🚀 the Birth of Bitcoin: a Financial Revolution

Imagine a world where money isn’t controlled by banks or governments but by the people using it. This sounds like a page from a science fiction novel, but in 2009, it became a reality with the creation of Bitcoin. Picture an invisible currency, digital, not in coins or bills that you can hold, but in bits and bytes on the internet. This wasn’t just a new way to pay for things; it was a revolution in how we think about money itself. For the first time ever, a currency was made that allowed two people to exchange value directly, without needing a middleman like a bank. This idea caught on like wildfire, appealing to people who were tired of traditional banks and looking for more control over their money. What made Bitcoin truly stand out was its technology, called blockchain, a secure system of recording transactions that made cheating nearly impossible. As the first of its kind, Bitcoin didn’t just open the door to a new world of digital currencies; it posed a challenge to the very foundation of how financial transactions were conducted. It’s a bit like the first time someone used an email instead of sending a letter through the post office – revolutionary, simplifying, and full of potential for what could come next.

| Milestone | Date | Significance |

|---|---|---|

| Creation of Bitcoin | 2009 | The start of the cryptocurrency revolution |

| First Transaction | 2010 | Bitcoin is used to buy two pizzas, demonstrating its potential as a means of payment |

| Blockchain Technology | 2009 | Introduction of a secure, decentralized system for transactions |

🔍 Unpacking Major Bitcoin Peaks and Valleys

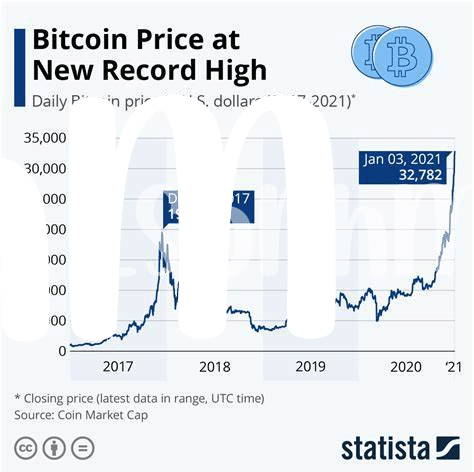

Bitcoin’s journey through the financial landscape has been nothing short of a rollercoaster ride, filled with high peaks and deep valleys that could make even the most seasoned investor’s head spin. Imagine, if you will, a financial adventure that begins quietly and then suddenly takes off, much like a rocket launching into space, soaring to unimaginable heights before occasionally tumbling back down to earth. Each peak in Bitcoin’s journey represents a moment of triumph, where its value reached unprecedented levels, making headlines and drawing in waves of new enthusiasts eager to be part of the digital currency revolution. But with every peak, a valley inevitably follows, where its value dips, sometimes dramatically, leading to moments of uncertainty and introspection among those who’ve hitched their fortunes to Bitcoin’s star.

However, these fluctuations aren’t just random occurrences; they’re the outcome of various factors playing out on a global stage. For example, technological advancements, shifts in investor sentiment, and even regulatory changes have all played their parts in shaping Bitcoin’s value over time. It’s like watching a dance, where Bitcoin moves in response to the music played by the world’s events, both big and small. Understanding these movements isn’t just about looking at charts and graphs; it’s about seeing the bigger picture and how global events, from political instability to breakthroughs in technology, influence investor behavior and, subsequently, Bitcoin’s value. For those looking to dive deeper into the world of digital currencies, exploring resources like https://wikicrypto.news/the-ultimate-guide-to-litecoin-wallets-features-and-types can offer valuable insights into not just Bitcoin, but the broader cryptocurrency ecosystem.

