Overview of Bosnia’s Aml Laws 🌍

Bosnia’s AML laws are a crucial component in regulating financial activities within the country. These laws aim to combat money laundering and terrorist financing by setting guidelines for financial institutions and businesses to follow. Understanding the intricacies of Bosnia’s AML laws is essential for anyone involved in financial transactions within the region and ensures compliance with regulatory requirements. By delving into the specifics of these laws, individuals and organizations can navigate the financial landscape effectively and contribute to a more transparent and secure financial environment within Bosnia.

Impact of Aml Laws on Bitcoin 💰

The enforcement of Anti-Money Laundering (AML) laws in Bosnia directly impacts Bitcoin transactions, shaping the regulatory landscape for digital currencies. As authorities strive to combat illicit financial activities, Bitcoin users face increased scrutiny and compliance requirements to ensure transparency and accountability in their transactions. The intersection of AML laws and Bitcoin usage presents unique challenges, necessitating a deep understanding of regulatory frameworks and proactive measures to navigate this evolving environment effectively.

Compliance Challenges for Bitcoin Users 🚫

Bitcoin users face intricate compliance challenges due to Bosnia’s AML laws, navigating a landscape of evolving regulations and a lack of standardized procedures. The decentralized nature of cryptocurrencies makes it challenging to trace transactions and verify the identities of individuals involved, posing significant hurdles for both users and regulatory authorities. Additionally, the potential for misuse of Bitcoin for illicit activities adds another layer of complexity to ensuring compliance with AML laws, requiring innovative approaches and heightened vigilance from users to stay ahead of regulatory expectations.

Emerging Trends in Aml Regulations ⏳

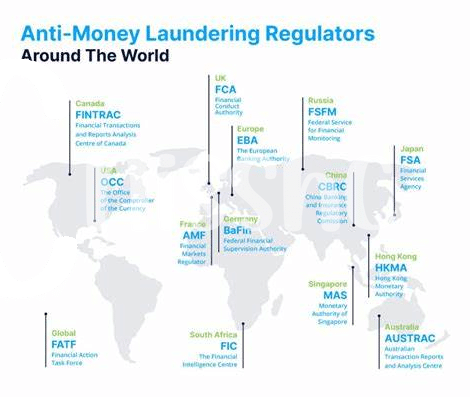

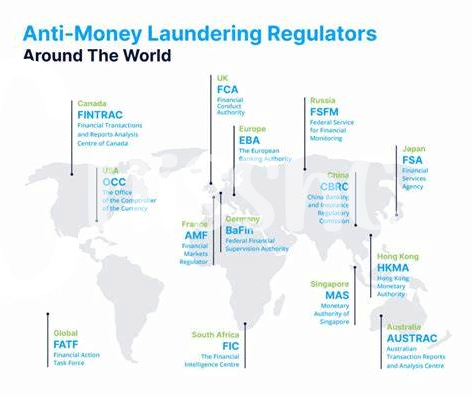

Emerging trends in AML regulations are shaping the landscape for Bitcoin transactions across global jurisdictions. Regulatory authorities are increasingly focusing on enhancing transparency and accountability within the cryptocurrency sector. This shift is evident through the integration of advanced technology and data analytics to bolster AML efforts and combat illicit activities 📈. To stay abreast of these developments, it is crucial for Bitcoin users to understand and adhere to the evolving regulatory frameworks, ensuring compliance and mitigating risks associated with non-compliance.

For further insights into AML compliance in the Bitcoin sector, explore essential steps outlined in the guide on bitcoin anti-money laundering (AML) regulations in Benin available at this link: bitcoin anti-money laundering (AML) regulations in Benin.

Strategies for Adapting to Regulatory Changes 🔧

In an ever-evolving landscape of regulatory changes, staying ahead in compliance is crucial for Bitcoin users in Bosnia. Adopting a proactive approach involves implementing robust monitoring systems to track and verify transactions effectively. Embracing technological solutions such as blockchain analytics tools can assist in ensuring adherence to AML laws and swiftly identifying any suspicious activities. Collaborating with regulatory bodies and participating in industry discussions also play a vital role in adapting to the dynamic regulatory environment. Moreover, educating users on compliance requirements and best practices can aid in navigating the complex regulatory framework with agility and transparency.

Future Outlook for Bitcoin Transactions 🚀

As the landscape of financial regulations evolves, Bitcoin transactions are poised for significant changes. The integration of advanced technologies like blockchain analysis tools and the increasing scrutiny from global AML authorities will shape the future of Bitcoin interactions. These developments will not only enhance the security and legitimacy of Bitcoin transactions but also foster greater trust among users and regulatory bodies alike. Additionally, the collaboration between industry stakeholders and policymakers will play a crucial role in establishing comprehensive AML frameworks that streamline compliance processes and promote innovation in the cryptocurrency space. Amidst these transformations, adapting to emerging AML regulations without stifling growth and innovation will be key to sustaining the momentum of Bitcoin as a transformative financial asset.

Bitcoin anti-money laundering (AML) regulations in Barbados