What Is Usdt and Its Goal? 🎯

Imagine a world where your digital money keeps its value just like a regular dollar bill in your wallet. That’s the dream behind USDT, a digital buddy that tries to stick by the value of the good old US dollar, aiming to offer you the stability of your hard-earned cash with the bonus of digital speed and flexibility. Whether you want to shop online, trade in the digital market, or send money across the globe in a blink, USDT is like your trusty sidekick in the digital age, promising to keep things steady in a world that’s often a roller coaster. Its mission? To blend the best of both worlds – the reliability of fiat currency with the innovation of digital currency. Here’s a little sneak peek into its goal:

| 🎯 Goal | Stability and Trust in Digital Exchange |

| 🌐 Use Cases | Online Shopping, Digital Trading, Global Money Transfer |

| 💡 Vision | Combine Fiat Reliability with Digital Versatility |

In simple terms, it aims to be your digital dollar – reliable, consistent, and ready for the future of finance.

The Magic of 1:1 Usd Backing 🔒

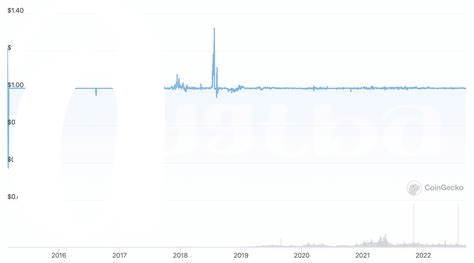

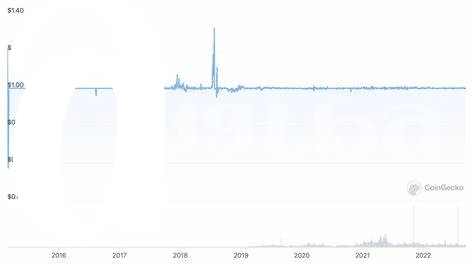

Imagine you have a dollar in your pocket, and no matter where you go, it’s always worth exactly one dollar – sounds pretty straightforward, right? This simple concept is at the heart of what makes USDT, a digital currency, so intriguing. Unlike the rollercoaster ride of other digital currencies, USDT aims to maintain a steady value, mirroring the US dollar, hence the term ‘pegged’. But how does it manage this feat? It’s all about the backing. For every USDT out there, there’s a real US dollar tucked away in a reserve, ensuring that USDT can always be exchanged 1:1 with the dollar. This means if you have 100 USDT, you should be able to swap it for 100 real dollars. It’s like having a virtual wallet that holds real money, but in digital form. This secured backing not only makes USDT a reliable haven during market storms but also bridges the gap between traditional finance and the futuristic world of digital currencies. If you’re curious about how other digital currencies stack up against each other, take a look at https://wikicrypto.news/litecoin-vs-bitcoin-key-differences-explored for a deep dive into their key differences and advantages. This setup ensures that, regardless of the wild swings in the digital currency market, USDT remains a stable digital token, tethered securely to the unyielding value of the US dollar.

How Trading Keeps the Peg Stable ⚖️

Imagine you have a favorite toy that everyone wants to play with. Because it’s so popular, you decide to lend it out, but you want to make sure you can always get it back in perfect condition. This is kind of like how a special kind of digital money called USDT works. It wants to be as valuable as a real dollar, so people can use it easily without worrying about its value changing. To do this, there’s a nifty trick involving trading. Just like swapping toys with friends, people buy and sell USDT to keep its value right on target.

When the toy, or USDT in our case, becomes too expensive or too cheap, traders step in like superheroes. 🦸♂️🦸♀️ They buy or sell it to make sure its value stays the same as the real dollar. This is like making sure your toy always comes back to you, no matter how many times it’s borrowed. This helps everyone feel confident about trading with USDT, making it as reliable as having a dollar in your pocket. Through this magical dance of buying and selling, USDT keeps its promise of being just like real money, even in the bustling world of digital currencies.

Role of Arbitrage in Price Corrections 🔄

Imagine you’re at a big market where everyone is trying to trade fruits. Some people believe oranges are worth more than apples, and others believe the opposite. This difference in opinion makes the market exciting. Similarly, in the world of digital money, there’s something called arbitrage that helps keep the price of USDT, a digital dollar, stable. Imagine two shops: one sells the digital dollar for a real dollar, and the other sells it for slightly more or less. Smart traders spot this difference and buy cheap from one shop to quickly sell to the other at a higher price. This might sound like magic, but it’s simple buying low and selling high, ensuring that the price of the digital dollar stays close to a real dollar. This action is like a self-correcting mechanism that keeps everything balanced. It’s an essential part of why you can trust that your digital dollar will have the same buying power as your real one, maintaining peace of mind in a digital world. Speaking of understanding more about the digital world, especially how other digital currencies work, how does ethereum work might give you further insights into the fascinating mechanisms behind these digital assets.

Trust and Transparency: Audits and Reports 📊

In the world of digital money, where pieces of code stand in for physical cash, faith plays a big part. Imagine lending someone a $10 note and getting a promise to return it someday – you’d want some assurance they’d give it back, wouldn’t you? That’s where routine check-ups, or audits, step in for USDT, acting much like a health check for your finances to ensure everything’s as it should be. These audits peek behind the curtain, verifying that for every USDT out there, there’s a real dollar snug in the bank, promising the stability everyone counts on. More than just ticking boxes, these reports are shared openly, letting anyone with internet access take a look. This open-book approach helps build a bridge of trust with users, reassuring them that their digital dollars have real-world buddies waiting. Yet, this transparency isn’t just about keeping things straight with users; it’s also a beacon for regulators and watchdogs, ensuring that everything’s up to the mark and above board.

Here’s a little table that breaks down what these reports usually cover:

| Aspect Covered | Details Checked |

|---|---|

| Reserves | Verification that the amount of real money matches the digital tokens in circulation. |

| Accounting Practices | Ensuring that the methods used to count and keep track of money meet industry standards. |

| Transparency | Assessing how openly and accurately information is shared with the public. |

This practice, while seemingly straightforward, plays a crucial role in making sure that the digital and real-world values of USDT stay in harmony, fulfilling the core promise of stability and trust in the whirlwind world of cryptocurrency.

Challenges and Controversies Faced 🌪️

In the world of digital currency, USDT has faced its fair share of hurdles and raised eyebrows. The road hasn’t always been smooth, with concerns about its actual dollar reserves sparking debates among users and regulators alike. Imagine you’re holding a digital dollar, but whispers in the market suggest it might not have a real dollar sitting somewhere for each digital one you own. That’s been a big worry for some people. Additionally, there have been legal tussles that shine a light on the complex regulatory landscape these digital currencies navigate. It’s a bit like sailing in stormy seas, where clear skies can suddenly turn menacing, challenging the trust of even the most seasoned sailors.

But it’s not just about weathering storms. Transparency and accountability play huge roles in calming the waters. Reports and audits are lighthouses, guiding ships safely to shore by ensuring everything is as it should be. Yet, even with these mechanisms, skepticism sometimes looms like fog, making the journey for trust a challenging voyage. For a deeper dive into the realm of digital currency and its potential future, consider exploring how other cryptocurrencies stand in this ever-evolving market. Specifically, for insights on how Litecoin could play a role in the landscape of digital finance, check out this analysis on litecoin future price. It’s a fascinating exploration of how other currencies measure up and navigate their own challenges and controversies in the quest to achieve stability and gain investor confidence.