📊 Understanding the Basics of Litecoin

Imagine stepping into a digital world where money flows freely, without the need for traditional banks or borders. Now, enter Litecoin, a form of electronic cash that enables you, yes you, to send money to anyone in the world almost instantly and with very low fees. Born from the digital ledger technology known as blockchain, Litecoin is like a younger sibling to Bitcoin, designed to be faster and more plentiful. Imagine sending a letter and having it delivered almost instantly, that’s how Litecoin aims to move money.

| Feature | Description |

|---|---|

| Creation Date | 2011 |

| Founder | Charlie Lee |

| Maximum Supply | 84 million coins |

| Block Generation Time | 2.5 minutes |

| Transaction Fee | Significantly low |

Now, let’s talk nuts and bolts without getting lost in the jargon. Litecoin is digital money, but there’s no physical coin. You store it in a digital wallet, which can be an app on your phone or computer. Every transaction is recorded on a public list called the blockchain, which helps keep everything open and secure. Think of it as having a super transparent bank ledger, but everyone has access to see the transactions—just not who made them. So, why choose Litecoin? Besides being faster than many other cryptocurrencies, it’s also widely accepted as a form of payment, making it a handy option for investors and shoppers alike.

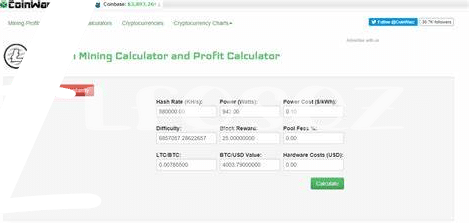

🛠️ Tools of the Trade: Finding the Right Calculator

Finding the perfect tool to help you navigate the waters of Litecoin investment can feel like searching for a needle in a haystack. However, once you’ve got your hands on the right calculator, it’s like having a map to buried treasure. These calculators take into account various factors such as the current price of Litecoin, mining difficulty, and electricity costs to give you a clearer picture of potential profits. It’s important to remember that while these tools offer valuable insights, they’re best used as a guide rather than an exact science.

With the right calculator by your side, piecing together your investment strategy becomes significantly easier. You can play around with different scenarios to see how changing one variable can impact your return. This is crucial for making informed decisions about how much to invest and when to do so. Moreover, understanding the underlying assumptions these calculators make can help you better assess their reliability. As you dive deeper into the world of Litecoin investing, it’s also beneficial to equip yourself with knowledge from various sources. For instance, exploring analyses such as https://wikicrypto.news/ethereum-classic-vs-ethereum-uncovering-the-key-differences can provide you with a broader perspective on the market, further refining your investment strategy.

💡 Evaluating Your Risk: How Much to Invest

Before diving into the exciting world of Litecoin investment, it’s vital to pause and consider an often overlooked but crucial aspect: how much of your hard-earned cash are you comfortable putting on the line? Think of investing as a journey through a mysterious forest. You’d need a map, some essential tools, and, importantly, you need to decide how much food and water (in this case, your money) you’re willing to carry. It’s all about balance. Carry too little, and you might not make it to the other side. Too much, and the journey becomes unnecessarily heavy.

Navigating the investment landscape requires a blend of excitement for potential gains and respect for the risks involved. It’s akin to planting a seed in your garden. You hope it grows, but you also know not all seeds sprout. Deciding on the amount to invest shouldn’t just be about how much you can afford to lose; it’s also about understanding your comfort level with risk and your long-term financial goals. Imagine you’re at a buffet. You want to try a bit of everything, but overloading your plate on the first round might ruin your appetite for the rest of the meal. Similarly, pacing your investment and not putting all your resources into one basket from the get-go gives you the flexibility to adjust as you learn and grow on your investment journey.

