Bitcoin Takes Off: the Early Bird’s Flight 🚀

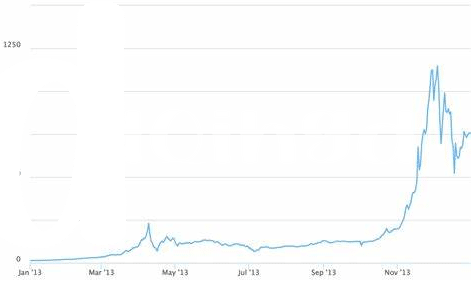

In 2013, the digital world witnessed something extraordinary, akin to spotting a rare bird taking its first successful flight. Imagine discovering a treasure map where X marks a spot not of gold, but of a digital currency that could potentially redefine how we think about money. This year marked the beginning of an incredible journey for Bitcoin, a journey that started with whispers among tech enthusiasts and grew into a chorus of intrigued investors. Its value, low and inviting at the year’s start, encouraged the daring and the curious to invest, making it a playground for those looking for something new beyond the traditional confines of stock markets and gold investments. As more people learned about Bitcoin, its unique appeal started to shine through; it was decentralized, digital, and it promised a level of anonymity in transactions. This was the year it started to flutter its wings, gaining altitude in the financial ecosystem. The table below captures the essence of this remarkable ascent:

| Month | Price at the Beginning | Price at the End |

|---|---|---|

| January 2013 | $13.28 | $20.41 |

| December 2013 | $1,083.14 | $757.50 |

This simply shows just how dramatically its value soared within a year, making it a watershed moment for digital currencies. 🚀🎢💡

Price Surge: the Roller Coaster Ride 🎢

2013 was a whirlwind year for Bitcoin, echoing the ups and downs of a true roller coaster ride. Imagine hopping on a ride, uncertain if you’re ready for the twists and turns. That was Bitcoin, starting the year at humble prices only to skyrocket to heights few could have envisioned. Like a roller coaster cresting its highest point, investors held their breath as Bitcoin reached over $1,000. This surge wasn’t just numbers on a screen; it was fueled by a concoction of curiosity, speculation, and a bit of fear of missing out. But as with all highs, the journey wasn’t without its stomach-churning drops, leaving many to ponder the stability and future of this digital currency. Amidst this thrilling ride, https://wikicrypto.news/bitcoin-in-2014-a-prequel-to-cryptocurrency-boom offers a glimpse into the preparations leading to the next chapter of the cryptocurrency saga, ensuring newcomers and veterans alike steer clear of common pitfalls. The journey through 2013 not only tested the resilience of Bitcoin but also laid the foundation for its eventual acceptance, making it a year to remember.

The Cyprus Effect: Crisis Fuels Bitcoin Interest 🌍

In 2013, a far-off island nation faced a financial crisis that would unexpectedly give Bitcoin a nudge into the spotlight. Cyprus, dealing with heavy debt and banking instability, sought help leading to a controversial decision: to tax bank deposits, an effort to stabilize the economy. This move sent shockwaves around the world, stirring fears about the safety of money in banks. Suddenly, there was a surge in interest for an alternative place to stash cash, away from traditional banks’ reach. Enter Bitcoin, the digital currency that operates on the internet, promising a level of control and security that traditional banks couldn’t in the face of a crisis. It was like discovering a secret hideaway where your money could chill, away from the prying eyes of economic instability.

