🎢 Ethereum’s Wild Ride: a Quick History Recap

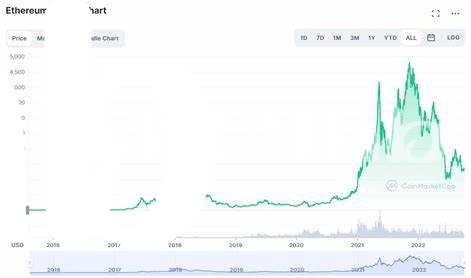

Ethereum’s journey has been like a thrilling ride at an amusement park, full of unexpected twists and turns. Launched back in 2015, this digital currency quickly climbed its way up, grabbing the attention of tech enthusiasts and investors alike. Its unique feature, allowing people to create their own operations, not just transactions, sparked a whole new wave of possibilities in the digital world. However, just like any rollercoaster, it had its fair share of highs and lows. From record-breaking peaks to sudden dips, Ethereum’s value has danced to the rhythm of the market’s unpredictable tunes, keeping everyone on their toes.

The adventure Ethereum has embarked upon is more than just numbers going up and down; it’s a tale of innovation, challenge, and evolution. Below is a quick snapshot of Ethereum’s key milestones that have marked its journey:

| Year | Event | Impact on Value |

|---|---|---|

| 2015 | Ethereum Launch | Introduced a new player to the world of cryptocurrencies |

| 2016 | DAO Attack | Initial setback, leading to a hard fork decision |

| 2017 | ICO Craze | Surge in value as Ethereum became a platform for new projects |

| 2018 | Market Correction | Value dropped, echoing the volatility of cryptocurrencies |

Throughout this exciting journey, Ethereum has not only survived the challenges but has also paved the way for a whole new world of blockchain-based applications, making its rollercoaster ride a must-watch for anyone curious about the future of digital finance.

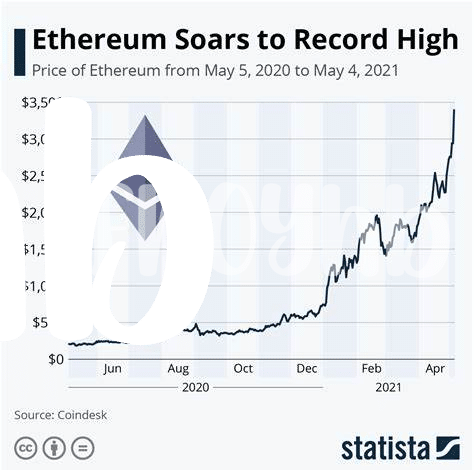

💰 the Ups and Downs: Reading Ethereum’s Value

Ethereum, much like a rollercoaster, has seen its fair share of highs and lows, making it a thrilling yet unpredictable ride for its enthusiasts. Imagine it as the heart of an exciting digital playground, where its value swings up and down, guided by a mix of techie updates, world events, and investor sentiments. Each twist and turn in its value tells a unique story—a blend of innovation, speculation, and real-world adoption shaping its path. Just as tech updates breathe new life into Ethereum’s capabilities, global events can just as quickly send it into a dive or soar. It’s this blend of influences that makes Ethereum’s journey more than just numbers on a chart; it’s a snapshot of where the digital future is heading. It’s no surprise that enthusiasts and investors hang onto every update, trying to decipher what comes next. For those looking deeper into the ups and downs of digital currencies, insights into how to navigate these volatile waters can be immensely valuable.

🛠 Tech Updates: How They Influence Ethereum’s Price

Imagine your favorite game getting an exciting update – that’s exactly what happens in the world of Ethereum with its tech upgrades. Just as a game update can add cool new features or fix pesky bugs, Ethereum’s updates can do much the same, making it faster or more secure, and this often gets people really excited. When Ethereum announces an upgrade, it’s like sending out an invitation to a party that everyone wants to attend. This excitement can lead to more people buying Ethereum, pushing its value up. It’s a bit like everyone rushing to buy the latest version of their favorite game, causing it to sell out in stores!