🔍 Deep Dive: Analyzing Calculator Results

Once you’ve found the right calculator to help guide your Litecoin investment journey, diving deep into the results it provides can feel like uncovering a treasure map. This part of the process isn’t just about punching in numbers and waiting for the magic to happen. It’s about understanding what those numbers are telling you and, more importantly, what they mean for your wallet. Let’s say the calculator spits out an expected return based on current market conditions. Great, right? But hold on. Before you start dreaming of a Litecoin-funded tropical vacation, it’s important to remember that numbers can tell different stories based on the “what-ifs” of the market. For instance, what if the market takes an unexpected turn? Is your investment prepared to weather the storm? This is where analyzing the results comes into play, allowing you to make informed decisions that align with your risk tolerance and investment goals. By examining the potential highs and lows that the calculator presents, you’re essentially peering into the possible futures of your investment, preparing yourself for whatever may come. And speaking of being prepared, familiarizing yourself with market trends is crucial. To delve deeper into this topic and explore whether is litecoin legit, offers a wealth of knowledge. Remember, a calculator is a tool, not a crystal ball. It’s up to you to interpret its insights and steer your investment ship wisely, taking cues from the sea of information available at your fingertips. This balanced approach of analytical thinking combined with informed insights paves the way for smarter investment moves, turn by turn.

🚀 Strategies for Maximizing Litecoin Returns

To maximize your investment returns with Litecoin, think of it as gardening. You wouldn’t plant seeds in a garden and expect them to grow without water, sunlight, and a bit of care. Similarly, investing in Litecoin requires attention, patience, and strategy. First off, consider the timing of your investment. Just like planting in the right season maximizes growth, entering the market at a favorable time can significantly impact your returns. Keep an eye on market trends and try to buy low. Another strategy involves diversification. Don’t put all your eggs in one basket. Spread your investments across different cryptocurrencies, including Litecoin, to reduce risk. This way, even if one doesn’t perform as expected, the others might balance your portfolio.

Furthermore, consider reinvesting your returns. If your Litecoin investment grows, reinvesting the profits can compound your gains, much like watering a plant encourages more growth. However, it’s crucial to analyze the market before reinvesting to ensure the conditions are still favorable. Below is a table summarizing these strategies:

| Strategy | Description |

|---|---|

| Timing the Market | Buy low based on market trends. |

| Diversification | Spread investments across multiple cryptocurrencies. |

| Reinvesting Returns | Reinvest profits for compound growth. |

Remember, successful Litecoin investment doesn’t just come from choosing the right moment to buy or sell. It’s about making informed decisions, being patient, and learning from the community. Always stay informed and engage with other investors to gather insights and experiences. This collective wisdom can be the guiding light on your investment journey, helping you navigate through the ups and downs of the market.

💬 Community Wisdom: Learning from Others

In the colorful world of Litecoin investing, it’s easy to get caught up in numbers and predictions. Yet, one of often-overlooked treasure troves of insight is the collective wisdom of the community. Picture this: you’re navigating the sometimes choppy waters of investing, and you encounter a storm. Who better to guide you than those who’ve sailed these waters before? By engaging with forums, social media platforms, and local meetups, investors can tap into a vast reservoir of real-world experiences. These are not just tales of triumphs and trials but a source of practical strategies that have been tested and tempered in the very market you’re venturing into.

Imagine a fellow investor sharing a cautionary tale that helps you avoid a common pitfall, or a nugget of wisdom that turns your strategy from good to gold. It’s like having a map where X marks the spot of hidden treasures, only these treasures are nuggets of advice on how to maximize your Litecoin returns. For instance, learning when to hold onto your coins and when it might be wise to trade can be crucial. Furthermore, discussions around the latest tools and resources, like the perfect calculator for forecasting ltc price, can provide invaluable insights.

In essence, by listening and learning from the community, investors not only enrich their understanding but also weave a safety net made of shared knowledge. This collective wisdom becomes a beacon, guiding through uncertainty towards more informed and, ideally, more profitable investment choices. So, dive into the wisdom pool; the insights you fish out could be the key to unlocking the full potential of your Litecoin investments.