Introduction to Bitcoin and Its Tax Implications 💡

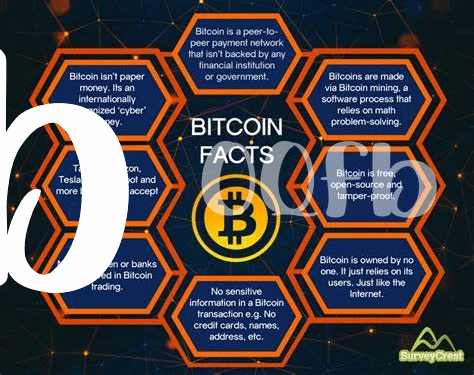

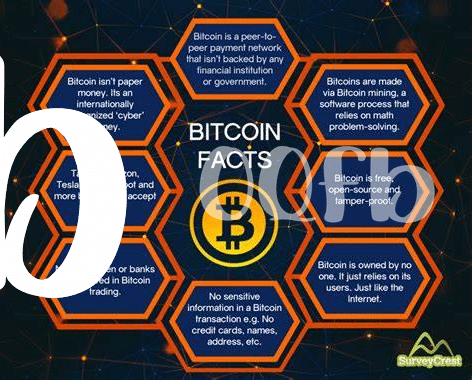

Bitcoin, known for its decentralized nature and innovative technology, has gained popularity as a digital currency. As more individuals and businesses begin to engage with Bitcoin, understanding its tax implications becomes crucial. The unique characteristics of Bitcoin, such as anonymity and cross-border transactions, present challenges and opportunities in the realm of taxation. Governments around the world are working to create regulatory frameworks to address the taxation of Bitcoin transactions, mining activities, and investments. Stay tuned to delve into the evolving tax landscape for Bitcoin and the practical implications it carries for individuals and businesses in Micronesia.

Tax Regulations on Bitcoin Transactions 📝

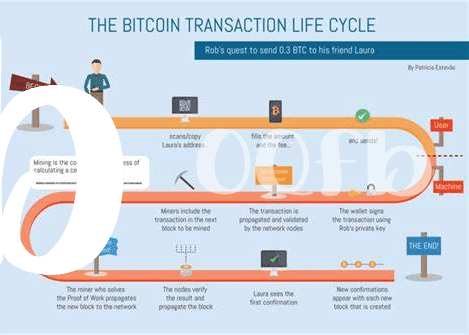

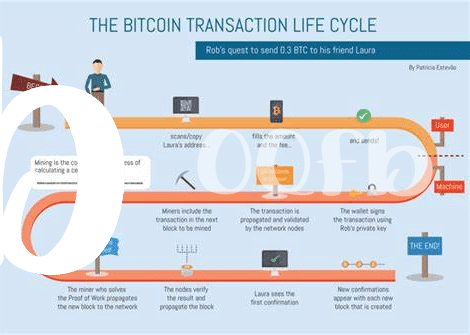

Tax Regulations on Bitcoin Transactions can vary significantly from one jurisdiction to another, leading to an intricate web of rules and requirements for those involved in the cryptocurrency space. Authorities worldwide are grappling with the implications of digital assets on their existing tax frameworks, seeking to balance innovation with regulatory oversight. Understanding the tax treatment of Bitcoin transactions is essential for individuals and businesses alike to ensure compliance and mitigate potential risks. With the evolving landscape of crypto tax regulations, staying informed and proactive is key to navigating the complexities of this rapidly growing market.

Tax Reporting for Bitcoin Mining Activities ⛏️

Bitcoin mining activities are a unique aspect of the cryptocurrency world that brings its own set of tax reporting requirements. Entities engaged in Bitcoin mining must accurately report their income generated from mining operations, taking into account factors such as electricity costs, equipment depreciation, and any expenses incurred during the mining process. Proper documentation and record-keeping are essential to ensure compliance with tax regulations and avoid any potential liabilities in the future. It is crucial for miners to stay informed about the ever-changing tax landscape concerning cryptocurrency activities to navigate the complexities of reporting their mining income effectively.

Capital Gains Tax on Bitcoin Investments 💰

When it comes to investing in Bitcoin, one key aspect that individuals need to consider is the capital gains tax implications. As the value of Bitcoin fluctuates, any profit made from selling or trading this digital asset is subject to capital gains tax. This tax is imposed on the difference between the purchase price and the selling price of Bitcoin. It’s important for investors to keep track of their transactions and accurately report any capital gains to ensure compliance with tax regulations. Understanding how capital gains tax applies to Bitcoin investments can help investors make informed decisions and manage their tax liabilities effectively.

For further insights into the legal consequences of Bitcoin transactions in Mauritania, you can refer to this article on legal consequences of bitcoin transactions in Mauritania.

Tax Challenges Faced by Bitcoin Users 🤔

Navigating the realm of Bitcoin poses various challenges for users when it comes to taxation. One key issue is the lack of clear guidance from tax authorities on how to accurately report Bitcoin transactions and holdings. Additionally, the volatility of Bitcoin prices can make it challenging to determine the exact value for tax purposes, especially when it comes to capital gains calculations. Another hurdle faced by Bitcoin users is the complex nature of tax regulations governing digital assets, leading to uncertainty and confusion. These challenges highlight the need for improved clarity and streamlined processes in the taxation of Bitcoin to ensure compliance and minimize potential liabilities for users.

Future Outlook: Evolving Tax Landscape for Bitcoin 💭

One of the key aspects shaping the future of Bitcoin taxation is the evolving tax landscape. As governments continue to grapple with the regulatory challenges posed by cryptocurrencies, including Bitcoin, we can expect to see significant developments in how these digital assets are taxed. This encompasses a range of considerations, from defining the nature of Bitcoin for tax purposes to determining appropriate taxation frameworks. As the awareness and adoption of Bitcoin grow globally, the need for clear and comprehensive tax guidelines will become increasingly imperative for both authorities and taxpayers. Stay updated on the latest legal changes and implications of Bitcoin transactions in various jurisdictions, such as the legal consequences of bitcoin transactions in Moldova, to navigate the evolving tax landscape effectively.