📈 Understanding the Drivers Behind Bitcoin’s Value Shifts

To really get why Bitcoin’s value goes up and down, think of it as a rollercoaster, influenced by a bunch of different factors. Imagine a big news story drops about Bitcoin, good or bad. This can cause lots of people to either buy or sell their Bitcoin, changing its price. Then, there’s trust in the technology itself. As more folks understand and trust how Bitcoin works, more are likely to jump in, driving the price up. But if something shakes that trust? You guessed it, the price might fall. Governments can also play a big role. If a country says, “We’re cool with Bitcoin,” its value can shoot up. On the flip side, if a country puts tough rules on it, the value could drop. And then there are the tech improvements. Sometimes Bitcoin gets a tech upgrade that makes it better and safer to use, which can make more people want to buy it. So, when you hear about the price of Bitcoin going up or down, remember, it’s all about how people are feeling about these kinds of things. 🎢🔧🌍

💡 Bitcoin and Global Events: an Intriguing Connection

Just think of Bitcoin like a boat floating in the ocean. The ocean is our global events. Sometimes, when the weather (events) is smooth, the boat glides effortlessly, soaring in value. Other times, a storm (like political changes or economic shifts) might hit, causing the boat to rock and its value to drop. For instance, when a major country announces a new law affecting Bitcoin or there is economic uncertainty, you can almost see Bitcoin reacting, bobbing up and down in this vast financial sea. This connection between Bitcoin and world events isn’t just coincidence; it’s a dance of cause and effect. As the world moves, so does Bitcoin, sometimes predictably, other times, surprisingly. For those keen to explore more or wanting to dive deeper into understanding these patterns, especially if you’re eyeing other digital currency adventures, the best place to stake cardano offers a wealth of insights. It’s about connecting the dots, seeing the pattern in the chaos, and maybe, just maybe, predicting where our Bitcoin boat will sail next. 🌍📉📈

📊 Predictive Tools and Techniques for Bitcoin Trends

Imagine having a crystal ball that helps you peek into Bitcoin’s future. We don’t have magical globes, but we do have some pretty smart tools and ways of guessing where Bitcoin’s price might head next. One popular method is looking at charts that track Bitcoin’s price over time, kind of like watching a rollercoaster’s path from the ground. These charts can show us patterns – if we notice Bitcoin’s price tends to jump after certain events or times of year, we might guess it’ll do it again. It’s not a sure thing, but it gives us a clue.

Another cool trick is listening to what the big players in the market are saying and doing. If lots of them start buying up Bitcoin, it’s like seeing which way the wind is blowing and guessing a storm might be coming. Some tech-savvy folks even use algorithms, which are like complex recipes for computers to follow, to predict Bitcoin’s movements. These models crunch a ton of data, including past prices, how many people are buying and selling, and even what’s happening in the world, to make educated guesses about future prices.

| Tool/Technique | Description |

|---|---|

| Charts | Visual representation of Bitcoin’s price over time to identify patterns. |

| Market Sentiment Analysis | Assessing the mood of market participants to gauge future movements. |

| Algorithms | Using complex mathematical models to predict future price movements based on historical and real-time data. |

🌐 Future Gazing: Where Is Bitcoin Heading Next?

Peering into the future of Bitcoin feels a lot like trying to gaze into a crystal ball – exciting, a bit mysterious, and filled with endless possibilities. What’s undeniable is that Bitcoin has transformed how we think about money in the digital age. Its journey, marked by dizzying highs and sudden lows, suggests a path forward that is anything but linear. As we look ahead, several factors will play pivotal roles in shaping Bitcoin’s trajectory. Technological advancements, regulatory changes, and shifts in investor sentiment are likely to steer Bitcoin’s value in unpredicted ways. However, to stay ahead of the curve and make sense of potential future trends, enthusiasts and investors alike turn to tools and historical data for insight. For those looking to dive deeper into the current state of Bitcoin and potentially predict its next moves, keeping an eye on the bitcoin live price usd can provide invaluable real-time information. While the future is uncertain, one thing is for sure: Bitcoin continues to be a focal point in the conversation about the future of money, promising an intriguing journey ahead for those willing to follow its evolution.