Unpacking Bitcoin Basics: What Makes It Unique? 🎓

Imagine a digital coin, accessible to anyone with internet access, daring to stand apart from traditional money. Bitcoin does just that, offering a unique blend of technology and simplicity that’s hard to find elsewhere. At its heart, Bitcoin runs on a transparent and secure technology called blockchain. This technology is like a digital ledger, recording every transaction for all to see, ensuring no one can cheat the system. What really sets Bitcoin apart is its independence from central control. Unlike regular money, which governments and banks manage, Bitcoin operates on a peer-to-peer network, maintained by its users. This independence gives Bitcoin its unfading allure, attracting people from all corners of the globe who seek an alternative to conventional financial systems. Its digital nature not only makes transactions fast and borderless but also adds a layer of security that traditional money struggles to match.

| Feature | Description |

|---|---|

| Technology | Blockchain, a secure and transparent digital ledger |

| Control | Decentralized, not governed by banks or governments |

| Accessibility | Available to anyone with internet access |

| Security | Offers a higher level of security than traditional money |

| Transaction Speed | Fast and borderless |

This combination of features not only marks a significant shift from how we usually perceive money but it also challenges the very foundations of the financial philosophies we’ve grown accustomed to.

The Finite World of Bitcoin: Only 21 Million! 🌏

Imagine opening your favorite board game and finding out there’s a limited number of pieces you can play with. That’s pretty much what’s happening with Bitcoin. Think of it as a digital treasure with only 21 million coins available. Unlike the endless printing of paper money that leads to its value dropping over time, Bitcoin keeps things tight. This scarcity is a bit like having a rare gem; because there aren’t many out there, people believe it’s worth more, keeping its value strong in a world where traditional money can weaken.

This unique feature of Bitcoin sets the stage for a financial adventure. As we dive into the digital currency waters, it’s key to understand that this limitation is designed to prevent the kind of value loss we often see with regular money, which can be printed endlessly. In the story of money, where inflation is the villain constantly eroding the value of your savings, Bitcoin emerges as a hero, capped at 21 million coins to fight the good fight. It’s an economic saga where the rules of the game are dictated by mathematics rather than the printing presses, making Bitcoin a fascinating topic of conversation and, for many, a promising way to secure their financial future.

Inflation: Traditional Money’s Biggest Weakness 📉

Imagine you have a magic wallet that makes your money less valuable over time. That’s kind of what happens with traditional money due to something called inflation. 🎩💸 Essentially, inflation means that the money you have buys less than it did before. It’s like going to your favorite donut shop and discovering that the price of donuts has gone up, so your $1 now buys a smaller donut than it used to. This happens because governments can print more money, and when there’s more money chasing the same amount of goods, prices go up. 🍩➡️💰 It’s a big problem for our savings because it means the value of what we’ve saved goes down over time. This is why some people are looking at things like Bitcoin, which promises a way to protect against losing value in this way. But understanding why and how traditional money loses its value is the first step in exploring these new alternatives.

Bitcoin’s Shield Against Inflation: a Closer Look 🛡️

Imagine a shield, strong and steadfast, protecting a precious treasure from harm. This is what Bitcoin does in the world of money, where the treasure is its value, and the harm is inflation, the gradual decrease in what your money can buy over time. Traditional currencies, like dollars or euros, can lose purchasing power because governments can print more money whenever they decide. However, Bitcoin operates differently. It has a pre-set limit on how many bitcoins can exist – 21 million, no more, no less. This scarcity is like a magical charm that shields Bitcoin from inflation’s eroding effects, making it a unique kind of money that can maintain its value over time.

To understand how this shield works, it helps to know a bit about how inflation and currency work. Most of us are used to hearing about prices going up, which is a sign of inflation. But Bitcoin, by its digital design, follows a different path. As we dive deeper, it’s fascinating to see real-world behaviors align with economic theories. For more on how Bitcoin fits into our wider world, including its role in bitcoin in literature and film explained, which can offer a unique perspective on its place in culture. Through its capped quantity, Bitcoin presents a compelling argument against inflation, standing firm where traditional currencies might falter, making it an interesting subject for anyone curious about the future of money.

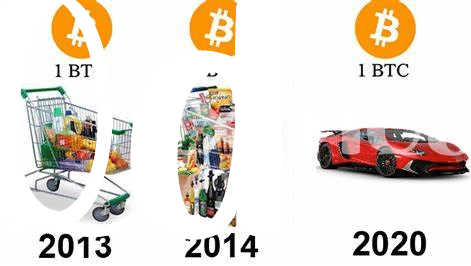

Real-world Examples: Bitcoin Vs. Inflation over Time 📊

Imagine a world where your savings stay intact, not eaten away by the monster of devaluation. This is what Bitcoin aims to achieve, standing as a strong soldier against the persistent inflation that traditional money often falls victim to. Take Venezuela and Zimbabwe, for example, where hyperinflation made their currencies almost worthless. Here, Bitcoin shone like a beacon of hope, helping people preserve their wealth by providing a safe haven that wasn’t tied down to the fate of their national economies. It’s a global player that doesn’t bow to local economic downturns, thereby maintaining its purchasing power. Now, let’s look at some numbers:

| Year | Bitcoin Value Increase | Inflation Rate (Global Average) |

|---|---|---|

| 2015 | +35% | 3.4% |

| 2017 | +1,318% | 3.2% |

| 2020 | +300% | 3.2% |

This table showcases how, during significant years, Bitcoin not only survived but thrived, offering a stark contrast to the relatively constant inflation rates worldwide. Through these practical instances, it’s evident that Bitcoin has carved out a niche for itself as a formidable opponent against inflation, thereby securing its position as not just a digital currency but a financial sanctuary for many.

Future Predictions: Can Bitcoin Maintain Its Charm? 🔮

Peering into the crystal ball to forecast Bitcoin’s future is as intriguing as it is complex. Is it possible for Bitcoin to keep its allure in the face of evolving financial landscapes and technological advancements? A lot depends on its adaptability and the continued belief in its value as a hedge against traditional monetary systems. With its finite supply, Bitcoin presents a stark contrast to fiat currencies that can be printed endlessly, hence maintaining its appeal to those wary of inflation. However, the road ahead is fraught with challenges, including regulatory hurdles and the environmental impact of mining. The key to Bitcoin’s sustained charm lies in overcoming these obstacles while preserving its core properties.

As we ride the wave into the future, it’s fascinating to ponder how emerging technologies like artificial intelligence might intersect with Bitcoin and cybersecurity concerns. For instance, learning more about bitcoin and cybercrime explained reveals intriguing dynamics at play. Could sophisticated AI algorithms lead to enhanced security for Bitcoin transactions, or might they usher in new forms of cyber threats? Navigating these waters will be crucial for Bitcoin’s journey ahead. Ultimately, Bitcoin’s ability to adapt and address these evolving challenges will determine if it can continue captivating the imagination and confidence of its users.