Understanding the Legal Landscape 🏛️

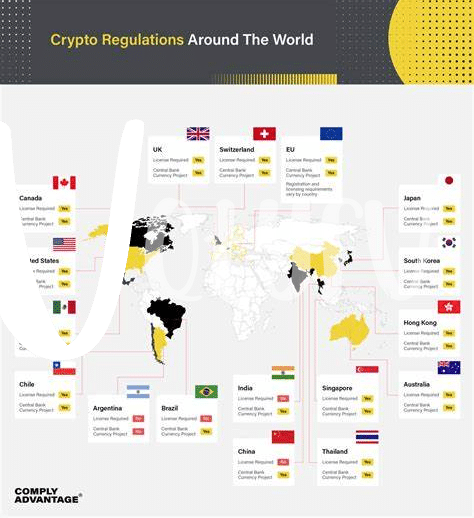

The legal landscape surrounding cryptocurrency exchanges in Syria is a complex terrain that mandates a thorough understanding for smooth operations. Navigating the regulations and compliance requirements with finesse is crucial to avoid pitfalls and ensure legality. By delving into the legal framework with diligence, businesses can adapt strategies and protocols that align seamlessly with the established norms, fostering a secure and sustainable exchange environment.

Necessary Documentation and Verification 📄

When it comes to getting started with a cryptocurrency exchange in Syria, having the right documentation and verification processes in place is crucial. This ensures not only compliance with regulations but also builds trust with users. Gathering necessary paperwork, such as identification documents and proof of address, is just the beginning. Verification processes, including Know Your Customer (KYC) and Anti-Money Laundering (AML) checks, play a vital role in ensuring the legitimacy of users and transactions. Maintaining accurate records and conducting regular audits further enhances security and transparency. By prioritizing thorough documentation and verification procedures, exchange operators can establish a solid foundation for a trustworthy and compliant platform.

Security Measures and Best Practices 🔒

When it comes to safeguarding your cryptocurrency assets, it’s crucial to implement robust security measures and adhere to best practices. One key aspect is utilizing secure wallets to store your digital currencies. Hardware wallets, such as Ledger or Trezor, offer an extra layer of protection by keeping your funds offline when not in use. Additionally, enabling two-factor authentication on your exchange accounts can help prevent unauthorized access and enhance the overall security of your holdings. Regularly updating your passwords and being cautious of phishing attempts are simple yet effective practices in maintaining the security of your cryptocurrency investments. By staying vigilant and implementing these security measures, you can better safeguard your assets in the ever-evolving landscape of digital currencies.

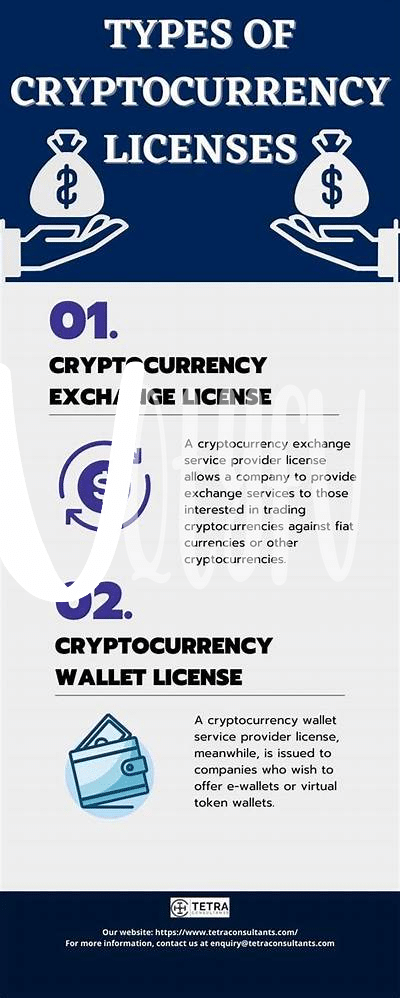

Choosing the Right Exchange Platform 💻

When it comes to selecting the right exchange platform for your cryptocurrency endeavors, there are several factors to consider. The user interface, transaction fees, security features, customer support, and available cryptocurrency options all play a crucial role in making a decision. It’s essential to research and compare different platforms to find the one that aligns best with your trading goals and risk tolerance.

In the fast-evolving world of cryptocurrencies, staying informed is key. Regularly monitoring news updates, market trends, and regulatory changes can help you make informed decisions when it comes to choosing and navigating through cryptocurrency exchange platforms. For more in-depth information on the process of securing a cryptocurrency exchange license in Sweden, check out this resource on cryptocurrency exchange licensing requirements in Sweden.

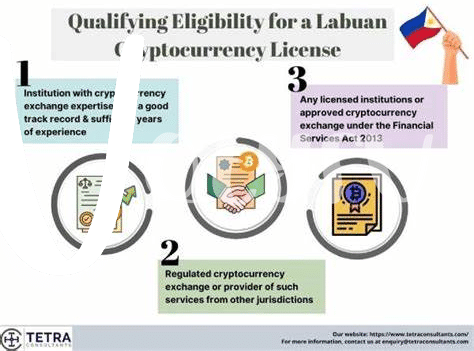

Compliance with Regulatory Requirements 📝

Navigating regulatory requirements in the cryptocurrency space can often feel like walking through a maze without a map. However, by proactively ensuring that your exchange complies with all necessary regulations, you can not only safeguard your business but also build trust with your customers and regulators. Understanding and adhering to the specific legal frameworks in Syria is crucial in maintaining the legitimacy and longevity of your exchange platform.

Implementing robust compliance measures not only demonstrates your commitment to upholding industry standards but also helps to mitigate potential risks associated with non-compliance. By staying informed about any updates or changes in regulatory requirements, you can adapt your strategies accordingly and ensure that your exchange operates within the boundaries of the law. This proactive approach not only benefits your business but also contributes to a more secure and resilient cryptocurrency ecosystem in Syria.

Managing Risks and Staying Informed 🚨

Managing risks in the world of cryptocurrency exchanges is crucial for success. Staying informed about market trends, regulatory updates, and emerging cybersecurity threats is a continuous process that demands vigilance. One must actively monitor their investment portfolio, assess potential vulnerabilities, and adapt strategies to mitigate risks effectively. By staying informed, investors can make educated decisions, stay ahead of potential pitfalls, and safeguard their assets in the ever-evolving landscape of digital currencies. It is not just about reacting to risks but proactively managing them that sets successful cryptocurrency traders apart.

For the current cryptocurrency exchange licensing requirements in Tajikistan, and to compare them with the regulatory framework in Switzerland, it is essential to research the specific guidelines outlined by each country. You can learn more about the cryptocurrency exchange licensing requirements in Tajikistan by visiting the official regulatory sources and comparing them with the established regulations in Switzerland for a comprehensive understanding of the diverse regulatory landscapes in the cryptocurrency industry. Stay informed and compliant to navigate the complexities of international cryptocurrency regulations effectively.