🚀 Bitcoin’s Journey: from Obscurity to Mainstream Investment

Once just a whisper in the tech world, Bitcoin burst onto the scene, turning heads and sparking curiosity. It began as a secret treasure known only to a few, a digital ‘coin’ you couldn’t hold but could own. Seemingly overnight, Bitcoin evolved, catching the eye of the adventurous and the skeptic alike. It transformed from a hidden gem into a shining beacon in the investment landscape, drawing in everyone from casual enthusiasts to serious investors, all intrigued by its promise and potential.

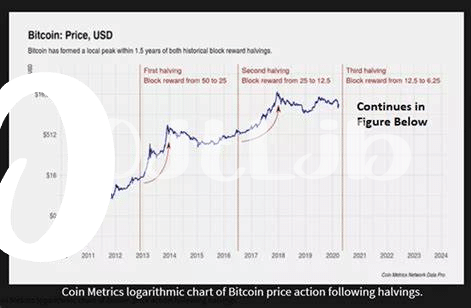

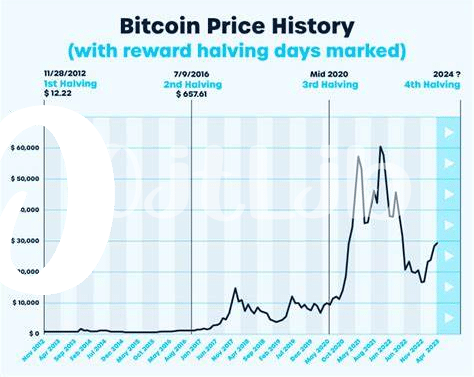

The leap from obscurity wasn’t just a lucky break; it was fueled by a growing belief in Bitcoin’s value and a desire for a financial system that wasn’t anchored by traditional rules. Here’s a glimpse into how Bitcoin has grown over the years:

| Year | Milestone |

|---|---|

| 2009 | Creation of Bitcoin |

| 2013 | $1,000 mark reached |

| 2017 | Surges past $10,000 |

| 2021 | All-time high, drawing widespread attention |

As Bitcoin stitched its way through the fabric of finance, it wove a new pattern for the future, opening doors to possibilities once deemed impossible.

💡 Understanding Bitcoin’s Value: More Than Digital Gold

Many people look at Bitcoin and see it as just another type of money, a kind of digital gold, if you will. But it’s much more than that. Bitcoin represents a shift in how we think about and use money. It’s decentralized, meaning it’s not controlled by any one country or bank, making it a truly global way to trade and invest. Beyond its gold-like qualities, Bitcoin has value because it’s built on a technology called blockchain. This tech allows for secure, transparent transactions without the need for middlemen. That’s revolutionary. And with advancements in technology, who knows how Bitcoin will evolve? Its potential goes beyond being a safe haven during economic uncertainty; it’s a pioneer in the financial world’s future. For those curious about how Bitcoin’s suitability as an investment might change, especially considering the evolving landscape of digital transactions, a deeper look into the topic at https://wikicrypto.news/the-anonymity-illusion-debunking-myths-about-bitcoin-transactions can provide some insightful forecasts.

🌍 Global Shifts: How World Events Influence Bitcoin

Imagine a world where everything you hear on the news could nudge the price of Bitcoin up or down. That’s the reality we’re living in. From presidential tweets to new policies in big countries, Bitcoin reacts like a speedboat to waves, zipping this way and that. It’s like a global game of tug-of-war, where countries, crises, and celebrations all have a hand on the rope. This isn’t about distant events you hear in the news; it’s about the very real effects they have on the digital coins sitting in your wallet.

Now, think bigger – economic trends that stretch across continents. When a big economy sneezes, Bitcoin catches a cold. It’s a dance of numbers and nations, where Bitcoin’s value swings to the rhythm of global events. But this isn’t cause for alarm. For the smart investor, it’s an opportunity. By keeping an eye on the world stage, you can anticipate these swings. The key is not just to watch, but to understand how the dots connect, transforming news into investment strategy. It’s not just about being reactive; it’s about being proactive, seeing the ripples before they reach the shore.

