Overview of Aml Requirements in Comoros 🌍

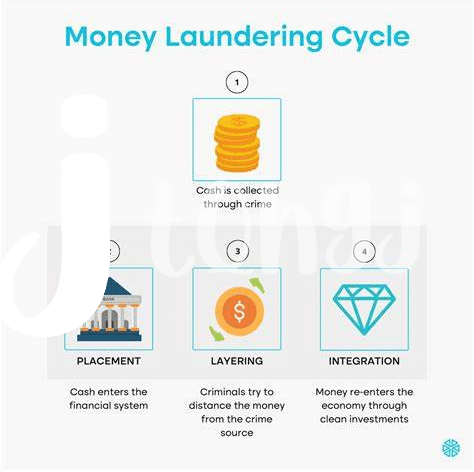

In Comoros, Anti-Money Laundering (AML) requirements play a crucial role in ensuring financial transparency and security. These regulations are designed to prevent illicit activities such as money laundering and terrorist financing within the country’s financial systems. By adhering to AML requirements, individuals and businesses contribute to maintaining the integrity of the financial sector and safeguarding against criminal activities. Understanding and following these guidelines are essential steps for fostering a trustworthy and compliant financial environment in Comoros.

Importance of Complying with Regulations 📝

Compliance with regulations is not just a box to check; it’s a fundamental aspect of ensuring transparency and trust within the Bitcoin ecosystem. By adhering to AML requirements in Comoros, businesses and users contribute to the overall integrity of the financial system, safeguarding against illicit activities and promoting legitimate economic growth. Every effort put into understanding and following these regulations is a step towards building a more secure and stable environment for all participants. Embracing compliance not only benefits individual entities but also strengthens the reputation of Bitcoin as a viable and trusted financial medium in Comoros. The value of compliance extends beyond mere obligation; it underpins the foundation for a sustainable and flourishing crypto landscape in the region.

Impact of Aml Regulations on Bitcoin 🤝

Aml regulations play a crucial role in shaping the landscape for Bitcoin in Comoros. These regulations are designed to combat illegal activities, such as money laundering and terrorist financing, which could potentially involve digital currencies like Bitcoin. As a result, users and businesses dealing with Bitcoin must adhere to these Aml requirements to ensure transparency and accountability in their transactions. This impact highlights the importance of fostering a compliant environment that safeguards the integrity of the cryptocurrency market while promoting responsible usage and investment practices in Comoros.

Challenges Faced by Users and Businesses 💼

Users and businesses in Comoros encounter various challenges when it comes to navigating Anti-Money Laundering (AML) requirements for Bitcoin. One of the key difficulties is ensuring compliance with the regulations while maintaining the privacy and anonymity that are intrinsic to cryptocurrency transactions. Additionally, the rapidly evolving nature of regulatory frameworks poses a constant challenge, requiring continuous monitoring and adaptation by both users and businesses. Moreover, the lack of clarity and consistency in AML guidelines can create confusion and hinder smooth operations. Finding the balance between regulatory compliance and operational efficiency remains a persistent obstacle for entities involved in Bitcoin transactions in Comoros.

Strategies for Navigating Aml Requirements 🗺️

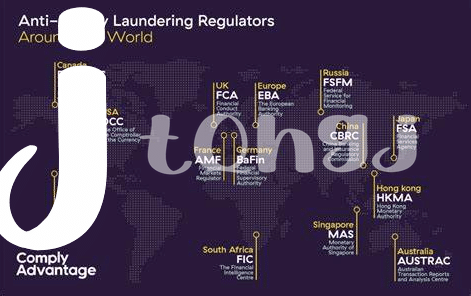

Navigating AML requirements in Comoros requires a proactive approach that blends compliance with innovation. To successfully operate within these regulations, businesses must prioritize robust KYC processes, implement transaction monitoring systems, and foster a culture of compliance across all levels. Engaging with regulatory authorities and staying updated on evolving AML guidelines is crucial. Collaboration with industry peers to share best practices and leveraging technological solutions can streamline compliance efforts efficiently. Emphasizing a comprehensive risk-based approach can enhance resilience against potential AML-related challenges.

Future Outlook for Bitcoin and Aml in Comoros 🔮

In contemplating the future landscape of Bitcoin and AML in Comoros, one can envision a scenario where increased awareness and adherence to regulations continue to shape the dynamics of the cryptocurrency sector in the country. As authorities and market participants strive for a balance between innovation and security, the evolution of AML requirements for Bitcoin in Comoros may foster a more robust and sustainable ecosystem. This gradual maturation could potentially enhance investor confidence and pave the way for further integration of digital assets into the mainstream financial realm.