Licensing Requirements in Tunisia 🌍

In Tunisia, obtaining a cryptocurrency license involves navigating a structured framework set by regulatory authorities. This process aims to ensure transparency, security, and compliance within the cryptocurrency ecosystem. From registration requirements to financial solvency criteria, each step is designed to protect investors and uphold the integrity of the market. By adhering to these licensing requirements, businesses can operate with confidence while fostering trust among consumers. The Tunisian approach reflects a commitment to balance innovation with regulatory oversight, creating a foundation for sustainable growth in the digital currency sector.

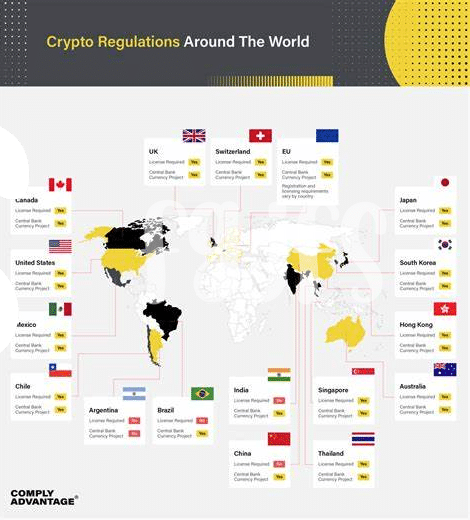

Global Standards on Cryptocurrency Licensing 🌐

Cryptocurrency licensing requirements vary across the globe, reflecting the evolving nature of this digital asset. Countries worldwide are navigating the complexities of regulating cryptocurrencies, aiming to strike a balance between fostering innovation and mitigating risks. From robust registration processes to stringent compliance protocols, each jurisdiction brings its own set of standards to the table. As the cryptocurrency landscape continues to expand, there is an increasing call for harmonization and collaboration among regulatory bodies to streamline licensing procedures. This collaborative approach holds the potential to enhance transparency, bolster investor confidence, and pave the way for a more cohesive regulatory framework on a global scale.

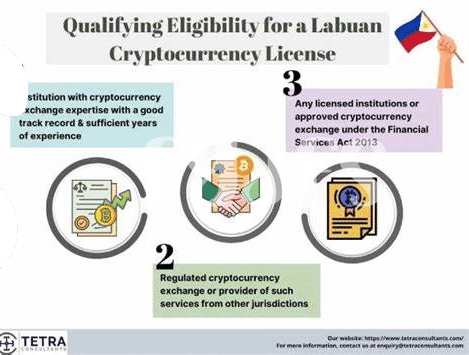

Key Differences in Regulatory Approaches 🔍

Regulatory approaches to cryptocurrency licensing vary across different countries, reflecting the evolving landscape of the digital economy. While some nations adopt a cautious stance with stringent requirements and oversight, others embrace a more flexible and innovation-friendly framework. These variations in regulatory approaches can impact how companies operate within the cryptocurrency space and navigate compliance challenges. Understanding the key differences in how jurisdictions approach licensing can provide valuable insights for companies seeking to expand their international presence and engage with diverse regulatory environments. By exploring these nuances, stakeholders can better grasp the complexities of global cryptocurrency regulation and strategize effectively to comply with varying standards.

Impact on Foreign Investors 🤝

The presence of clear and consistent licensing requirements for cryptocurrency operations in any country can significantly influence foreign investors’ decisions to enter and participate in that market. For foreign investors, the transparency and stability of regulatory frameworks play a crucial role in instilling confidence in the sector. When evaluating investment opportunities in the cryptocurrency space, foreign entities closely examine the legal environment, seeking assurances of compliance and protection. The impact on foreign investors can be profound, as stringent or unclear licensing requirements may deter potential investments, while well-defined and accommodating regulations can attract capital inflows and foster industry growth.

For more insights into navigating cryptocurrency exchange licensing requirements in different regions, including Tanzania, refer to the comprehensive guide available at cryptocurrency exchange licensing requirements in Tanzania.

Potential for Harmonization and Collaboration 🤝

Collaboration among regulators worldwide in the realm of cryptocurrency licensing offers a promising avenue for fostering greater trust and consistency in the industry. By aligning standards and practices, countries can enhance the credibility of the sector and attract more foreign investment. This collaborative approach also facilitates information sharing and best practices, leading to a more secure and transparent ecosystem for all stakeholders involved. As the digital asset landscape evolves, the potential for harmonization presents an exciting opportunity to establish a unified framework that benefits both businesses and consumers alike.

Future Outlook for Cryptocurrency Regulation 🚀

In the rapidly evolving landscape of cryptocurrency regulation, the future outlook holds a mix of challenges and opportunities. As more countries seek to establish clear guidelines for the use and trading of digital assets, we can expect to see a continued push towards greater transparency and accountability in the industry. This shift is likely to bring both regulatory clarity for market participants and increased investor confidence, paving the way for further mainstream adoption of cryptocurrencies.

For a deeper dive into how different countries are approaching cryptocurrency exchange licensing requirements, you can explore the specific regulations in Thailand and Syria. Understanding the nuances of these frameworks can provide valuable insights into the global regulatory landscape for cryptocurrency exchanges. Explore the cryptocurrency exchange licensing requirements in Thailand to compare them with the regulations in Syria.