Overview of Bitcoin Remittance Regulations in Svg 🌴

Bitcoin remittance regulations in Saint Vincent and the Grenadines have experienced notable developments in recent years, reflecting the global trend towards recognizing and adapting to digital currencies. The regulatory landscape in SVG has been shaped by a mix of cautious optimism and the need for consumer protection, with efforts aimed at striking a balance between fostering innovation and safeguarding against potential risks. As a result, various rules and guidelines have been introduced to govern the operation of bitcoin remittance services within the jurisdiction, signaling a growing acceptance of cryptocurrencies as a legitimate means of transferring value across borders.

Evolution of Digital Currency Adoption in the Caribbean 🏝️

The Caribbean region has witnessed a notable shift in the adoption of digital currencies, reflecting a growing trend towards embracing innovative financial solutions. As the appeal of digital assets continues to expand across various sectors, the Caribbean stands out as a progressive hub for exploring the potential of virtual currencies. With a forward-looking approach, stakeholders in the region are actively engaging with digital currency frameworks and exploring opportunities for enhancing cross-border transactions. This evolution marks a significant step towards redefining traditional financial landscapes and fostering a more inclusive and efficient ecosystem for financial services in the Caribbean.

The increasing acceptance of digital currencies in the Caribbean underscores a shift towards modernizing financial systems and embracing technological advancements to meet evolving consumer demands. This gradual transition not only reflects a willingness to explore new avenues for financial inclusion but also signifies a proactive stance towards leveraging the benefits of digital currencies for enhancing economic growth and promoting innovation in the region. The ongoing evolution of digital currency adoption in the Caribbean presents a promising outlook for fostering collaborations and driving sustainable developments in the realm of financial technologies.

Impacts of Regulatory Clarity on Bitcoin Remittance Services 💰

Regulatory clarity plays a crucial role in shaping the landscape of Bitcoin remittance services in Saint Vincent and the Grenadines. When regulations are clearly defined and enforced, it provides a sense of legitimacy and security for both service providers and users. This, in turn, can lead to increased trust and adoption of Bitcoin as a viable remittance option. Additionally, clear regulations can help mitigate risks associated with fraud, money laundering, and other illicit activities, creating a safer environment for conducting cross-border transactions. By promoting transparency and accountability, regulatory clarity paves the way for the sustainable growth and development of Bitcoin remittance services, fostering a more robust and efficient financial ecosystem in the region.

Challenges Faced by Bitcoin Remittance Providers 🤔

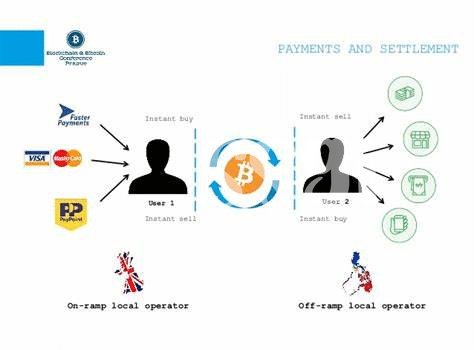

Challenges faced by Bitcoin remittance providers can range from regulatory uncertainties to operational complexities. Navigating the evolving landscape of financial regulations, particularly in the Caribbean region, presents a considerable hurdle for service providers. Additionally, ensuring compliance with anti-money laundering (AML) and know your customer (KYC) requirements can be resource-intensive and time-consuming. Technical challenges, such as network congestion leading to delayed transactions and fluctuating transaction fees, also pose obstacles for efficient cross-border payments using Bitcoin. Despite the potential for innovation and cost savings that Bitcoin remittance offers, providers must actively address these challenges to build trust with users and regulators. For more insights on navigating cross-border money transfers safely in other regions, check out this resource on bitcoin cross-border money transfer laws in Peru: bitcoin cross-border money transfer laws in Peru.

Future Prospects for Bitcoin Remittance in Saint Vincent 🚀

Saint Vincent and the Grenadines represents a promising landscape for the future of Bitcoin remittance services. With the increasing digital transformation and the progressive regulatory environment, the potential for Bitcoin remittances to thrive in this region is evident. As more individuals and businesses in Saint Vincent embrace digital currencies, the demand for efficient and cost-effective cross-border payments is expected to grow significantly. This presents an opportunity for Bitcoin remittance providers to innovate and cater to the evolving needs of the market, offering secure and convenient solutions for sending and receiving funds internationally. The future prospects for Bitcoin remittance in Saint Vincent are indeed bright, signaling a positive trajectory for the adoption and utilization of cryptocurrency in the realm of cross-border transactions.

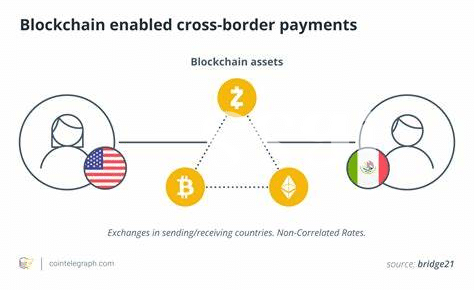

The evolving landscape of financial technology and the regulatory clarity surrounding digital currencies in Saint Vincent set the stage for further growth and development in the Bitcoin remittance sector. As stakeholders continue to collaborate and navigate the regulatory framework, the potential for innovation in cross-border payments using Bitcoin is ripe. By leveraging the advantages of blockchain technology and the borderless nature of cryptocurrencies, the future of remittances in Saint Vincent holds promise for greater efficiency, transparency, and accessibility in the realm of international money transfers.

Potential for Innovation in Cross-border Payments Using Bitcoin 💡

The rise of Bitcoin has opened up new possibilities for cross-border payments, offering a potential for innovative solutions in the realm of remittance services. The decentralized nature of blockchain technology allows for secure and transparent transactions, reducing the reliance on intermediaries and decreasing transfer costs. In Saint Vincent and the Grenadines, where traditional banking services may be limited, Bitcoin presents an opportunity to revolutionize the way cross-border payments are conducted. As the regulatory landscape continues to evolve, there is a growing interest in leveraging digital currencies for international money transfers. The potential for innovation in this space lies in developing user-friendly platforms and integrating greater accessibility for individuals looking to send and receive remittances globally. By exploring the transformative power of Bitcoin in cross-border transactions, Saint Vincent could position itself at the forefront of financial innovation in the Caribbean region.

For further insight on bitcoin cross-border money transfer laws in Poland, check the bitcoin cross-border money transfer laws in Saint Lucia for comparison.