learned, it’s not just the highs that matter, but how we use the lows to build something even stronger.

| 🧐 Lesson | 🔄 Impact |

| Understanding the Value | Increased knowledge on what drives Bitcoin’s worth |

| Blockchain Technology | Expanded interest beyond Bitcoin to its underlying tech |

| Community Resilience | Greater collective wisdom and preparation for future dips |

🔗 Blockchain Buzz: Beyond Just Bitcoin Value

When people talk about Bitcoin, the focus is often on its price – how it goes up and then sometimes tumbles down. But there’s something more lasting and potentially more revolutionary happening here 🌟. It’s called blockchain, the tech behind Bitcoin. Imagine it as a digital ledger that’s open for everyone to see. It’s this technology that’s got folks excited, not just because it powers Bitcoin, but because of its potential to change how we do everything from voting to keeping our online identities secure.

Now, beyond its price, Bitcoin has been a key player in funding for good causes. Yes, the world of digital currency is not just about making money. It’s also about giving back in innovative ways. For instance, have you heard about philanthropic initiatives funded by bitcoin donations explained? This includes efforts to find renewable energy solutions for bitcoin mining operations, ensuring it’s not just wealth that’s being generated but a positive impact on our planet 🌍. The buzz around blockchain is not just noise; it’s a melody of potential, innovation, and philanthropy playing together.