Current Bitcoin Adoption Trends 📈

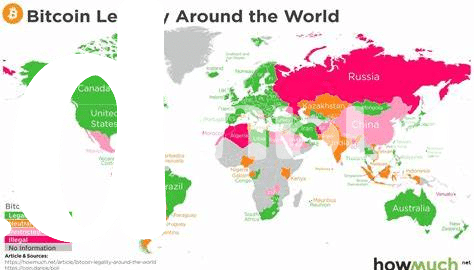

Bitcoin adoption is steadily on the rise in Equatorial Guinea, reflecting a growing interest in digital currency among the population. More individuals and businesses are exploring the use of Bitcoin for transactions and investments, indicating a shift towards embracing this innovative financial technology. The increasing acceptance of Bitcoin in the country suggests a positive trend towards a more digital and interconnected economy, providing new opportunities for financial growth and development.

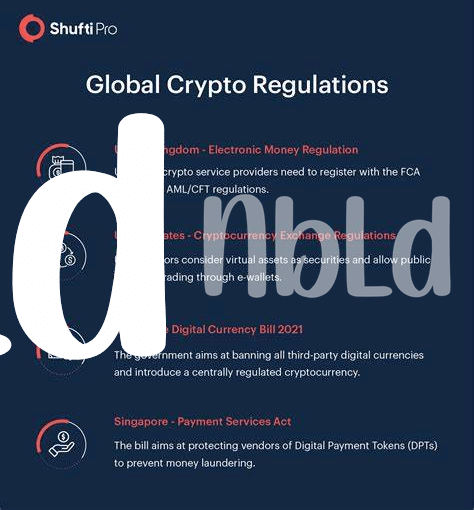

Regulatory Hurdles and Compliance Challenges 🚫

Navigating the intricate landscape of regulatory hurdles and compliance challenges can be a daunting task for Bitcoin banking entities in Equatorial Guinea. Adhering to evolving regulations while staying innovative is crucial for establishing trust and credibility within the financial sector. Understanding and proactively addressing compliance issues is paramount to ensure sustainable growth and foster a conducive environment for the integration of Bitcoin banking services. In this intricate dance between regulation and innovation, strategic planning and adaptability play pivotal roles in overcoming challenges and seizing opportunities within the dynamic realm of digital banking.

Within the realm of Bitcoin banking in Equatorial Guinea, the alignment of regulatory frameworks with the disruptive nature of cryptocurrencies remains a key focal point. Striking a balance between compliance requirements and technological advancements is imperative for driving the sector forward amidst a rapidly evolving landscape. By actively engaging with regulatory bodies and embracing innovative solutions, Bitcoin banking institutions can pave the way for enhanced transparency, security, and efficiency in financial transactions. Thoughtful navigation through regulatory hurdles can ultimately lead to a more inclusive and resilient financial ecosystem, unlocking new avenues for growth and collaboration.

Potential for Financial Inclusion and Access 🌍

Financial inclusion is a powerful tool that can bridge the gap between underserved populations and traditional banking services. By leveraging Bitcoin technology, Equatorial Guinea has the potential to significantly expand access to financial services, particularly in remote areas where traditional banks have limited reach. This inclusive approach not only empowers individuals to participate in the global economy but also fosters entrepreneurship and economic growth within the country.

Security Risks and Fraud Concerns 🔒

When it comes to digital currencies such as Bitcoin, security risks and fraud concerns are critical considerations that need to be addressed with utmost vigilance. With the decentralized nature of cryptocurrencies, the potential for malicious actors to exploit vulnerabilities is a constant threat. Ensuring robust security measures, such as encryption protocols and secure storage solutions, is paramount in safeguarding assets and preventing fraudulent activities from compromising the integrity of the Bitcoin banking ecosystem.

As the adoption of Bitcoin grows in Equatorial Guinea, investors and users alike must stay informed and educated on best practices to mitigate security risks and combat potential fraud. By promoting awareness and implementing stringent security protocols, the Bitcoin banking sector can foster trust and confidence among stakeholders, paving the way for a more secure and resilient financial landscape. [For more insights on Bitcoin banking services regulations in El Salvador, check out this article on bitcoin banking services regulations in El Salvador.]

Role of Innovation and Technology Advancements 🌐

In today’s rapidly evolving financial landscape, the marriage of innovation and technology in the realm of Bitcoin banking is paramount. Advancements in blockchain technology have opened up new possibilities for secure transactions and streamlined processes. The role of innovation and technology advancements in Bitcoin banking heralds a paradigm shift in how financial services are accessed and utilized. As pioneers continue to push the boundaries of what is possible, the potential for transformative change in the way individuals interact with their finances becomes increasingly tangible.

Future Growth and Market Opportunities 🚀

In the fast-evolving landscape of Bitcoin banking in Equatorial Guinea, the future holds promising growth and market opportunities. As the global financial ecosystem continues to embrace digital currencies, there is immense potential for expansion and innovation in this space. With strategic planning and a forward-thinking approach, stakeholders in Equatorial Guinea can position themselves to capitalize on the growing demand for Bitcoin services. Stay informed about the regulatory landscape by exploring the Bitcoin banking services regulations in Dominica.