Early Birds Catch the Bitcoin 🐦

Back in the day, when most folks hadn’t even heard of digital money, a small group of curious minds stumbled upon Bitcoin, a new kind of currency living on the internet. These adventurers, intrigued by the potential of a money system untouched by banks or governments, began to explore and invest in Bitcoin, often just for fun or out of sheer curiosity. They were the true pioneers, navigating uncharted waters with little more than a belief in the idea and a willingness to take a leap into the unknown. This early investment was, for many, a leap of faith, trusting in the potential of a technology that was barely understood outside of niche internet forums. As they began to acquire and use Bitcoin, whether for small online purchases or as a new form of investment, they unknowingly laid the foundation for its growth. Their participation helped to build a community, however small, that believed in Bitcoin’s potential. This initial group of users and believers started a ripple effect, drawing in more participants and, importantly, catching the attention of those who would later contribute to its development and wider adoption. Here’s a simple breakdown of the early Bitcoin adopters’ impact:

| Year | Bitcoin Value Trend | Early Adopter Activity |

|---|---|---|

| 2010-2012 | Gradual Increase | Contributed to community growth and technological development |

Their faith and early use of Bitcoin paved the way for the innovations and wider attention that would eventually lead to significant price increases.

Media Buzz: When Everyone Started Talking 📢

Suddenly, Bitcoin wasn’t just a word tech enthusiasts whispered in the dark corners of the internet—it was everywhere. From newspaper headlines capturing its meteoric rise to social media platforms buzzing with stories of overnight millionaires, Bitcoin had captured the public’s imagination. This widespread attention wasn’t just casual chatter; it played a critical role in pushing Bitcoin’s value higher. As more people learned about this digital gold, curiosity turned into investment. What was once the realm of the tech-savvy began to attract individuals from all walks of life, eager to be part of this financial revolution. This explosive mix of intrigue and exposure didn’t just fuel the fire; it turned Bitcoin into an inferno of interest and speculation. For those looking to dive deeper into the world of cryptocurrencies, a treasure trove of information awaits at https://wikicrypto.news/ethereum-wallet-mistakes-to-avoid-for-new-users, where the journey of knowledge continues.

Tech Upgrades: Making Bitcoin Better 💻

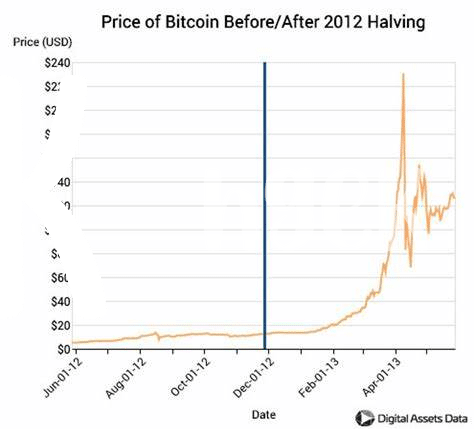

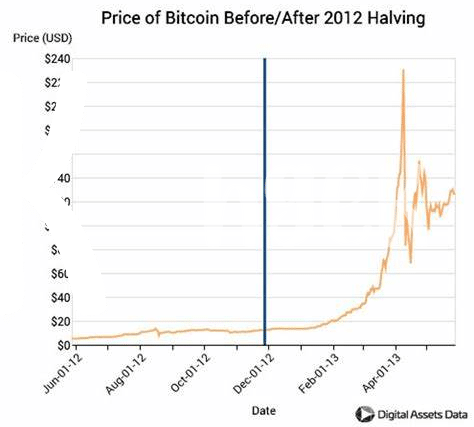

Imagine a group of savvy inventors and computer wizards gathering around, tinkering and improving a digital treasure. That’s exactly what happened with Bitcoin in 2012, as these tech enthusiasts rolled up their sleeves to make buying, selling, and storing Bitcoin smoother and more secure. 🛠️💡 One big highlight was improving the ‘plumbing’ of Bitcoin – think of it as upgrading the pipes in an old house so water (or in this case, digital transactions) could flow faster and more cleanly. They introduced something called a ‘wallet’ which made it easier for people to keep their Bitcoins safe, much like a digital piggy bank. Another game-changer was increasing the speed at which transactions were confirmed. This was akin to shifting from dial-up to high-speed internet, making everything with Bitcoin quicker and encouraging more people to use it. 🚀 These improvements were crucial. They didn’t just make Bitcoin better; they made it more attractive to folks who were sitting on the fence, curious but not yet convinced. By enhancing the backbone of Bitcoin, these tech upgrades fueled the fascination and trust in what many saw as the future of money.