However, it’s not all smooth sailing. Sometimes, these updates can take longer than expected, or they might not live up to everyone’s high hopes right away. This can make people a bit nervous, leading some to sell their Ethereum, which can cause its value to drop. It’s a bit like when a game gets a big update but still has a few glitches; some players might stop playing for a while. So, keeping an eye on these updates can give you clues about where Ethereum’s price might be heading next, just like knowing what updates are coming to your favorite game can get you excited about what’s to come.

🌍 Global Factors Shaking Ethereum’s Market Position

In the thrilling journey of Ethereum, imagine it like a boat navigating the vast ocean, where global winds and storms have a significant say in its direction. International policies, economic shifts, and major events across the globe are akin to weather changes, causing sudden waves in Ethereum’s value. For instance, when a country announces a big move, either embracing or rejecting cryptocurrency, it’s like a gust of wind, sometimes pushing the boat forward with excitement or pulling it back with uncertainty. These political and economic climates, along with investors’ sentiments, weave an intricate dance, swaying Ethereum’s market standing. It’s not just about the numbers; it’s a story of how the world’s mood influences this digital asset. Keeping up with these changes is essential, and for those keen to understand Ethereum’s journey in comparison to its counterparts, a closer look at its evolution and distinct characteristics is informative. Dive deeper into this analysis by clicking on the litecoin calculator, offering insights into the unique paths of Ethereum and Ethereum Classic. As enthusiasts and investors watch closely, decoding these global cues becomes an exciting part of the Ethereum voyage, blending the thrill of speculation with the analytical challenge of understanding the world’s economic heartbeat.

📈 Predictions: What Experts Say about Ethereum’s Future

Peeking into the future of Ethereum feels a bit like trying to read a crystal ball – exciting but uncertain. Yet, many experts are gearing up with their forecasts, equipped with data and trends. It’s a bit like weather predictions – while we can’t know for sure, patterns give us a good guess. From the bustling forums of tech aficionados to the polished desks of financial analysts, the consensus leans towards optimism. They argue that Ethereum’s continual updates, like the much-anticipated move to a more energy-efficient system, coupled with its already fundamental role in the blockchain world, set the stage for potential growth. Think of Ethereum as a city undergoing rapid development; as it grows more efficient and versatile, more people want to move in.

But of course, the crypto world is no stranger to surprises, with sudden storms and sunny days. Experts urge enthusiasts to buckle up for a ride that could climb to new highs or dip into unexpected lows. They point to a mix of factors, from tech breakthroughs that could catapult Ethereum’s utility and value, to global economic shifts that sway the market’s mood. Here’s a simple table laying out what the enthusiasts say:

| Expert Opinion | Reason | Potential Outcome |

|---|---|---|

| Optimistic | Ethereum’s updates & essential role in blockchain | Price increase |

| Cautious | Global economic changes & market surprises | Unpredictable volatility |

The key takeaway? Stay informed, stay agile, and remember that in the world of Ethereum and crypto at large, change is the only constant.

🚀 Navigating the Volatility: Tips for Ethereum Enthusiasts

Embarking on the Ethereum journey can feel like strapping in for a loop-the-loop rollercoaster ride—you know there will be thrilling highs and stomach-churning lows, but the adventure is too enticing to pass up. 🎡 For those enthusiasts eager to ride the waves of Ethereum’s volatility without getting seasick, a few navigational tips can make all the difference. First, it’s vital to stay informed about the technology’s evolution and the broader world events that might impact Ethereum’s value; after all, knowledge is power. Additionally, diversifying your portfolio could help cushion against unforeseen dips—think of it as not putting all your eggs in one basket. 🥚 Also, setting realistic expectations and not letting emotions drive your decisions are key strategies. Emotional investing often leads to rash decisions at the worst possible times. And remember, patience is a virtue in the cryptocurrency world; Rome wasn’t built in a day, and neither is a robust Ethereum portfolio. For those curious about diversifying and exploring other cryptocurrencies, the question of whether ethereum classic is a worthy addition might come up. This investigative tangent could provide valuable insight into broader market trends and other opportunities. By adopting a measured, informed approach, enthusiasts can not only navigate Ethereum’s volatility but also enjoy the journey with a bit less turbulence.