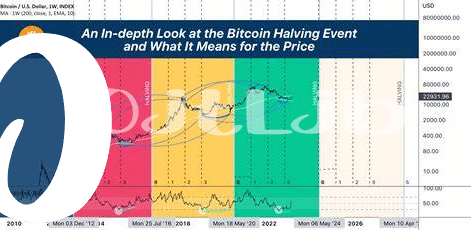

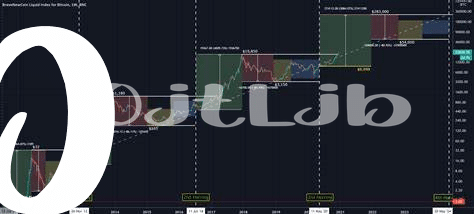

🛠️ Smart Investment Strategies: Navigating Bitcoin’s Volatility

Navigating the roller coaster that is Bitcoin investment requires a mix of patience, research, and a bit of courage, given its well-known price swings. Think of it as surfing: you need to know when to paddle out, when to ride a wave, and importantly, when to get off before you wipe out. A smart strategy starts with understanding that there’s no one-size-fits-all approach. Diversification, for example, can be a lifesaver – spreading your investment across various assets can cushion the blow if Bitcoin’s price takes a sudden dive. Also, staying informed is key. The world of Bitcoin is ever-evolving, and keeping abreast of the latest trends and forecasts, like those discussed at are bitcoin transactions anonymous market trends in 2024, can provide valuable insights for making informed decisions. Moreover, leveraging tools and platforms that offer real-time data and analysis can help you spot patterns and make smarter, timing-sensitive decisions. Finally, remember the golden rule of investing: never invest more than you can afford to lose. This mantra is especially pertinent in the volatile realm of Bitcoin, where fluctuations are part and parcel of the game.

🤖 Future Predictions: the Role of Technology in Bitcoin’s Growth

As we look to the horizon, technology stands front and center in shaping Bitcoin’s future. Innovations like lightning-fast transactions and enhanced security protocols make Bitcoin an even more attractive asset. Imagine a world where buying coffee with Bitcoin is as simple as using traditional money, thanks to advancements in blockchain technology. This accessibility could invite more people to invest, further integrating Bitcoin into everyday life.

| Technological Advancement | Impact on Bitcoin |

|---|---|

| Enhanced Security Measures | Increases investor confidence |

| Scalability Solutions | Facilitates faster, cheaper transactions |

| Integration with Financial Systems | Improves accessibility and usability |

Furthermore, the integration of Bitcoin with emerging tech like quantum computing and artificial intelligence could revolutionize how we perceive its value and use. As these technologies evolve, Bitcoin’s potential for growth skyrockets, potentially reshaping the financial landscape. Staying informed and adaptable will be key for investors aiming to ride the wave of technological transformation in the Bitcoin space.

💬 Community Power: the Impact of Social Media on Bitcoin

Now, let’s dive into an often overlooked but mighty force in the Bitcoin universe – the buzzing hive of enthusiasts, skeptics, and every voice in between found on social media platforms. Imagine the conversations on Twitter, Reddit, or YouTube as not just chats or debates but powerful winds capable of pushing the massive Bitcoin ship in one direction or another. Every tweet, share, or like acts like a vote in the grand democratic space of the internet, swaying opinions, shaping perceptions, and even influencing market movements. This communal power underscores not just the democratic ethos of Bitcoin but also highlights how integral these platforms have become in educating, warning, and guiding investors. It’s a world where the latest news, insights, or even rumors on platforms can trigger waves, making or breaking fortunes almost overnight. As we navigate this digital ecosystem, it’s crucial to not only listen but engage, question, and contribute wisely, remembering the sway our collective voices hold. For those keen on understanding more about Bitcoin’s dynamics, from privacy concerns to the latest in tech trends, peering into the what is bitcoin mining market trends in 2024 can offer valuable insights, shedding light on the intricate dance between technology, privacy, and market speculation.