Adoption 🚀

With the rising trend of digital currencies, Gabon is poised to embrace the potential of Bitcoin banking. Encouraging adoption through education and accessibility will be crucial in bridging the gap between traditional financial systems and decentralized cryptocurrencies. Empowering individuals and businesses to transact seamlessly with Bitcoin can revolutionize the financial landscape in Gabon, opening up new avenues for economic growth and financial inclusion. By fostering a culture of trust and understanding, Bitcoin adoption can pave the way for a more secure and efficient banking ecosystem in the country.

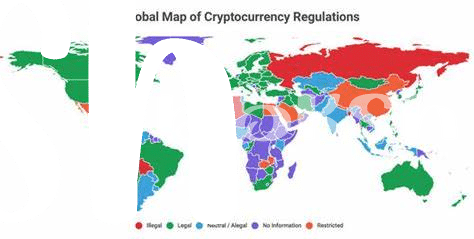

Regulatory Environment 📜

The regulatory landscape surrounding Bitcoin banking in Gabon presents a complex yet crucial aspect for the industry’s growth and stability. As the digital currency continues to gain momentum globally, it faces the challenge of navigating through various regulatory frameworks that differ from country to country. By understanding and adapting to Gabon’s specific regulatory environment, Bitcoin banks can establish a solid foundation for operations while also contributing to the overall financial ecosystem in the region. It is essential for stakeholders to collaborate with policymakers to ensure a balanced approach that fosters innovation without compromising on regulatory compliance and consumer protection.

Economic Impact 💰

The rise of Bitcoin banking in Gabon is poised to create a ripple effect across the nation’s financial landscape. As digital currencies gain momentum, the economic impact is undeniable. Businesses are exploring new avenues for growth, and consumers are embracing this innovative payment method. This shift has the potential to revolutionize traditional banking systems and drive economic progress in Gabon.

Security Concerns 🔒

In the rapidly evolving landscape of digital currencies in Gabon, introducing Bitcoin banking services poses an array of security concerns that necessitate careful consideration. As technology advances, so do the methods of potential cyber threats and attacks that could jeopardize the stability and trust in the banking sector. Safeguarding user data, preventing hacking incidents, and ensuring secure transactions are paramount to fostering confidence in Bitcoin transactions. Stay informed about the latest developments and best practices in security measures to fortify the future of Bitcoin banking in Gabon.

bitcoin banking services regulations in Germany

Fintech Innovation 🌐

In the realm of financial technology, fresh ideas and cutting-edge technology are revolutionizing the way we manage our finances. Fintech innovations in Gabon are paving the way for a more accessible and efficient banking experience, bridging the gap between traditional banking services and modern digital solutions. By incorporating these advancements, the financial sector in Gabon is poised to unlock new opportunities for both consumers and businesses, enhancing convenience, speed, and security in transactions. The landscape of financial technology is continually evolving, and embracing these innovations is crucial for staying ahead in the digital age.

Public Awareness 🧠

Living in Gabon, it’s essential for the public to understand the benefits and risks associated with using Bitcoin for banking purposes. Education plays a crucial role in this process, as awareness leads to informed decision-making. Through workshops, digital campaigns, and community events, individuals can learn about the opportunities that Bitcoin banking presents, empowering them to leverage this innovative financial technology effectively. As more people become aware of the potential of Bitcoin banking, its adoption and acceptance are likely to increase in Gabon. For further information on bitcoin banking services regulations in Greece, visit bitcoin banking services regulations in Georgia.