As Cyprus battled its financial demons, Bitcoin shone as a beacon of hope, not just for tech enthusiasts, but for anyone rattled by the crisis. The island’s turmoil demonstrated a powerful point: in our interconnected world, a financial scare in one corner can spark a global quest for safer money havens. This episode didn’t just fuel Bitcoin’s growth; it etched the digital currency on the map as a serious contender in the world of finance. The curiosity and urgency driven by the Cyprus crisis transformed Bitcoin from an obscure digital trend into a topic of mainstream conversation, proving that when traditional systems falter, innovative alternatives have room to soar. 🌍🚀💡

Silk Road: the Dark Side of Growth 🕵️♂️

2013 was a year when Bitcoin’s name got tangled with a web of secrecy, thanks to an online marketplace known as Silk Road. Picture this: a hidden part of the internet where people could buy and sell things you wouldn’t find in your local store, all paid for with Bitcoin. This marketplace gained notoriety for being a one-stop shop for illicit goods, casting a long shadow on Bitcoin’s growing reputation. While Bitcoin was starting to catch the world’s attention as a revolutionary way to move money around without the usual bank fees or waiting times, the association with Silk Road posed questions about the dark uses of this digital currency. Amidst this, curious minds and investors were drawn in, intrigued by the technology and its potential, which, in a way, fueled its growth even more. For those looking to dive deeper into the world of cryptocurrencies and how they work beyond the surface, understanding the intricacies can be crucial. A good starting point might be exploring how digital currencies like Litecoin operate, especially in the realm of mining, which keeps these networks running smoothly. For a comprehensive look at the costs and profits associated with this, clicking on ethereum wallet can offer some valuable insights. This chapter in Bitcoin’s history reminds us that with innovation comes the challenge of navigating the fine line between use and misuse, a lesson that remains relevant as cryptocurrencies continue to evolve.

Mainstream Attention: Media’s Love-hate Relationship 📺

2013 was a year Bitcoin couldn’t be ignored, catching the eyes and screens of everyone from the curious observer at home to the talk show hosts on TV. The love affair between Bitcoin and the media was a rollercoaster ride of its own, with headlines swinging from enthusiastic endorsements to dire warnings. The spotlight intensified as more people began to wonder, “What is this digital currency that seems to be taking the world by storm?” As stories of overnight millionaires and revolutionary technology filled the airwaves, so did tales of market volatility and security concerns. This dual narrative created a powerful magnet for viewers, readers, and listeners, ensuring Bitcoin was a hot topic of conversation across dinner tables and online forums alike.

Interestingly, this media frenzy played a significant role in catapulting Bitcoin into the mainstream consciousness. 📈🎤💬 Every news piece, whether positive or negative, acted as a beacon, drawing more attention to Bitcoin. This phenomenon showcased the classic scenario where “all publicity is good publicity.” The more the media delved into Bitcoin’s potential and pitfalls, the more people wanted to learn about it, understand it, and potentially invest in it. The discussions weren’t just confined to the financial sections of newspapers or specialized tech platforms; Bitcoin was everywhere, from morning news shows to late-night talk segments. This broad exposure was instrumental in demystifying digital currency for the general public, marking a pivotal chapter in Bitcoin’s journey from the fringes of the internet to a globally recognized asset.

| Year | Media Sentiment | Impact on Bitcoin Awareness |

|---|---|---|

| 2013 | Mixed | Significantly increased |

Looking Back: Lessons from 2013’s Wild Ride 🧐

Reflecting on 2013, we traveled through a year where Bitcoin proved it was more than a digital whisper; it roared into mainstream consciousness. Through its ups and downs, this period taught us critical lessons. For starters, it highlighted how global events, like the banking crisis in Cyprus, can drastically influence people’s interest in alternative forms of money. 🌍 It also shed light on the darker uses of Bitcoin, reminding us that innovation often walks hand in hand with challenges. 🕵️ The year’s media frenzy, with its swings from skepticism to fascination, underscored the importance of understanding what we’re investing in, beyond the headlines. 📺 But perhaps the most enduring lesson was the demonstration of Bitcoin’s resilience. Even amid controversy and volatility, it managed to attract a growing community of believers and skeptics alike, setting the stage for the future of digital currencies. As we look at litecoin cost in the following year, it’s this enduring spirit of innovation and resilience that continues to shape the digital currency landscape. 🧐