Key Risks for Bitcoin Users in Drc 🚫

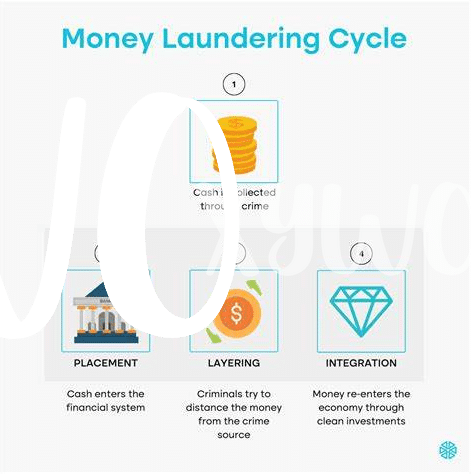

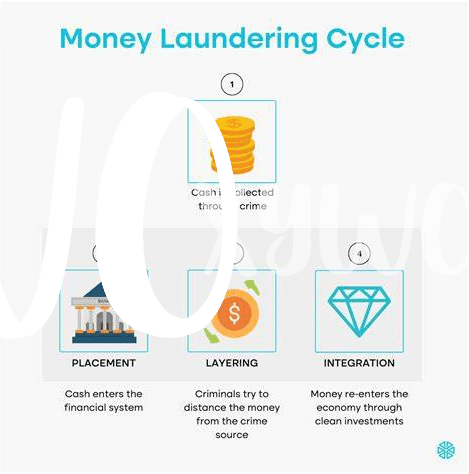

Bitcoin users in the Democratic Republic of Congo face a myriad of challenges, including security risks related to cyber threats and hacking attempts. The lack of clear regulations and oversight in the cryptocurrency space makes users vulnerable to fraudulent activities and scams. Additionally, the volatile nature of Bitcoin prices poses a financial risk for users in the DRC who may not have the resources to navigate sudden market fluctuations. These key risks underscore the importance of implementing robust AML regulations to protect users and foster a more secure environment for cryptocurrency transactions.

Benefits of Aml Regulations for Bitcoin 💡

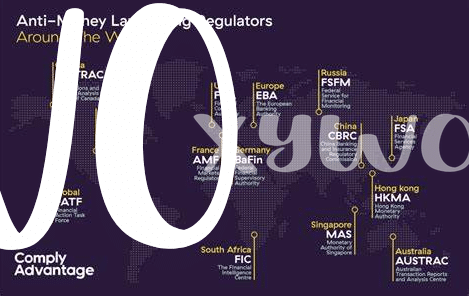

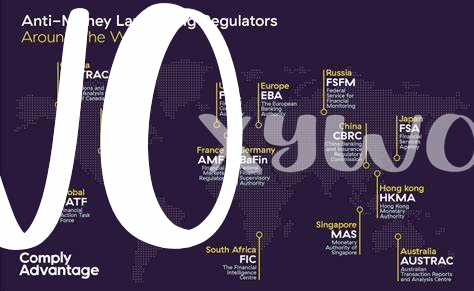

Amidst the evolving landscape of the digital currency realm in the Democratic Republic of the Congo (DRC), the implementation of Anti-Money Laundering (AML) regulations for Bitcoin transactions has sparked a diverse array of reactions and perspectives. These regulations aim to enhance transparency and accountability within the ecosystem, potentially offering a layer of protection for users against illicit activities. Furthermore, the incorporation of AML measures could foster increased trust and legitimacy in the Bitcoin market, enticing more individuals and businesses to explore the realm of digital assets with greater confidence and security.

Impact of Regulations on Privacy and Security 🔒

The implementation of AML regulations can have far-reaching impacts on the privacy and security of Bitcoin users in the DRC. While these regulations aim to enhance transparency and combat illicit activities, they also raise concerns about the potential compromise of user privacy. Striking a balance between regulatory requirements and safeguarding user information is crucial to ensure a secure and trusted environment for all stakeholders involved. The challenge lies in maintaining security protocols while adhering to regulatory mandates, as any breaches could have significant repercussions for both individuals and the broader cryptocurrency ecosystem.

Challenges in Compliance for Small-scale Users 💼

Small-scale Bitcoin users in the DRC face unique challenges when it comes to complying with Anti-Money Laundering (AML) regulations. Navigating the intricacies of these regulations can be daunting for individuals with limited resources and technical knowledge. From understanding the required documentation to implementing secure transaction processes, the compliance journey can seem overwhelming. This article sheds light on the specific obstacles that small-scale users encounter, offering insights on how they can overcome these challenges effectively.

Remember to check out this article on bitcoin anti-money laundering (AML) regulations in the Dominican Republic for more information: bitcoin anti-money laundering (AML) regulations in Dominican Republic.

Opportunities for Growth in a Regulated Environment 💰

In a regulated environment, Bitcoin users in DRC can seize the opportunity for growth by gaining increased credibility and trust among investors and stakeholders. This can open doors to formal financial partnerships and avenues for expanding their crypto-related businesses. With adherence to AML regulations, users may find easier access to traditional banking services, paving the way for broader financial inclusion and driving overall economic empowerment within the region. Additionally, operating within a regulated framework can attract more substantial investments and foster a more stable and secure ecosystem for Bitcoin transactions to thrive, ultimately contributing to the growth of the cryptocurrency sector in DRC.

Future Prospects for Bitcoin Adoption in Drc 🌍

The potential for Bitcoin adoption in the Democratic Republic of the Congo (DRC) holds promise for economic empowerment and financial inclusion. As awareness of digital currencies grows and regulatory frameworks evolve, there is an opportunity for innovative solutions to address traditional banking limitations in the region. The DRC’s embrace of AML regulations for Bitcoin could pave the way for increased investor confidence and mainstream acceptance, leading to a more robust ecosystem for digital transactions and economic development.

insert link: bitcoin anti-money laundering (aml) regulations in dominica