Current State of Bitcoin Adoption in Laos 🇱🇦

The landscape of digital currency in Laos is gradually evolving, with Bitcoin adoption steadily gaining traction. Despite its current nascent stage, more individuals and businesses are exploring the benefits of using Bitcoin. As awareness grows, there is a growing interest in how this decentralized form of currency can potentially revolutionize the traditional banking sector in Laos.

Regulatory Challenges Faced by Bitcoin Banks 🚫

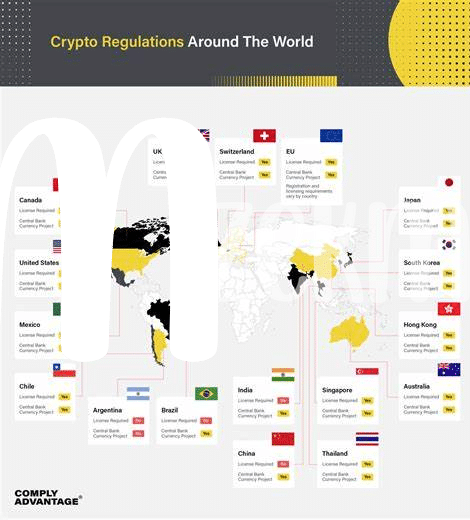

The emerging Bitcoin banking sector in Laos faces significant regulatory challenges that impede its growth and development. Navigating the complex legal landscape poses a major hurdle for Bitcoin banks operating in the country. Regulatory uncertainties, stringent compliance requirements, and lack of clear guidelines can create roadblocks for businesses looking to establish themselves in the digital currency space. These challenges not only present operational difficulties but also hinder investor confidence and market stability.

In order to thrive in this dynamic industry, Bitcoin banks in Laos must actively engage with regulators, advocate for clearer frameworks, and implement robust compliance measures to address the regulatory challenges head-on. By fostering collaboration between industry stakeholders and regulatory authorities, the sector can pave the way for sustainable growth and innovation, unlocking the full potential of Bitcoin banking in Laos.

Opportunities for Growth in the Sector 📈

In the fast-evolving landscape of Laos’ Bitcoin banking sector, companies are presented with a myriad of opportunities for growth. As the demand for digital financial solutions continues to rise, Bitcoin banks have the chance to expand their services and reach a broader customer base. By embracing innovative technologies and developing user-friendly platforms, these financial institutions can position themselves as key players in the country’s evolving financial ecosystem. Additionally, with a focus on customer education and awareness, Bitcoin banks can build trust and credibility among the local population, further stimulating growth in the sector.

Technological Innovations Driving Industry Forward 🔧

The technological landscape in the Bitcoin banking sector is rapidly evolving with advancements propelling the industry forward. Innovations such as blockchain integration, decentralized finance solutions, and improved cybersecurity measures are catalyzing efficiency and security within banking operations. These advancements not only enhance user experience but also contribute to the sector’s overall development and sustainability. For more insights on how regulations impact Bitcoin banking services, check out this informative article on bitcoin banking services regulations in Lebanon.

Impact of Global Market Trends on Laos Banking 🌍

In today’s interconnected world, global market trends play a crucial role in shaping the landscape of Laos’ banking sector. As international markets evolve and fluctuate, Laos must adapt to stay competitive and relevant. Trends such as digitalization, shifting consumer preferences, and economic fluctuations can significantly impact the country’s banking industry. Understanding and responding to these global market trends will be key for Laos to navigate the ever-changing financial ecosystem and capitalize on new opportunities for growth.

Future Outlook and Potential for Expansion 🚀

Laos has shown promising potential for the expansion and future outlook of its Bitcoin banking sector. With increasing awareness and regulatory frameworks gradually taking shape, there is a growing opportunity for market players to capitalize on this evolving landscape. Technological advancements and global market trends will likely play pivotal roles in shaping the sector’s growth trajectory. The stage is set for Laos to embrace the digital currency wave and position itself as a key player in the region’s cryptocurrency ecosystem.