Current Regulations 📜

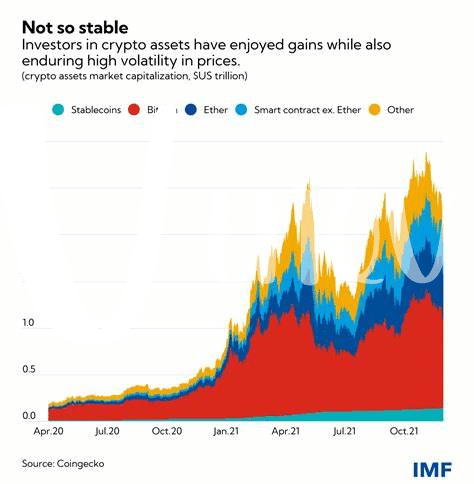

Bitcoin banking regulations in Nepal have experienced a dynamic landscape influenced by the evolving digital currency market. The current framework, albeit in a nascent stage, reflects the government’s cautious approach towards integrating Bitcoin into the traditional financial system. This regulatory environment sets the tone for how businesses and individuals engage with cryptocurrencies, prompting a detailed examination of compliance requirements and operational boundaries. As stakeholders navigate this uncharted territory, a delicate balance must be struck between fostering innovation and safeguarding against potential risks in the financial sector.

Impact on Bitcoin Users 💼

Bitcoin users in Nepal are navigating a rapidly evolving landscape, where regulations wield significant influence over their activities. The impact on these users is multifaceted, ranging from increased compliance requirements to potential restrictions on certain types of transactions. However, amidst these challenges, there lies a silver lining of opportunities for innovation and growth within the Bitcoin ecosystem. By adapting to and embracing regulatory changes, users can pave the way for a more secure and sustainable future.

Regulatory Challenges ⛔

The evolving landscape of Bitcoin banking regulations in Nepal has brought forth a multitude of challenges. Navigating the complexities of compliance requirements and adapting to rapidly changing regulatory frameworks presents a significant hurdle for both financial institutions and Bitcoin users alike. Ensuring transparency and security while fostering innovation in a regulatory environment that may lack clarity poses a formidable obstacle to the growth of Bitcoin banking in Nepal.

Government Initiatives 💡

Government Initiatives in Nepal are crucial in shaping the landscape of Bitcoin banking regulations. Through various policy measures and regulatory frameworks, the government aims to provide clarity and guidance to both industry players and users alike. These initiatives play a vital role in fostering a supportive environment for the growth of Bitcoin banking services in the country, paving the way for innovation and financial inclusion. Stay updated on similar developments in other regions such as Nigeria through insightful articles on key players influencing Bitcoin banking policies in the country like bitcoin banking services regulations in Namibia.

Industry Responses 💬

Bitcoin banking regulations in Nepal have sparked various responses within the industry. Companies operating in the crypto space have shown a mix of caution and optimism towards the evolving regulatory landscape. Some are actively engaging with authorities to shape policies that are conducive to their operations, while others are strategizing ways to adapt to the changing environment. Overall, industry responses reflect a dynamic ecosystem where stakeholders are proactively navigating the challenges and embracing the opportunities presented by regulatory shifts.

Future Opportunities 🔮

In the rapidly evolving landscape of Bitcoin banking regulations in Nepal, the future holds promising opportunities for both businesses and consumers. As the regulatory framework matures, there is a potential for increased investor confidence and participation in the Bitcoin market. This could pave the way for innovative financial services and products tailored to the needs of Nepali users, fostering a more inclusive and accessible financial ecosystem. The integration of Bitcoin banking services could also support cross-border transactions and enhance financial inclusion, unlocking new avenues for economic growth and development.

To explore more about Bitcoin banking services regulations in Nauru, check out the detailed guidelines on bitcoin banking services regulations in Niger.