Overview 🌍

In a constantly evolving financial landscape, the global interest in Bitcoin has surged, leading to a ripple effect in various countries, including Kyrgyzstan. The allure of digital currencies as a decentralized form of finance has sparked curiosity and debate among policymakers, businesses, and the general public. This overview delves into the complex and dynamic intersection of Bitcoin and banking regulations within the context of Kyrgyzstan, shedding light on the opportunities and challenges that lie ahead.

Current Bitcoin Usage 📈

The widespread adoption of Bitcoin in Kyrgyzstan has been steadily increasing, as more individuals and businesses embrace the use of this digital currency. From buying goods and services to investment opportunities, Bitcoin has become a popular choice for many. Its decentralization and ease of transactions have contributed to its growing popularity within the country. Familiarity with Bitcoin has led to innovative ways of incorporating it into daily life, shaping the landscape of financial transactions in Kyrgyzstan.

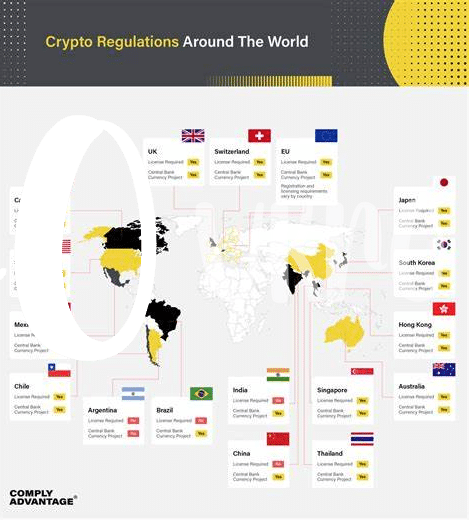

Regulatory Environment 📜

The evolving landscape of financial regulations in Kyrgyzstan is reshaping how Bitcoin is perceived and utilized within the country. As authorities navigate the intersection of traditional banking systems and decentralized digital currencies, businesses and individuals alike are faced with a changing set of rules and requirements. This dynamic environment presents both challenges and opportunities for the future of Bitcoin adoption in Kyrgyzstan.

Future Outlook 🚀

In terms of the future outlook for Bitcoin banking regulations in Kyrgyzstan, there is a sense of both anticipation and uncertainty. The evolving regulatory environment could pave the way for greater acceptance and integration of Bitcoin in the country’s financial landscape. However, there are also concerns about potential challenges and hurdles that may need to be addressed. Despite these uncertainties, there is a glimmer of optimism regarding the opportunities for innovation and growth that could arise from navigating and adapting to the changing regulatory landscape.

For further insights into the legal landscape of Bitcoin in Kuwait, especially regarding banking services regulations, check out this informative article on bitcoin banking services regulations in Kuwait.

Potential Challenges 💡

Bitcoin’s entry into the banking sector in Kyrgyzstan brings both promise and uncertainty. As the digital currency gains ground, potential challenges loom on the regulatory horizon. Key concerns may revolve around ensuring financial stability, preventing illicit activities, and establishing consumer protection measures. Striking a balance between fostering innovation and maintaining regulatory oversight will be crucial in navigating the evolving landscape of Bitcoin banking in Kyrgyzstan. Adapting to these challenges will be essential for the sustainable growth of the cryptocurrency ecosystem in the country.

Opportunities for Innovation 💰

In the realm of digital finance, the landscape of possibilities for technological advancement and financial inclusion is vast. The emerging trends in blockchain technology offer a myriad of opportunities for innovation in the financial sector, particularly in unbanked regions. By leveraging decentralized platforms and smart contracts, new models of secure and efficient financial services can be developed to bridge the gap between traditional banking systems and the underserved populations. This opens doors for creative solutions that empower individuals to access, transfer, and utilize financial resources in ways previously unimaginable, ultimately fostering economic growth and resilience in these communities.

Within this dynamic environment, the potential for collaboration and experimentation presents itself as a cornerstone for driving progress and fostering financial empowerment. By nurturing a culture of innovation and embracing the disruptive potential of blockchain technology, stakeholders have the chance to redefine the traditional paradigms of banking and finance, shaping a more inclusive and efficient financial ecosystem for all. [Here is more information on bitcoin banking services regulations in Kiribati.]