📜 Overview of Bitcoin Trading Regulations

Bitcoin trading regulations in the Maldives govern the buying and selling of cryptocurrencies within the country. These regulations aim to ensure transparency, security, and investor protection in the digital asset market. Understanding and following these rules is essential for traders and exchanges to operate legally and maintain trust among stakeholders. By staying compliant with the established guidelines, individuals and businesses can contribute to a safer and more stable environment for cryptocurrency transactions in the Maldives.

💡 Key Compliance Requirements for Traders

Bitcoin traders in the Maldives must adhere to strict compliance requirements to ensure the legality and security of their transactions. One fundamental aspect is the need to verify customer identities and maintain clear records of all trading activities. Additionally, implementing robust security measures to protect against fraud and cyber threats is paramount. Compliance also entails staying updated on regulatory changes and promptly addressing any issues or concerns raised by the authorities. By following these key requirements diligently, traders can operate confidently within the legal framework and contribute to a more transparent and trustworthy cryptocurrency trading environment in the Maldives.

💼 Registration Process for Cryptocurrency Exchanges

Cryptocurrency exchanges in the Maldives follow a structured registration process to operate within the legal framework. Understanding the requirements and providing necessary documentation is key to obtaining the necessary approvals. The registration process typically involves submitting detailed information about the exchange, its ownership structure, compliance procedures, and security measures. Additionally, exchanges may need to demonstrate their ability to protect customers’ funds and adhere to anti-money laundering regulations. By completing the registration process meticulously, cryptocurrency exchanges can establish credibility within the market and gain the trust of traders seeking a secure and compliant platform to engage in digital asset transactions.

🛡️ Anti-money Laundering Measures in Place

Bitcoin trading in the Maldives is subject to stringent anti-money laundering measures. These measures are in place to prevent illegal activities such as money laundering and terrorist financing. Traders are required to adhere to strict guidelines and procedures to ensure the legitimacy of their transactions, including thorough customer due diligence checks and the reporting of any suspicious activities to relevant authorities. These measures aim to promote transparency and accountability within the cryptocurrency market, safeguarding both investors and the integrity of the financial system.

For further insights into the legal consequences of Bitcoin transactions in Luxembourg, you can refer to this informative article on WikiCrypto News: Legal Consequences of Bitcoin Transactions in Luxembourg.

💸 Tax Implications of Bitcoin Trading in Maldives

The tax implications of Bitcoin trading in the Maldives can vary depending on the nature of the transactions and the individual’s tax status. It is important for traders to keep detailed records of their cryptocurrency activities, including purchases, sales, and any related expenses. This information will be crucial for accurately reporting capital gains or losses to the tax authorities. Additionally, it is advisable to seek guidance from a tax professional to ensure compliance with local tax laws and regulations.

As the cryptocurrency market continues to evolve, tax authorities in the Maldives may introduce new guidelines or regulations to address the tax implications of Bitcoin trading. Traders should stay informed about any changes in tax laws that may impact their trading activities and be prepared to adjust their reporting accordingly. By staying proactive and maintaining accurate records, traders can navigate the tax implications of Bitcoin trading with confidence and peace of mind.

🔄 Future Outlook and Potential Regulatory Changes

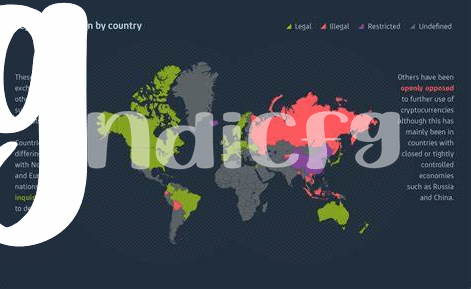

🔄 Amid the evolving landscape of cryptocurrency regulations in the Maldives, there is anticipation for potential changes that could shape the future of Bitcoin trading in the region. Regulatory authorities are closely monitoring the market and considering adjustments to ensure investor protection and financial stability. This proactive approach reflects a commitment to fostering a conducive environment for digital asset trading while addressing emerging challenges and risks.

In considering the future outlook, stakeholders in the cryptocurrency industry are keenly observing how regulatory changes may impact trading practices and compliance requirements. The collaborative efforts between government entities and industry stakeholders signal a proactive approach towards adapting to the dynamic nature of the cryptocurrency market. As the regulatory framework evolves, market participants are expected to stay informed and compliant to navigate the regulatory landscape effectively.