Bitcoin Regulations in San Marino 🌍

San Marino has taken significant steps in establishing clear regulations around the use of Bitcoin within its borders. These regulations provide a framework for the legal and secure use of Bitcoin as a payment method and investment vehicle. By defining guidelines for the operation of cryptocurrency exchanges and businesses involved in Bitcoin transactions, San Marino aims to promote financial transparency and protect consumers from potential risks associated with this decentralized digital currency.

Within this regulatory environment, individuals and businesses in San Marino can confidently engage in Bitcoin transactions, knowing that there are established rules to govern these activities. This framework not only boosts trust in the cryptocurrency market but also sets a positive precedent for other countries looking to regulate Bitcoin within their jurisdictions.

Impact on International Money Transfers 💸

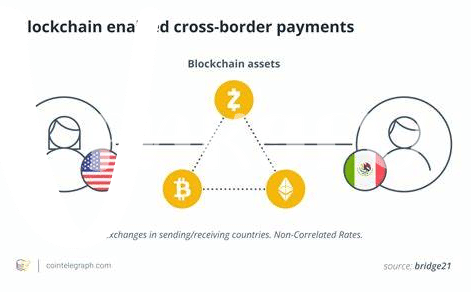

Bitcoin’s influence on global money transfers has revolutionized the traditional financial landscape. As San Marino embraces Bitcoin regulations, the impact on international money transfers transcends borders. This shift introduces a new era of cross-border transactions, marked by increased efficiency and reduced costs. By leveraging the decentralized nature of Bitcoin, participants can bypass traditional intermediaries and streamline the transfer process. This not only accelerates transaction speed but also enhances transparency and security. Despite the regulatory landscape posing certain challenges, the advantages of using Bitcoin for international transfers are undeniable. As these regulations shape the future outlook of global transactions, the potential for further innovation and adaptation looms large. Embracing the transformative power of Bitcoin heralds a promising future for international money transfers.

Compliance Requirements and Challenges 📝

Navigating the regulatory landscape in the realm of Bitcoin transactions can be a complex endeavor that requires meticulous attention to detail. Compliance requirements surrounding international money transfers involve a delicate balance between adhering to existing laws and embracing the innovative potential of cryptocurrencies. Ensuring compliance can pose significant challenges, especially in a sector that is constantly evolving and subject to regulatory scrutiny. From Know Your Customer (KYC) protocols to Anti-Money Laundering (AML) measures, businesses must stay vigilant and proactive in meeting regulatory standards while harnessing the benefits of Bitcoin for cross-border transactions. Balancing compliance obligations with the efficiency and security afforded by Bitcoin presents both opportunities and hurdles in the dynamic arena of international money transfers.

Advantages of Using Bitcoin for Transfers ✨

Bitcoin offers a plethora of advantages for international money transfers. Its decentralized nature allows for swift and secure transactions without the need for intermediaries, reducing costs and processing times significantly. Additionally, Bitcoin operates on a global scale, making cross-border transfers seamless and efficient. The transparency of blockchain technology ensures that transactions can be tracked in real-time, providing a level of security and accountability that traditional banking systems may lack. Moreover, the flexibility and accessibility of Bitcoin empower individuals to have more control over their finances and investments. As regulations continue to evolve, Bitcoin stands out as a promising solution for international money transfers, offering a glimpse into the future of financial transactions worldwide.(Associated link: bitcoin cross-border money transfer laws in saint kitts and nevis)

Future Outlook and Potential Changes 🚀

In the rapidly evolving landscape of international money transfers, the future outlook and potential changes for Bitcoin regulations in San Marino are poised to play a significant role. As the digital currency continues to gain traction as a viable alternative to traditional financial systems, the dynamics of cross-border transactions are expected to undergo notable transformations. With a focus on enhancing efficiency, transparency, and security, the regulatory framework surrounding Bitcoin in San Marino is likely to adapt to meet the evolving needs of global financial transactions. As technological advancements and regulatory developments unfold, the potential changes in how Bitcoin is utilized for international money transfers could have far-reaching implications for the way individuals and businesses navigate the complexities of cross-border payments. Embracing these shifts and staying abreast of emerging trends will be crucial for participants in the global financial ecosystem to leverage the full potential of Bitcoin for facilitating seamless and cost-effective international money transfers.

Key Takeaways for Global Transactions 🌐

Global transactions can greatly benefit from the key takeaways on Bitcoin regulations and compliance. Understanding the implications for international money transfers can enhance efficiency, security, and transparency in cross-border transactions. By staying informed on the compliance requirements and potential changes, businesses and individuals can navigate the evolving landscape of digital currencies for seamless transactions. Leveraging the advantages of Bitcoin in transfers can lead to cost savings, faster processing times, and broader accessibility across borders. As we look to the future, adapting to regulatory shifts and embracing the opportunities presented by cryptocurrency can pave the way for a more connected and efficient global financial ecosystem. Keeping abreast of developments in Bitcoin cross-border money transfer laws in jurisdictions like Samoa remains crucial for a comprehensive understanding of regulatory frameworks.

Bitcoin cross-border money transfer laws in Saint Vincent and the Grenadines