Basics of Bitcoin Reporting 📊

Bitcoin, the popular digital currency, has gained significant attention in recent years. Understanding the basics of Bitcoin reporting is essential for individuals looking to navigate the world of cryptocurrency. From keeping track of transactions to understanding the concept of wallet addresses, having a grasp on these fundamentals is crucial for accurate reporting. Additionally, being aware of the various platforms available for tracking Bitcoin activity can streamline the reporting process and ensure compliance with regulations. By familiarizing yourself with the basics of Bitcoin reporting, you can approach your financial responsibilities with confidence and clarity.

Reporting Requirements in Saint Lucia 🇱🇨

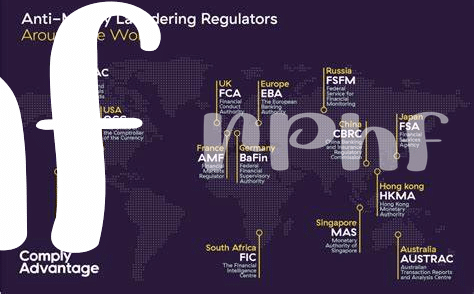

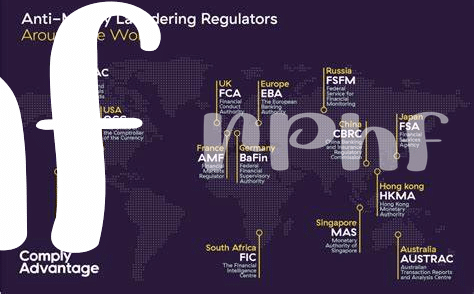

When it comes to navigating the world of reporting requirements for Bitcoin in Saint Lucia, it’s essential to understand the specific rules and regulations that apply in this jurisdiction. Compliance with these guidelines ensures transparency and accountability in your cryptocurrency dealings. Saint Lucia has laid out clear directives on how individuals and businesses should report their Bitcoin transactions. These requirements serve to uphold financial integrity and prevent illicit activities within the digital currency space. By familiarizing yourself with and adhering to these reporting obligations, you can operate confidently within the framework of the law while engaging in Bitcoin transactions in Saint Lucia.

Understanding Tax Implications 💰

Bitcoin transactions in Saint Lucia may have tax implications that individuals need to consider. Income generated from Bitcoin activities, such as mining or trading, is subject to taxation. Individuals are required to report their Bitcoin income accurately to the tax authorities. Additionally, any capital gains realized from Bitcoin investments may also be subject to taxation. Understanding the tax implications of Bitcoin transactions is crucial for individuals to ensure compliance with the tax laws in Saint Lucia. It is recommended to keep detailed records of all Bitcoin transactions to facilitate accurate reporting and to seek guidance from tax professionals if needed.

Tips for Accurate Reporting 📝

Tips for accurate reporting:

One important aspect of accurate reporting is to keep detailed records of all your Bitcoin transactions. This includes the date, amount, and purpose of each transaction. Additionally, it’s essential to stay informed about any changes in reporting requirements in Saint Lucia to ensure compliance. Utilizing cryptocurrency tax software can also help streamline the reporting process and minimize errors.

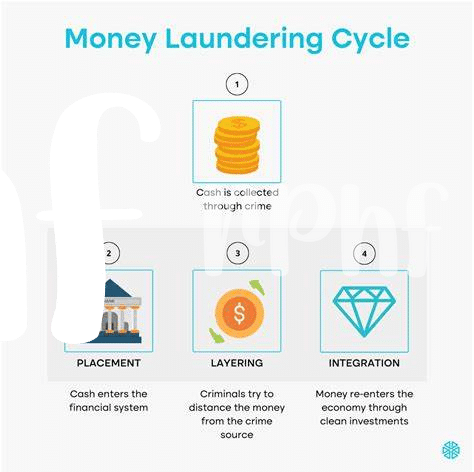

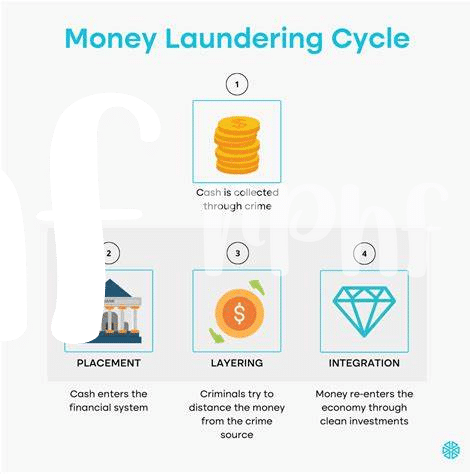

Ensuring accuracy in your Bitcoin reporting is crucial to avoid potential penalties for non-compliance. By following these tips and staying proactive in your reporting efforts, you can navigate the complexities of cryptocurrency tax regulations with confidence. For more insights on Bitcoin compliance, consider reading about the latest developments in bitcoin anti-money laundering (AML) regulations in Romania [here](https://wikicrypto.news/latest-developments-in-bitcoin-aml-compliance-in-russia-what-to-know).

Potential Penalties for Non-compliance ⚖️

Non-compliance with Bitcoin reporting requirements in Saint Lucia can lead to various penalties, including fines and potential legal action. It is crucial for individuals and businesses to understand and adhere to the reporting guidelines to avoid facing these consequences. Failure to comply with the regulations can result in financial setbacks and reputational damage, making it essential to stay informed and up to date with the reporting requirements set by the authorities. Seeking guidance from tax professionals or utilizing available resources can help prevent non-compliance and mitigate the risks associated with improper reporting practices. It is important to prioritize accurate and timely reporting to ensure compliance and avoid the negative repercussions of potential penalties for non-compliance.

Resources for Further Assistance ℹ️

For further assistance with reporting requirements for Bitcoin in Saint Lucia, there are resources available to help clarify any uncertainties and provide guidance. You can seek support from financial advisors specializing in cryptocurrency taxation, consult official government websites for updated information, and consider joining online forums or communities where individuals share insights and experiences related to Bitcoin reporting. Additionally, staying informed about regulatory developments, such as the Bitcoin anti-money laundering (AML) regulations in Saint Kitts and Nevis, can help enhance your understanding of compliance measures in the broader context of cryptocurrency taxation.