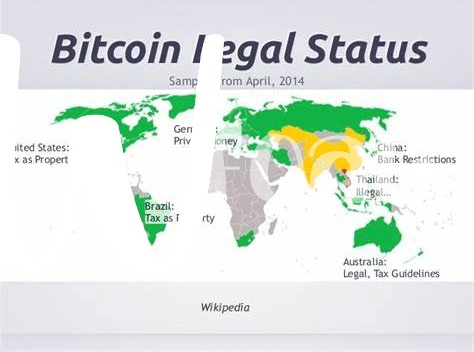

Regulatory Landscape 📜

The regulatory environment surrounding Bitcoin transactions in Mali is a complex tapestry of laws and guidelines that can pose challenges for businesses and individuals alike. Navigating this landscape requires a thorough understanding of the regulatory framework and staying abreast of any changes or updates that may impact the legality of such transactions. Compliance with these regulations is crucial to avoid potential legal risks and ensure smooth operations within the cryptocurrency space. The evolving nature of regulatory oversight in Mali necessitates a proactive approach to compliance, staying proactive and responsive to regulatory developments is essential in mitigating legal risks and maintaining a sustainable business model.

Risks of Conducting Transactions 💰

The evolving landscape of digital currency transactions introduces a myriad of complexities and uncertainties for participants. The decentralized nature of Bitcoin, while heralded for its autonomy, also poses inherent risks when engaging in transactions. From volatility in valuation to vulnerability to cyber threats, individuals and businesses face a spectrum of challenges. Additionally, the anonymity factor of transactions, while appealing for privacy reasons, opens doors to potential illicit activities and regulatory scrutiny. Understanding these risks is crucial in navigating the intricate web of compliance and legal obligations in the realm of Bitcoin transactions.

Compliance Challenges for Businesses 🏢

Businesses operating in the intricate landscape of Bitcoin transactions face a myriad of compliance challenges. Navigating the regulatory requirements while ensuring adherence to legal frameworks can be a daunting task. From anti-money laundering protocols to data protection measures, businesses must meticulously design and implement robust compliance programs. The dynamic nature of cryptocurrency regulations adds another layer of complexity, requiring constant vigilance and adaptability. Establishing strong internal controls, conducting regular audits, and fostering a culture of compliance are essential strategies for mitigating risks and maintaining integrity in the evolving realm of digital transactions.

Legal Implications for Individuals 🚫

Individuals engaging in Bitcoin transactions in Mali face a myriad of legal implications, ranging from tax obligations to potential money laundering concerns. Understanding the legal framework surrounding cryptocurrency activities is crucial to avoid unintentional violations that could lead to severe consequences. It is imperative for individuals to educate themselves on the laws governing digital assets and seek legal guidance when uncertain. For further insights into the legal consequences of Bitcoin transactions, visit legal consequences of bitcoin transactions in Marshall Islands for valuable information on navigating legal challenges in this evolving landscape.

Enforcement Measures by Authorities 🕵️♂️

When it comes to regulating Bitcoin transactions in Mali, authorities have taken proactive steps to enforce compliance. The government has implemented strict monitoring mechanisms to track and investigate any suspicious activities involving cryptocurrencies. This includes conducting audits, imposing fines, and even resorting to legal action when necessary. Authorities work closely with financial institutions and businesses to ensure that all transactions adhere to the regulatory framework in place. Additionally, there is an emphasis on raising awareness among the public about the risks associated with engaging in unregulated Bitcoin transactions. By actively enforcing these measures, authorities aim to maintain transparency and security within the cryptocurrency market.

Strategies for Navigating the Legal Landscape 🗺️

Navigating the complex legal landscape surrounding Bitcoin transactions requires a proactive approach to compliance and risk management. Businesses operating in Mali must stay abreast of the evolving regulatory requirements to ensure their operations align with the current legal framework. Conducting thorough due diligence on potential transaction partners and implementing robust compliance measures can help mitigate the risks associated with engaging in Bitcoin transactions. Engaging legal counsel with expertise in cryptocurrency regulations is essential for developing a comprehensive compliance strategy tailored to the unique challenges posed by the digital currency environment.

To stay informed about the legal implications of Bitcoin transactions in other jurisdictions, such as Mexico, businesses can explore resources on the legal consequences of bitcoin transactions in Malta. By learning from global experiences and best practices, companies can enhance their compliance efforts and safeguard against potential regulatory pitfalls. Embracing a proactive and adaptable approach to compliance will not only help businesses navigate the legal complexities of Bitcoin transactions in Mali but also position them for sustainable growth in the dynamic digital economy.