What Is Bitcoin Halving? 🎓

Imagine a world where the amount of gold mined out of the earth gets cut in half every four years. In the realm of Bitcoin, a similar magical event happens, known as the Bitcoin halving. It’s when the reward for mining new blocks is halved, meaning miners receive 50% less Bitcoin for verifying transactions. This process is built into the heart of Bitcoin to ensure that not all coins are mined too quickly.

This special event rolls around approximately every four years and is a big deal for the Bitcoin community. It’s not just a ceremonial occasion but a fundamental feature that helps control the supply of Bitcoin, making sure it doesn’t run out too soon. Below is a simple explanation of how the rewards have changed over time:

| Halving Event | Reward Before Halving (BTC) | Reward After Halving (BTC) |

|---|---|---|

| 1st Halving (2012) | 50 | 25 |

| 2nd Halving (2016) | 25 | 12.5 |

| 3rd Halving (2020) | 12.5 | 6.25 |

By gradually reducing the supply of new Bitcoins entering the market, halving helps maintain a balance between supply and demand, ensuring the longevity and value of Bitcoin.

Why Halving Matters in Bitcoin’s World 🌍

Imagine Bitcoin as a big pie that gets divided every few years. This division is what we call Bitcoin halving. It’s like a big event in the world of Bitcoin because it changes how many new pieces of Bitcoin, or slices of the pie, get made. This is super important since it affects everyone involved – from those who own Bitcoin to those who make it, also known as miners. With each halving, miners find it a bit harder to create new Bitcoins, which means there are fewer new slices to go around. This can make each slice more valuable if people still want Bitcoin just as much, because there’s less of it being made. It’s a clever way to make sure that we don’t end up with too much Bitcoin too quickly, keeping it rare and, ideally, valuable. So, in a nutshell, the halving is a big deal because it helps manage the supply of Bitcoin, aiming to keep its value stable over time. Plus, it’s always a bit exciting to see how each halving shakes things up in the Bitcoin universe! For those looking to dive deeper into Bitcoin’s ecosystem and explore other fascinating aspects, check out this insightful piece on https://wikicrypto.news/arbitrage-opportunities-in-bitcoin-trading-a-how-to-guide.

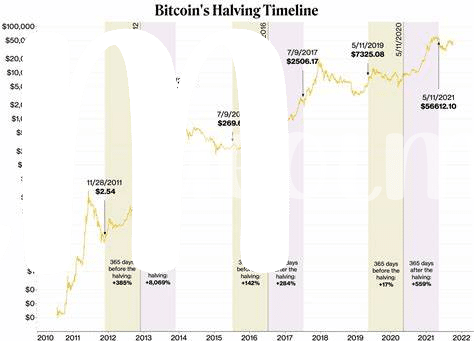

Impact on Bitcoin’s Value: before & after 📈

Imagine a huge party where the number of pizzas gets cut in half every few hours. At first, there might be plenty, but as the night goes on, if you still want a slice, you might be willing to pay more for it since there’s less to go around. This is a bit like what happens with Bitcoin whenever there’s a halving event. Before these events, there’s a buzz, a mix of excitement and speculation. People are curious, “What’s going to happen to the value of Bitcoin?” After all, when you know there will be less of something available in the future, it’s natural to think its value might go up. In the past, after each halving, we’ve seen Bitcoin’s price soar to new heights. It’s not immediate, though; it’s more like a slow climb up a giant roller coaster before the thrilling drop. This pattern has made some folks see halving as a signal to hold onto their bitcoins tightly, hoping the value climbs higher. But, just like roller coasters, the ride isn’t always smooth, and predicting the top is tricky. So, while history has shown us a pattern of price increases following halving, it’s always good to remember that in the world of cryptocurrency, surprises can and do happen.

The Halving Effect on Mining Communities ⛏️

Imagine a small village where everyone’s livelihood depends on mining gold. Now, imagine if suddenly, the amount of gold everyone could mine was cut in half. That’s somewhat what happens to Bitcoin miners every four years during what’s called the “halving.” It’s a big deal because miners are the heart of Bitcoin, securing the network and processing every transaction in exchange for new bitcoins as their reward. After a halving, miners receive 50% less Bitcoin for the same amount of work. This can shake up the community, leading some miners with less efficient setups to pause or stop their operations, as their income might not cover the costs anymore. However, it’s not all doom and gloom. The halving can encourage innovation, pushing miners to upgrade their equipment or find cheaper energy sources to stay competitive. Plus, if history is a guide, the reduced supply of new bitcoins can eventually lead to an increase in Bitcoin’s price, potentially offsetting the reduced reward. Understanding the dance between technology and economics in Bitcoin’s world is fascinating, and for those looking to dive deeper, bitcoin and quantum computing explained offers an insightful look into how Bitcoin stands against inflation and the role quantum computing might play in its future.

Strategies for Investors Around Halving Time 💼

When Bitcoin halving rolls around, it’s like the whole investing landscape takes a deep breath, waiting to see where the chips will fall. But here’s the scoop: savvy investors treat this event not with fear but as an opportunity. Before the halving occurs, some choose to buy into Bitcoin, anticipating that prices will skyrocket as the supply of new Bitcoins slows down. It’s like getting in line early at your favorite restaurant; you do it because you know it’ll be worth it once you’re enjoying your meal. Others might take a more cautious approach, keeping a keen eye on market trends and ready to act swiftly, whether that means buying more or perhaps selling some of their holdings depending on how the market responds.

| Strategy | Description | Why It’s Used |

|---|---|---|

| Pre-Halving Investment | Buying Bitcoin before the halving. | Investors aim to capitalize on the post-halving price increase. |

| Market Analysis | Closely watching market trends around halving. | Allows investors to make informed decisions, whether that’s to buy more or sell. |

In essence, navigating the waters around Bitcoin halving demands a blend of preparedness and agility. Understanding that the market can be unpredictable, but historical trends can offer valuable clues, equips investors to make the most of this event. Whether diving in early or playing the waiting game, the key lies in being informed and ready to pivot as the situation unfolds.

Future Halvings: What to Expect 🚀

As we peer into the digital horizon, the anticipation around Bitcoin’s future halvings is growing. These events, which happen roughly every four years, are more than just milestones. They’re signposts that guide the landscape of cryptocurrency investment and mining. Think of each halving as a tune-up for the Bitcoin network, ensuring it runs smoothly and stays scarce, which can be quite enticing for those holding or eyeing Bitcoin. As the reward for mining Bitcoin halves, the effort and resources required to produce new Bitcoin increase, making each coin more valuable over time. This built-in scarcity is a key driver of interest and investment in Bitcoin, particularly around halving times.

For investors and enthusiasts looking ahead, understanding the interplay between scarcity and value is pivotal. As we approach future halvings, the savvy observer would do well to keep an eye on the market dynamics before and after these events. Historically, halvings have been precursors to bullish behavior in the Bitcoin market, though past performance is not always indicative of future results. For those looking to dive deeper into how these dynamics play out, especially in relation to broader economic factors like inflation, a closer look at bitcoin and inflation explained can offer valuable insights. As we gear up for the next halving, staying informed and strategically poised could make all the difference. 🚀🌍💼