Current Bitcoin Aml Regulations in the Philippines 🌐

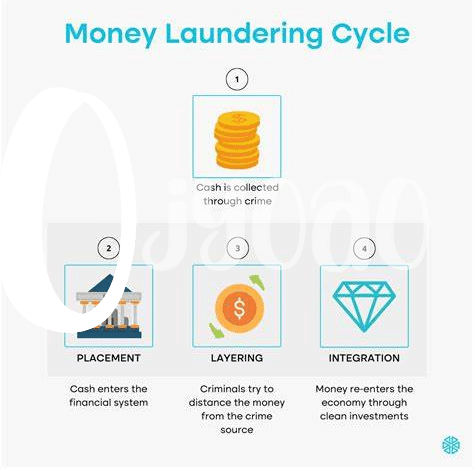

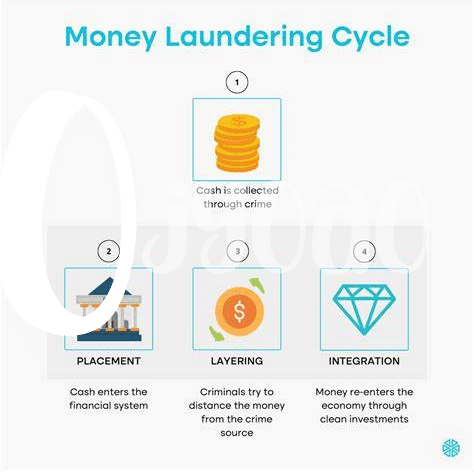

In the Philippines, current Bitcoin AML regulations seek to enhance transparency and accountability in the digital currency space. These regulations aim to prevent money laundering and illicit activities, requiring Bitcoin businesses to register with the central bank and adhere to stringent reporting requirements. Compliance with these regulations is essential to ensure the legitimacy of Bitcoin transactions and protect users from potential risks. The evolving landscape of AML regulations in the Philippines underscores the government’s commitment to fostering a secure environment for the growth of the digital currency market.

Potential Impact of Stricter Aml Laws 🧮

Stricter AML laws could bring about a significant shift in the Bitcoin landscape of the Philippines. As regulations tighten, the transparency and accountability in cryptocurrency transactions are expected to increase. This may lead to a more secure environment for users and investors, fostering a sense of trust in the market. However, these stricter laws could also pose challenges for smaller Bitcoin businesses, requiring them to adapt quickly to compliance measures to avoid penalties and ensure sustainability in the evolving regulatory framework. The potential impact of such stringent AML regulations is poised to reshape the dynamics of Bitcoin operations in the Philippines, influencing the behavior of both users and businesses in the crypto space.

Risks and Challenges for Bitcoin Users 💸

Bitcoin users face various risks and challenges in the ever-evolving landscape of digital currency. From the potential for fraud and hacking to the volatility of the market, navigating the world of Bitcoin can be complex. Moreover, the anonymity associated with Bitcoin transactions can also raise concerns about its potential use in illegal activities. Understanding these risks is crucial for users to protect themselves and make informed decisions in their Bitcoin ventures.

Compliance Requirements for Bitcoin Businesses 📝

Bitcoin businesses in the Philippines face a myriad of compliance requirements to adhere to legal frameworks. From stringent Know Your Customer (KYC) protocols to Anti-Money Laundering (AML) measures, the landscape demands strict adherence 📝. Navigating these obligations is essential for the sustainability and credibility of Bitcoin enterprises in the burgeoning digital economy. Failure to comply could not only result in regulatory penalties but also erode customer trust and hinder business growth.

To explore legal consequences of Bitcoin transactions in Vietnam, check out this insightful article on the legal consequences of bitcoin transactions in Vietnam to gain a deeper understanding of the implications for businesses operating in the crypto space.

Role of Government Oversight and Enforcement 🕵️♂️

The government plays a crucial role in overseeing and enforcing AML regulations in the Bitcoin space. Their monitoring and enforcement actions are vital in maintaining the integrity of the financial system and protecting users from illicit activities. Government agencies work closely with industry stakeholders to ensure compliance with AML laws, fostering a safer environment for legitimate Bitcoin transactions. This collaboration is essential for building trust and confidence in the evolving landscape of digital currencies.

Future Outlook for Bitcoin Aml Regulations 🚀

As the landscape of Bitcoin AML regulations continues to evolve, it is crucial for stakeholders to stay informed and adapt to the changes. The future outlook for Bitcoin AML regulations in the Philippines holds potential for enhanced security measures and increased transparency within the cryptocurrency market. By understanding and complying with these regulations, Bitcoin users and businesses can contribute to a more secure and trustworthy ecosystem for digital transactions. Additionally, government oversight and enforcement play a pivotal role in shaping the future direction of AML policies in the Philippines. Stay informed and proactive to navigate these evolving regulatory landscapes.

Link to legal consequences of bitcoin transactions in Uzbekistan with anchor legal consequences of bitcoin transactions in Vanuatu: legal consequences of bitcoin transactions in Vanuatu