Regulatory Landscape 🌍

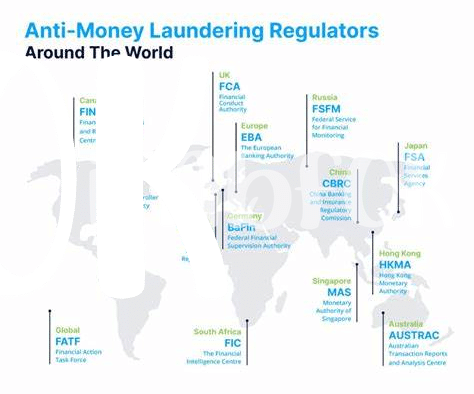

The regulatory landscape surrounding Bitcoin AML in Turkmenistan is a dynamic tapestry of evolving guidelines and policies. As the country navigates the complexities of integrating cryptocurrency into its financial framework, regulatory bodies are working diligently to establish clear guidelines for compliance and oversight. This intricate web of regulations not only sets the stage for transparency and accountability but also shapes the future trajectory of crypto adoption in the region.

In Turkmenistan, staying abreast of regulatory updates and compliance requirements is imperative for businesses and individuals engaging in Bitcoin transactions. Navigating this ever-changing landscape requires a comprehensive understanding of the regulatory framework and a proactive approach to compliance. By proactively addressing regulatory challenges, stakeholders can position themselves for success in a rapidly evolving financial ecosystem.

Crypto Transactions Monitoring 🔄

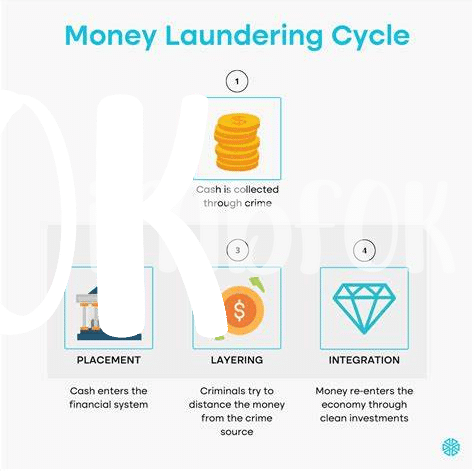

Within the realm of cryptocurrency, the monitoring of transactions is a critical aspect that warrants meticulous attention. By keeping an observant eye on the flow of crypto transactions, entities can effectively detect and mitigate potential risks such as money laundering and illicit activities. Implementing robust monitoring mechanisms not only serves as a safeguard for the integrity of the financial ecosystem but also bolsters compliance efforts in adherence to regulatory standards. Regular monitoring enables swift responses to suspicious activities, fostering a secure environment for legitimate transactions to thrive seamlessly. As the digital landscape continues to evolve, the necessity of vigilant crypto transactions monitoring remains paramount in upholding the integrity and trust within the burgeoning cryptocurrency market.

Compliance Tools and Solutions 💡

Navigating the complex world of Bitcoin AML regulations in Turkmenistan requires the utilization of robust compliance tools and solutions. These tools have become essential in helping businesses adhere to regulatory requirements and mitigate risks associated with crypto transactions. By leveraging advanced technology and innovative strategies, companies can streamline their AML processes, enhance monitoring capabilities, and ensure compliance with evolving regulations. Implementing these solutions not only enhances operational efficiency but also strengthens overall risk management frameworks, safeguarding businesses from potential vulnerabilities in the digital currency space.

Impact on Financial Institutions 💼

Financial institutions in Turkmenistan face a challenging landscape in navigating the implications of Bitcoin AML regulations. With the evolving regulatory environment, these institutions need to adapt and implement robust compliance measures to mitigate risks associated with cryptocurrency transactions. The impact on financial institutions extends to ensuring thorough customer due diligence, enhancing transaction monitoring capabilities, and investing in compliance tools and solutions. As they navigate these challenges, financial institutions play a crucial role in safeguarding against illicit activities and fostering a compliant ecosystem within the cryptocurrency space. To delve deeper into the future implications for Bitcoin AML compliance, particularly in Turkmenistan, explore the insights shared in this informative article on the bitcoin anti-money laundering (AML) regulations in Tonga. [Learn more here](bitcoin anti-money laundering (aml) regulations in Tonga).

Ensuring Customer Due Diligence 🔍

Customer due diligence is a crucial aspect of regulatory compliance in the cryptocurrency space. It involves verifying the identity of clients, assessing their risk levels, and monitoring transactions to detect any suspicious activities. By ensuring robust customer due diligence processes, financial institutions can mitigate the risks associated with money laundering and terrorist financing. Implementing thorough KYC (Know Your Customer) procedures not only strengthens the institution’s compliance framework but also builds trust with regulatory authorities by demonstrating a commitment to upholding AML (Anti-Money Laundering) regulations.

Additionally, integrating advanced technologies such as blockchain analytics and artificial intelligence can enhance the efficiency and effectiveness of customer due diligence processes. These tools can help automate identity verification, risk assessments, and transaction monitoring, enabling financial institutions to stay ahead of evolving compliance requirements. By staying proactive and continuously enhancing their due diligence measures, institutions in Turkmenistan can navigate the complex landscape of Bitcoin AML regulations while fostering a secure and transparent environment for cryptocurrency transactions.

Future of Bitcoin Aml in Turkmenistan 🚀

Turkmenistan is poised to witness significant advancements in the realm of Bitcoin Anti-Money Laundering (AML) regulations. As the country navigates the evolving landscape of cryptocurrencies, experts anticipate a proactive approach towards enhancing compliance measures. Stakeholders are increasingly embracing innovative technologies and robust frameworks to combat illicit activities within the digital asset space. The future outlook for Bitcoin AML in Turkmenistan encompasses strategic collaborations, heightened regulatory scrutiny, and the adoption of cutting-edge solutions to ensure a secure and transparent financial ecosystem. These developments signal a transformative journey towards bolstering integrity and trust within the cryptocurrency sector.

Insert link: bitcoin anti-money laundering (aml) regulations in Thailand