Overview of Smart Contracts and Bitcoin Transactions 💡

Smart contracts and Bitcoin transactions have revolutionized the way financial agreements are carried out in a digital landscape. Smart contracts, powered by blockchain technology, enable automated execution of predefined terms without the need for intermediaries. On the other hand, Bitcoin transactions have gained popularity as a decentralized and secure method of transferring value. These innovations have not only simplified processes but also raised questions regarding their legal implications in various jurisdictions, including Malaysia.

As the legal landscape continues to evolve in response to technological advancements, understanding the legal status of smart contracts and the regulation of Bitcoin transactions in Malaysia becomes crucial. This overview sets the stage for exploring the intersection of emerging technologies with traditional legal frameworks and the potential challenges and opportunities they present for investors and stakeholders.

Legal Status of Smart Contracts in Malaysia ⚖️

Smart contracts have begun to revolutionize the legal landscape, offering efficiency and transparency in contractual agreements. In Malaysia, the legal status of smart contracts is evolving, with authorities taking steps to recognize their validity within the existing legal framework. This recognition opens up new possibilities for businesses and individuals looking to leverage the benefits of blockchain technology in their transactions. As smart contracts gain acceptance, it is crucial for Malaysia to establish clear guidelines to govern their use and ensure legal certainty for all parties involved.

The incorporation of smart contracts into Malaysian law brings about a paradigm shift in traditional contract execution. By embracing this innovative technology, Malaysia can enhance contract performance, reduce the risk of disputes, and streamline the legal process. As the legal status of smart contracts continues to be defined, stakeholders must stay informed and adapt to the changing regulatory landscape to maximize the potential of this emerging technology.

Regulation of Bitcoin Transactions in the Country 📜

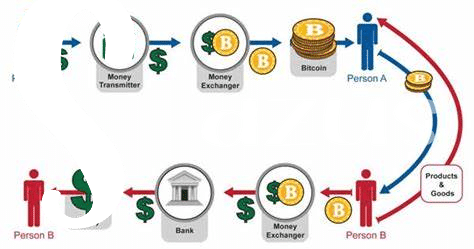

Bitcoin transactions in Malaysia are subject to specific regulations set by the country’s authorities. The regulatory framework aims to ensure transparency, security, and accountability in the use of cryptocurrencies within the Malaysian market. The guidelines cover aspects such as anti-money laundering (AML) and know-your-customer (KYC) policies to mitigate potential risks associated with digital currency transactions. Embracing these regulations is crucial for fostering trust and confidence among investors and users engaging in Bitcoin transactions in Malaysia. Furthermore, compliance with regulatory requirements is essential for maintaining the integrity of the financial system and safeguarding against illicit activities.

Impact of Smart Contracts on Traditional Legal Frameworks 💥

Smart contracts are revolutionizing traditional legal frameworks by automating and executing agreements without the need for intermediaries. This shift challenges the conventional understanding of contract law, as smart contracts operate based on code and predetermined conditions rather than interpretation by legal authorities. This impacts how contracts are enforced, potentially reducing the role of traditional legal structures in contract resolution. While this introduces efficiency and cost-effectiveness, it also raises questions about the need for legal intervention and oversight in contractual disputes. As smart contracts gain traction, the legal community must adapt to ensure that these innovations align with existing legal principles and protections. Embracing this change requires a careful balance between technological advancement and legal compliance to maintain the integrity of contract law in the digital age.

Challenges and Opportunities for Adoption in Malaysia 🔍

Smart contracts face both challenges and opportunities for adoption in Malaysia. One major hurdle is the need for widespread understanding and acceptance of this technology among businesses and legal entities. Cultural and regulatory barriers may also slow down the integration of smart contracts into existing legal frameworks. On the upside, the efficiency and transparency offered by smart contracts present significant opportunities for streamlining processes and reducing costs for businesses in Malaysia. Education, regulatory clarity, and proactive adoption strategies will be key to overcoming challenges and maximizing the benefits of smart contracts in the country.

Future Prospects and Recommendations for Investors 🚀

Future Prospects for smart contracts and Bitcoin transactions in Malaysia appear promising as the country continues to embrace digital innovations. Investors looking to capitalize on this trend should prioritize understanding local regulatory developments to mitigate risks and ensure compliance. Recommendations include staying informed on changes in legislation, collaborating with legal experts familiar with blockchain technology, and conducting thorough due diligence before engaging in transactions. These proactive steps can position investors for success in navigating the evolving landscape of decentralized finance.

For more insights on the legal consequences of Bitcoin transactions in Libya, please visit the legal consequences of Bitcoin transactions in Madagascar.