Political Moves and Economic Shifts 🌍

In the whirlwind year before the hike, world governments and financial markets were playing a bigger part than ever in the Bitcoin saga. As some countries toyed with the idea of creating their own digital currencies or regulating Bitcoin, others were not so welcoming, adding a layer of political intrigue to the mix. Meanwhile, economic shifts were also making waves. During times of economic uncertainty, people often look for alternative places to keep their savings safe from inflation or currency devaluation, and Bitcoin, with its promise of being a global and decentralized form of money, appeared as a shining beacon to many. This interest wasn’t just from the everyday saver; it reached into the hearts of those who had the power to sway economic trends. The fascinating part is, as more people and institutions got involved, the more mainstream attention Bitcoin garnered, leading to an uptick in its value. For a closer look at this pivotal time, perusing the bitcoin price 2013 might give you a clearer picture of the crescendo leading to the boom.

The Investor Frenzy: Big Money Jumps in 💼

Once everyone started buzzing about Bitcoin, it wasn’t long before the big players, those with hefty wallets, decided to take a keen interest. Imagine the world’s most influential investors and companies, usually dealing in traditional investments, turning their gaze towards this digital goldmine. They saw potential, not just for quick wins, but as a new frontier in the investment landscape. This shift wasn’t just about following a trend; it was about shaping the future of finance. Their entrance into the Bitcoin market added a new layer of legitimacy and propelled Bitcoin’s value to new heights. People took notice, and the belief in Bitcoin’s staying power grew stronger.

This wave of big money ignited a frenzy, reminiscent of the gold rushes of old, but in a digital realm. 🌐💸🔍 Below is a simple breakdown of how this investor frenzy impacted the Bitcoin ecosystem:

| Effect | Description |

|---|---|

| Market Stability | Large investments helped to somewhat stabilize Bitcoin’s otherwise volatile price, making it more attractive to everyday investors. |

| Mainstream Credibility | The involvement of notable investors and companies lent Bitcoin an air of credibility, encouraging more people to trust and adopt it. |

| Innovation Boost | With more funds flowing into the space, development and innovation were supercharged, making the technology even more robust and appealing. |

This chapter in Bitcoin’s history is critical for understanding how it moved from the fringes of tech forums into the mainstream financial consciousness. It’s a testament to the transformative power of collective belief and the allure of uncharted financial territories.

Looking Ahead: What This Rise Taught Us 🔮

As we look back at the rollercoaster that was Bitcoin’s 2012 price surge, it’s like unwrapping a treasure map that leads us through uncharted financial waters 🗺️💸. This remarkable journey not only showcased the tangible excitement of being part of something groundbreaking but also left us with invaluable lessons. For starters, it highlighted the sheer power of community and word-of-mouth in driving the value of digital assets 🗣️🌐. It taught us that technology improvements are not just fancy add-ons but vital upgrades that fuel the growth and stability of digital currencies 💡. Perhaps more subtly, the events of 2012 underscored the intricate dance between politics, global economies, and the digital currency space, revealing how they can push the value of a digital asset up or down like a skilled puppeteer 🎭. The entry of big investors signaled a new era, painting a picture of digital currencies not just as a nerdy hobby but as a legitimate component of a diversified investment portfolio 🏦📊. It’s a tale of growth, adaptation, and resilience, reminding us that in the digital age, the only constant is change. As we venture into the future, maintaining a curious and open mindset will be our best tool in navigating the ever-evolving landscape of digital currencies. For those keen on diving deeper into the specifics and want to explore how trends like these evolve, checking the bitcoin price 2014 can offer intriguing insights into the journey of cryptocurrencies beyond Bitcoin’s early days.