Understanding Aml Compliance in Bitcoin Exchanges 🧐

Accurate knowledge of AML compliance is vital for Bitcoin exchanges to operate securely and responsibly in the financial landscape. Understanding AML regulations helps exchanges establish robust procedures to detect and prevent money laundering activities effectively. By staying informed about compliance requirements, exchanges can protect their reputation and build trust with both customers and regulators. It is essential for exchanges to prioritize AML compliance to safeguard the integrity of their operations and contribute to the overall health of the cryptocurrency ecosystem.

Key Components of Aml Policies 🔍

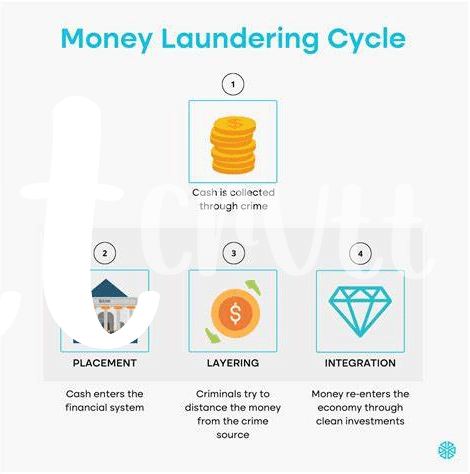

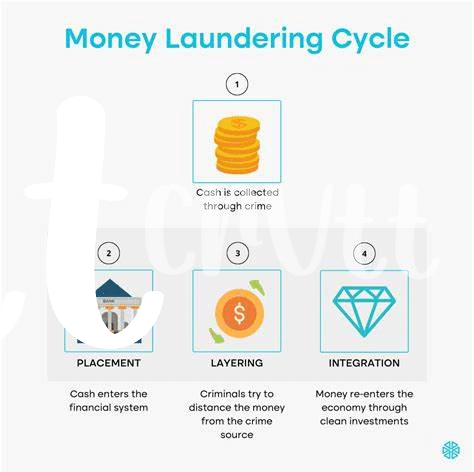

The foundation of robust AML policies lies in the careful identification and verification of customers, laying the groundwork for a secure exchange environment. This is complemented by rigorous transaction monitoring and reporting mechanisms, essential for flagging suspicious activities and ensuring compliance with regulatory standards. To strengthen these measures, ongoing staff training is imperative, equipping employees with the knowledge and skills to navigate the evolving landscape of AML regulations effectively.

Customer Due Diligence Process 🤝

In the realm of Bitcoin exchanges, ensuring customer due diligence is a crucial element of the compliance process. By carefully verifying the identities of users, monitoring their activities, and assessing the risks they pose, exchanges can mitigate potential money laundering and fraud risks. This process involves collecting comprehensive information about customers, including personal details and transaction histories. Striking a balance between thorough due diligence and user convenience is key in building trust and maintaining a secure trading environment.

Transaction Monitoring and Reporting 📊

The process of Transaction Monitoring and Reporting is a crucial aspect of AML compliance for Bitcoin exchanges. By continuously reviewing and analyzing transactions, exchanges can identify and flag any suspicious activities promptly. This proactive approach helps in preventing money laundering and other illicit activities within the cryptocurrency space. Regular reporting of such suspicious transactions to the relevant authorities is a key step in ensuring regulatory compliance. It not only helps in maintaining transparency but also in upholding the integrity of the exchange operations. Implementing robust monitoring and reporting procedures is essential for the security and legitimacy of Bitcoin transactions.

Link to bitcoin anti-money laundering (aml) regulations in Croatia: bitcoin anti-money laundering (aml) regulations in Croatia.

Implementing Aml Training for Staff 🎓

Implementing AML training for staff is crucial in ensuring compliance with regulations and safeguarding against financial crimes in Bitcoin exchanges. Through comprehensive training sessions, employees can grasp the fundamentals of AML procedures, recognize suspicious activities, and understand their role in maintaining a secure trading environment. By providing staff with the necessary knowledge and tools, exchanges can cultivate a culture of compliance and integrity within their organization. Regular training updates also help employees stay informed about the latest regulatory changes and best practices in AML compliance. Investing in ongoing education for staff members demonstrates a commitment to upholding regulatory standards and building a trustworthy reputation in the cryptocurrency market.

Dealing with Compliance Challenges 💡

When faced with compliance challenges in the realm of anti-money laundering for Bitcoin exchanges, it is crucial to stay agile and proactive. Embracing a flexible approach that allows for quick adaptation to changing regulations and evolving threats is key. Regularly reviewing and updating internal procedures, conducting comprehensive risk assessments, and fostering a culture of compliance within the organization can help navigate these challenges effectively. Seeking guidance from industry experts and staying informed about the latest developments in AML regulations are also instrumental in overcoming compliance hurdles.

Bitcoin Anti-Money Laundering (AML) regulations in Cuba with anchor Bitcoin Anti-Money Laundering (AML) regulations in Comoros.