What Is Bitcoin Halving? 🤔

Imagine a big, digital clock that counts down every four years, and when it hits zero, something cool happens in the world of Bitcoin, the digital money lots of people are talking about. This event is like a big digital birthday party for Bitcoin called “halving.” Here’s the deal: Bitcoin was made in a way that only a certain number of them can ever exist – 21 million, to be exact. To make sure they don’t all come out at once, the rules of the Bitcoin game say that the prize for the people who help keep the Bitcoin world running, known as “miners,” gets cut in half every four years. This halving makes sure that Bitcoin doesn’t run out too quickly and helps control its value, kind of like making sure there’s not too much of your favorite toy around so it stays special. It’s a big deal because it not only affects how many new Bitcoins come into the world but also can lead to changes in its price, making it a very exciting time for everyone watching.

| Event | Impact |

|---|---|

| Bitcoin Halving | Cuts the reward for mining in half, affects Bitcoin’s value |

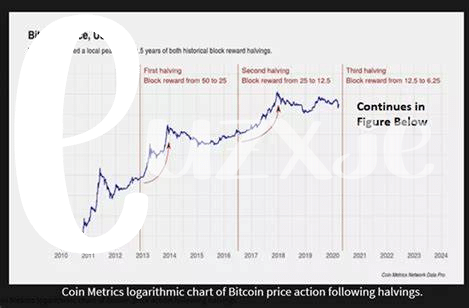

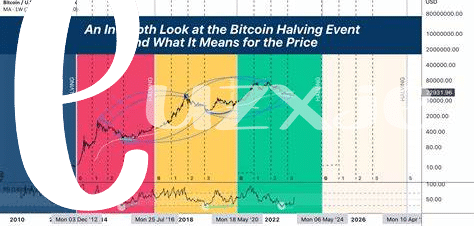

Past Halvings and Market Trends 📉📈

Looking back at Bitcoin’s journey, it’s clear that its milestone events, known as “halvings,” have significantly influenced its price and the broader market. Imagine a big birthday party for Bitcoin that happens roughly every four years; this is the halving. It cuts the reward for mining Bitcoin in half, making it rarer and theoretically more valuable over time. Historical patterns show a fascinating dance of value around these times. After the first few halvings, the price of Bitcoin experienced remarkable surges, painting a picture of anticipation and excitement in the crypto community. These trends give us hints, like bread crumbs left by investors of the past, guiding predictions for future market behavior. Learning from these patterns, savvy investors often adjust their strategies, trying to time their moves with these significant events. For those looking to dive deeper into how to navigate the upcoming halving, a rich resource can be found by clicking here https://wikicrypto.news/the-future-of-anonymous-bitcoin-transactions-2024-forecast, offering insights into smart investing strategies in anticipation of 2024’s pivotal moment. Observing the ebb and flow of Bitcoin’s value with an understanding of its past can unlock potential strategies for navigating its future, revealing a world of opportunity that waits beyond the next halving.

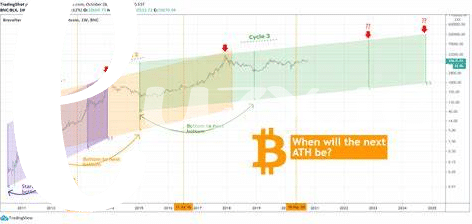

Predicting 2024’s Big Change 💡

Looking into the crystal ball of Bitcoin’s future, the 2024 halving event stands out as a pivotal moment. Imagine a world where Bitcoin becomes even more scarce than it already is. This halving cuts the reward for mining new blocks in half, meaning miners get 50% less Bitcoin for the same amount of work. 🎩✨ This scarcity tends to make Bitcoin more valuable. People start paying more attention, wondering if the price will go up like in a rare toy auction. Everyone wants the last piece of the puzzle, making it more precious.

Now, think about a seesaw. On one side, you have the miners, who might find it tougher to make a profit. On the other side, are the savvy investors, ready to pounce on the opportunity. 🕵️♂️💼 As the halving approaches, conversations buzz with speculation and strategies. History has shown us that halvings can lead to big price movements. While we can’t predict the future with 100% certainty, looking at past events gives us a roadmap. It’s like being at a crossroads where every direction promises an exciting journey for Bitcoin.

How Miners Might React ⛏️

Imagine a room full of treasure hunters, each with a map leading to half the gold previously promised. This is somewhat what Bitcoin miners might feel like come 2024. As the rewards for mining Bitcoin reduce, the cost of their quest doesn’t. Electricity and high-tech equipment still demand their pound of flesh. Some miners, the bigger ones with deeper pockets and more efficient operations, might carry on, unfazed. They could see this as a moment to shine, as less efficient miners bow out, reducing competition. On the other hand, the smaller operations might find themselves at a crossroads, pondering whether to continue the costly endeavor or pivot towards newer strategies, possibly pooling resources with others to share the load. Amidst this scenario, savvy investors and enthusiasts keen on understanding the shifts and planning their moves might find insights on how to buy bitcoin market trends in 2024, illuminating paths in the ever-evolving landscape. As the halving approaches, all eyes will be on these digital miners, whose reactions could ripple through the market, influencing strategies far and wide.

Investor Strategies before and after 📊

As the big event draws near, savvy investors gear up, studying patterns from the past to chart a smart course. Before the halving, there’s a buzz in the air – it’s all about timing. Do you buy now, hoping prices soar post-halving, or wait to see the market’s reaction? Each investor becomes a strategist, their moves dictated by predictions and gut feelings. It’s a high-stakes game, with whispers of history’s hints and the tempting dance of rising and falling charts. Yet, amid this financial whirlwind, risk management is key. Diversifying portfolios and setting clear boundaries for buying or selling become the guardrails on this thrilling ride.

| Strategy | Before Halving | After Halving |

|---|---|---|

| Market Analysis | Review past trends, predict impacts | Monitor real-time reactions, adjust forecasts |

| Risk Management | Set clear investment boundaries | Evaluate outcomes, potentially rebalance |

| Portfolio Diversification | Spread investments to mitigate risk | Adjust based on new market dynamics |

Then comes the aftermath. The halving event has passed, and the market has reacted, setting the new playing field. Investors now gaze at their charts with seasoned eyes, ready to adapt. They reassess, crunching the numbers once more, aiming to ride the wave of change. It’s a dynamic world, where staying informed and flexible could mean the difference between profit and loss. In the end, regardless of the market’s ebbs and flows, the investor’s goal remains unshaken: to navigate through the storm with wisdom and eventually anchor in the harbor of success.

Long-term Outlook for Bitcoin 🚀

Imagining the future of Bitcoin is like trying to paint the picture of a sunrise before the first light appears. As we lean in closer to 2024, many are watching with bated breath to see where Bitcoin’s journey will take us next. From its rollercoaster price changes to the revolutionary technology underlying it, Bitcoin remains at the forefront of digital currencies. With each halving event, including the anticipated one in 2024, Bitcoin takes a step into unknown territories, potentially leading to tighter supply and, historically, an uptick in value. This creates a twofold effect: igniting interest among new investors while reinforcing the belief among long-standing supporters that Bitcoin could redefine the essence of global finance. Additionally, the ongoing conversation about are bitcoin transactions anonymous security concerns further adds layers to the dialogue on its impact on market trends. As we speculate on its long-term outlook, it’s essential to consider these pivotal moments and discussions. They don’t just shape the narrative but also offer a glimpse into the evolving landscape, where Bitcoin might not just be a pioneer but a stalwart in the digital age, reshaping our ideas on value, security, and investment for generations to come. 🌐💡🚀