Understanding Bitcoin Basics 📈

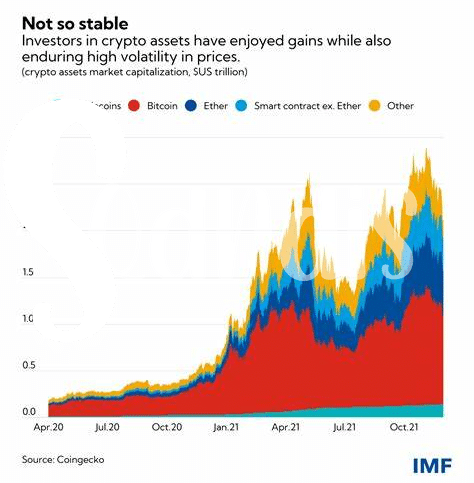

Bitcoin operates on a decentralized digital ledger known as the blockchain, revolutionizing traditional financial systems with its peer-to-peer transactions. It enables secure and transparent transfers without the need for intermediaries like banks. Each transaction is verified by network participants through cryptography, ensuring immutability and reducing the risk of fraud. Understanding the fundamentals of Bitcoin, such as wallets, addresses, and mining, is crucial in grasping its potential impact on the financial landscape.

In a rapidly evolving digital economy, grasping the essence of Bitcoin is indispensable for both individuals and financial institutions. Its decentralized nature challenges conventional banking models, offering a glimpse into a future where financial transactions are seamlessly conducted across borders. Embracing this technology necessitates a shift in mindset towards a more transparent and efficient financial ecosystem, ultimately shaping the way we perceive and utilize currency.

Compliance Regulations for Banks 🏦

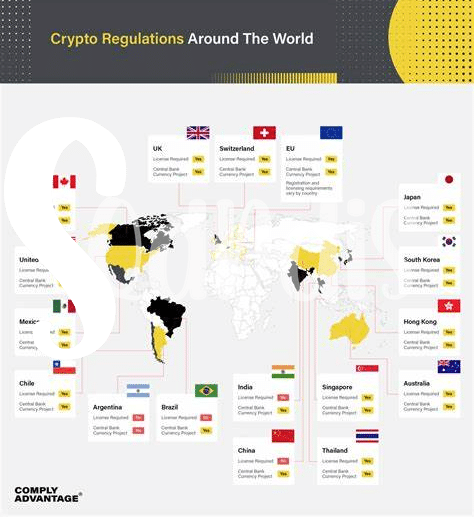

Navigating through the complex web of regulations can be a daunting task for banks venturing into the world of Bitcoin. Closely adhering to compliance requirements is essential to ensure a seamless integration of cryptocurrency transactions within the traditional banking framework. By aligning operations with regulatory standards, banks in Grenada can foster trust, transparency, and legal certainty in their Bitcoin offerings.

Importance of Kyc and Aml Procedures 🕵️♂️

KYC and AML procedures are essential safeguards for banks when dealing with Bitcoin. These procedures help verify the identities of customers and ensure that transactions are not linked to illegal activities. By enforcing KYC (Know Your Customer) and AML (Anti-Money Laundering) measures, banks in Grenada can enhance their security protocols and build trust with regulators, ultimately fostering a more transparent and compliant financial ecosystem.

Challenges in Implementing Compliance Measures 🤔

Challenges often arise when banks in Grenada aim to implement compliance measures for Bitcoin transactions. Navigating the evolving regulatory landscape requires constant vigilance and adaptability, as authorities work to keep pace with the rapidly growing digital currency market. In addition, the unique characteristics of Bitcoin, such as its decentralized nature and pseudonymous transactions, present inherent challenges in ensuring full compliance with traditional banking regulations.

For further insights on the challenges and opportunities in Bitcoin banking compliance, you can explore the article on bitcoin banking services regulations in Guinea.

Technology Solutions for Compliance 🖥️

Technology solutions play a crucial role in helping banks navigate the complex landscape of compliance requirements. With the rise of digital currencies like Bitcoin, banks in Grenada need robust systems that can ensure adherence to regulatory standards while also leveraging the benefits of blockchain technology. Advanced software tools offer automated monitoring capabilities, enabling banks to detect and prevent suspicious activities in real-time. These solutions streamline the KYC (Know Your Customer) and AML (Anti-Money Laundering) processes, enhancing efficiency and accuracy in compliance efforts. By embracing innovative technologies, banks can stay ahead of evolving regulations and safeguard their operations in the digital age.

Future Outlook for Bitcoin in Grenada 💡

In the context of Grenada, the future outlook for Bitcoin is poised for interesting developments. As the global acceptance of cryptocurrencies continues to grow, Grenada’s stance on Bitcoin could shape its financial landscape significantly. With potential regulatory adjustments and evolving market dynamics, there is room for innovative solutions to integrate cryptocurrencies like Bitcoin into the country’s financial ecosystem effectively.

For more information on Bitcoin banking services regulations in various countries, you can refer to the guidelines set forth in the Bitcoin banking services regulations in Gabon.