Introduction to Bitcoin Aml Regulations 🔍

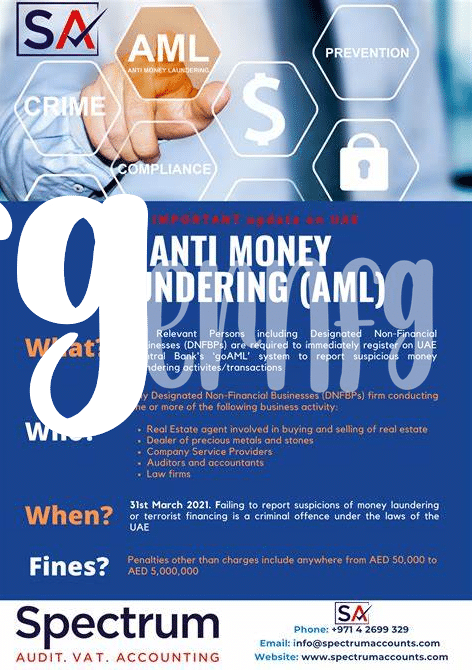

Bitcoin AML regulations have become a critical aspect of the cryptocurrency landscape, particularly in the UAE. The increasing adoption of digital assets has prompted regulatory bodies to establish guidelines to prevent money laundering and ensure compliance within the industry. Understanding these regulations is essential for individuals and businesses engaging in Bitcoin transactions to navigate the evolving regulatory environment effectively. By shedding light on the complexities of AML requirements specific to Bitcoin, stakeholders can better comprehend the implications and significance of regulatory compliance in the digital currency space.

Understanding Compliance Challenges 🤔

Navigating compliance challenges in the realm of Bitcoin AML regulations can often feel like decoding a complex puzzle. The evolving landscape of regulatory requirements, coupled with the dynamic nature of cryptocurrency transactions, presents a myriad of obstacles for businesses and individuals alike. From deciphering intricate reporting mandates to staying abreast of changing legislative frameworks, the journey towards achieving full compliance can be daunting. However, understanding these challenges is the first step towards successfully overcoming them.

In the realm of Bitcoin AML regulations, grasping the intricacies of compliance hurdles is essential for fostering a culture of transparency and accountability. Through a proactive approach that blends vigilance with innovation, businesses can proactively address these challenges and fortify their defenses against illicit activities within the digital asset space. By embracing a comprehensive understanding of compliance requirements, organizations can navigate the maze of regulations with confidence and integrity.

Importance of Kyc Procedures 🛡️

One can’t underestimate the essential role of KYC procedures in the financial world. These procedures serve as the first line of defense against money laundering and fraudulent activities. By verifying the identities of customers through KYC, financial institutions can significantly reduce the risks associated with illicit transactions. Embracing robust KYC measures not only helps in complying with regulations but also builds trust with customers, fostering a secure and transparent financial ecosystem.

A strong emphasis on KYC procedures not only safeguards the integrity of financial systems but also enhances the overall credibility of institutions. By implementing stringent KYC protocols, organizations can create a shield against potential financial crimes, ultimately contributing to a safer and more reliable financial environment for all stakeholders involved. Adopting a proactive approach to KYC demonstrates a commitment to compliance and ethical business practices, reinforcing the foundation of trust upon which the financial industry thrives.

Role of Technology in Aml Compliance 📱

The integration of technology in AML compliance is revolutionizing the way financial institutions combat money laundering activities. Advanced algorithms and machine learning tools are being utilized to detect suspicious patterns and transactions in real-time, enhancing the efficiency and accuracy of monitoring processes. Furthermore, blockchain technology plays a crucial role in ensuring transparent and secure transactions, providing a tamper-proof record of financial activities for regulatory purposes. The use of innovative technologies not only streamlines compliance procedures but also strengthens the overall integrity of the financial system.

In a rapidly evolving digital landscape, staying abreast of technological advancements is paramount for financial institutions to effectively navigate AML regulations. Embracing cutting-edge solutions empowers compliance teams to proactively identify and mitigate risks associated with money laundering, safeguarding both the institution and its stakeholders. By leveraging technology-driven approaches, organizations can adapt to the dynamic nature of financial crimes and proactively address emerging challenges in AML compliance. [Reference: Bitcoin Anti-Money Laundering (AML) Regulations in Uganda]

Impact on Financial Institutions 🏦

Bitcoin AML regulations have a significant impact on financial institutions in the UAE. Compliance with these rules requires robust monitoring systems and enhanced due diligence measures. Financial institutions are tasked with implementing stringent practices to detect and prevent money laundering activities related to Bitcoin transactions. Non-compliance can result in severe penalties, reputational damage, and legal consequences. As such, financial institutions are investing in advanced technologies and skilled personnel to navigate the complex regulatory landscape effectively. Adapting to evolving AML regulations is crucial for safeguarding the integrity of the financial system and maintaining trust among customers.

Future Trends in Uae Aml Regulations 🌐

In the ever-evolving landscape of AML regulations in the UAE, future trends indicate a strong emphasis on enhancing technological capabilities to streamline compliance processes. Integrating advanced tools like blockchain analytics and AI-driven monitoring systems is poised to revolutionize the way financial institutions detect and prevent money laundering activities. Moreover, regulatory bodies are increasingly focusing on cross-border collaboration and information sharing to combat financial crimes effectively. These proactive measures not only demonstrate the commitment of the UAE to stay ahead of illicit financial activities but also pave the way for a more secure and transparent financial ecosystem. This forward-looking approach positions the UAE as a key player in shaping global AML standards and practices.