Current Bitcoin Aml Regulations in San Marino 🌐

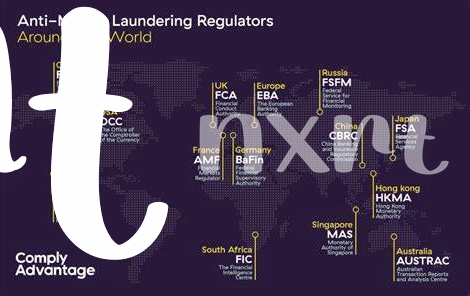

In San Marino, the landscape of Bitcoin AML regulations is evolving to address the growing digital currency market. The country has been proactive in implementing measures to combat money laundering and terrorist financing through its regulatory framework. AML regulations in San Marino aim to strike a balance between fostering innovation in the cryptocurrency sector and ensuring compliance with international standards. This approach reflects the country’s commitment to staying abreast of developments in the financial technology space while safeguarding the integrity of its financial system.

Trends and Challenges in Aml Compliance 📊

In the realm of AML compliance, navigating the ever-evolving landscape poses a multitude of challenges for stakeholders. The dynamic nature of financial regulations, coupled with the swift pace of technological advancements, demands constant vigilance and adaptability. Identifying and analyzing emerging trends is crucial to staying ahead of potential compliance risks. Increased scrutiny from regulators, the rise of digital assets, and the complexity of global transactions are key factors shaping the AML landscape. Balancing the need for robust compliance measures with operational efficiency remains a persistent challenge for businesses across sectors. Proactive strategies and innovative solutions are essential for mitigating risks and ensuring adherence to AML requirements.

Impact of Technological Innovations on Regulations ⚙️

The evolution of technological innovations is reshaping the landscape of regulations in the cryptocurrency sector. With advancements in blockchain analytics and AI-powered tools, regulators are gaining enhanced capabilities to monitor and enforce AML compliance. These technologies aid in identifying suspicious transactions, improving transparency, and strengthening the overall integrity of the financial system. As regulators harness the power of these innovations, the future of Bitcoin AML regulations in San Marino is poised to become more robust and efficient than ever before.

Future Outlook for Bitcoin Aml Compliance 💡

The landscape of Bitcoin AML compliance is rapidly evolving, with regulatory authorities adapting to the changing dynamics of the cryptocurrency market. As we look towards the future, the outlook for Bitcoin AML compliance is marked by a shift towards greater transparency and accountability. This entails the implementation of robust reporting requirements and enhanced due diligence measures to mitigate the risks of money laundering and illicit activities. Embracing these changes will not only strengthen the integrity of the Bitcoin ecosystem but also foster greater trust and confidence among stakeholders.

bitcoin anti-money laundering (aml) regulations in saint vincent and the grenadines

Potential Benefits of Stricter Regulations 💰

– Potential Benefits of Stricter Regulations 💰

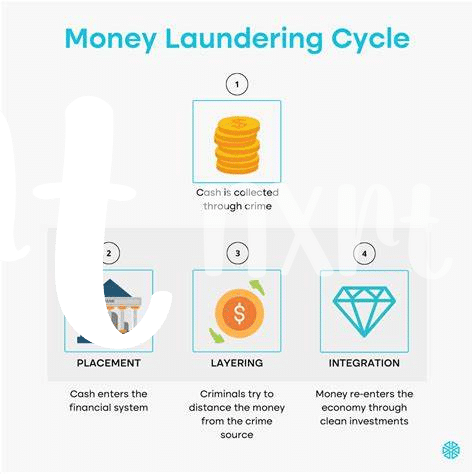

Stricter regulations in the Bitcoin Aml space can lead to increased transparency, trust, and legitimacy within the industry. By implementing stringent rules, such as thorough identity verification processes and transaction monitoring, the risk of illicit activities can be significantly reduced. This, in turn, may attract more institutional investors and traditional financial institutions to enter the cryptocurrency market, boosting overall adoption and value. Additionally, enhanced Aml regulations can help mitigate the reputational risks associated with digital assets, paving the way for greater acceptance and integration into the global financial system. Ultimately, stricter regulations could create a more secure and robust environment for Bitcoin transactions, benefiting both users and the industry as a whole.

Strategies for Navigating Evolving Aml Landscape 🔍

Navigating the evolving AML landscape requires proactive compliance measures that adapt to changing regulations and technology. Implementing robust monitoring mechanisms and conducting regular risk assessments can help ensure adherence to the latest AML requirements. Collaboration with industry peers and regulatory authorities can provide insights into emerging trends and best practices. Utilizing advanced analytics tools and automation can streamline compliance processes and enhance detection capabilities. Continuous training and education for employees on AML protocols are essential to maintain vigilance in combating financial crime. By staying agile and informed, businesses can effectively navigate the complex AML landscape and mitigate risks effectively. Bitcoin Anti-Money Laundering (AML) Regulations in Samoa