🌱 Origins: from Bitcoin’s Mystery to Ethereum’s Vision

Imagine a world where two superheroes emerged to change the game of digital currency. On one side, we have the enigmatic Bitcoin, brought to life by the mysterious figure known only as Satoshi Nakamoto back in 2008. This superhero of the digital realm introduced the world to the idea of cryptocurrency – a way to exchange value over the internet without the need for traditional banks or governments. It was the spark that ignited a revolution. Then, enter Ethereum, envisioned by the young genius Vitalik Buterin in 2013. Ethereum didn’t just want to be another form of digital money. No, it aimed higher, dreaming of a world where the blockchain – the technology Bitcoin runs on – could do more than just process transactions. It could run entire applications, opening up a universe of possibilities, from how we vote to how we program the internet. These origins are the bedrock on which these two giants stand, each with its own legacy and vision for the future of digital interaction.

| Feature | Bitcoin | Ethereum |

|---|---|---|

| Creator | Satoshi Nakamoto | Vitalik Buterin |

| Year Created | 2008 | 2013 |

| Primary Purpose | Digital Currency | Decentralized Applications Platform |

| Vision | A peer-to-peer electronic cash system | A global, open-source platform for decentralized applications |

🔗 Blockchains: Similar Paths, Different Journeys

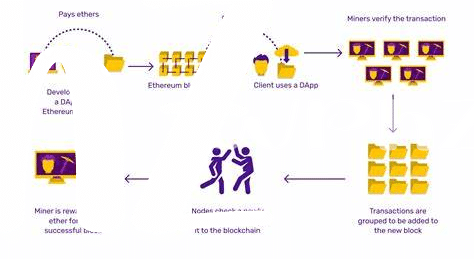

Imagine two travelers setting off on their own adventures through a vast land of technology and possibility. One, named Bitcoin, aims to revolutionize how we think about and use money, introducing an alternative to traditional banking by creating a digital currency. The other, Ethereum, while inspired by Bitcoin’s trailblazing journey, dreams bigger. It plans to not only change how we transact but also how we make agreements and run applications, all on a global scale. At their core, both use a system called blockchain, a kind of digital ledger that records all transactions across a network of computers. However, Ethereum takes it a step further by introducing smart contracts, making the blockchain not just a way to record transactions of currency but also a platform for developers to build and run their own decentralized applications. This is where their paths diverge significantly. Ethereum’s vision is to create a world computer that democratizes the creation and management of digital services, far beyond just sending and receiving money. To further understand the nuances of cryptocurrency innovations, including events that significantly impact their value and functionality, consider exploring insights on similar topics, such as https://wikicrypto.news/the-impact-of-halving-events-on-litecoins-valification.

💰 Crypto Uses: More Than Just Money

At first glance, many think of cryptocurrencies like Bitcoin and Ethereum as just digital money. However, scratch the surface, and a world of possibility emerges. Bitcoin laid the groundwork, showing us a new way to think about money beyond traditional banking. Yet, Ethereum took this idea further, introducing the concept of smart contracts. Imagine writing rules directly into money itself, rules that say, “Only spend me if condition X is met.” This opened the door to applications far beyond just buying and selling. From artists ensuring their creations are forever linked to their names through digital certificates, to startups raising funds directly from supporters without needing a middleman, the uses are as varied as they are innovative. Suddenly, it’s not just about transactions; it’s about creating a whole ecosystem of trustless applications, leading us to reimagine what we can do with technology. The narrative that cryptocurrencies are merely digital cash is fading, making way for a richer tapestry of potential that intersects finance, art, law, and more, demonstrating the profound versatility of blockchain technology.

⚙️ Tech Talk: Smart Contracts on Ethereum

Imagine you’re at a magic show, where the magician promises not just to pull a rabbit out of a hat, but also to make it perform tricks on command. In the world of cryptocurrency, Ethereum plays the magician, introducing something called smart contracts. Unlike traditional contracts written on paper and sealed with a handshake or signature, smart contracts are like self-operating digital agreements stored on the Ethereum blockchain. They automatically execute actions, such as transferring funds, when certain conditions are met, without needing a middleman to oversee the process. It’s a bit like setting up automatic payments for your bills, but on a much more complex scale.

Ethereum’s introduction of smart contracts has opened a world of possibilities beyond mere currency exchanges. These digital contracts can be used in various fields, from automating legal processes to securing digital rights and even managing entire organizations through decentralized autonomous organizations (DAOs). As we explore these futuristic applications, it’s also essential to stay updated on developments in other crypto spaces, such as litecoin analysis, which highlights strides towards greener mining practices. This exploration into Ethereum’s capabilities shows us that the blockchain is not just about currency; it’s a platform for innovation, pushing the boundaries of what digital transactions can be.

🚀 Speed and Space: Transaction Times and Costs

When we think about sending money to someone online, how fast it gets there and how much it costs us can be a big deal. Imagine you’re sending a text message; some get delivered almost instantly, while others might take a bit longer if your internet’s having a slow day. Bitcoin and Ethereum are a bit like this, but instead of sending texts, you’re sending digital money. Bitcoin, the trailblazer, knocks on the door of the digital world, taking its time, usually around 10 minutes to confirm a transaction, but it can be longer when it’s really busy. It’s like sending a parcel by regular mail; reliable, but not the fastest. Ethereum, on the other hand, aims to be like express delivery, often taking just a few minutes to nod back that your transaction is good to go. However, this speed can come at a cost, literally. During busy times, sending Ethereum can be like booking a same-day delivery service; it gets there fast, but your wallet feels the weight. Here’s a quick look at how transaction times and costs can vary:

| Crypto | Average Transaction Time | Transaction Cost |

|---|---|---|

| Bitcoin | ~10 minutes | Varies (Higher during peak times) |

| Ethereum | A few minutes | Varies (Can get costly during network congestion) |

Both have their moments in the spotlight, depending on whether you’re looking for speed or trying to keep costs low. The choice might feel like deciding between a snail mail and a courier service; each has its time and place, telling us there’s more to these digital wonders than meets the eye.

🌟 Future Potential: Beyond Just Currency

When we think about the roads both Ethereum and Bitcoin are paving for the future, it’s clear there’s a horizon far beyond just acting as digital money. Ethereum introduces an ecosystem where programs can run autonomously, creating a playground for innovation. This isn’t just about creating a digital currency; it’s about building a new digital economy. With Ethereum, the concept of “decentralized applications” takes the front seat, heralding a future where services across finance, healthcare, and even the arts could operate without the need for a central authority. This vision extends the utility of blockchain technology into realms we’re just beginning to explore.

On the other hand, Bitcoin has laid the foundational stone for what being a digital store of value means, demonstrating resilience and an increasing acceptance that could see it become a global reserve currency. Its simplicity and security have made it a beacon for those looking to preserve wealth in a digital age. Yet, the journey does not end here. Both platforms are constantly evolving, introducing improvements in scalability, security, and functionality that could greatly amplify their utility. For a glimpse into how these cryptocurrencies could shape our financial future, consider the evolving landscape of digital assets, including ltc miner, pointing towards a diverse ecosystem of cryptocurrencies coexisting, each serving unique functions within a broader, interconnected network.