🌍 Navigating the Global Landscape of Bitcoin Regulation

Imagine trying to follow a recipe that changes depending on where you’re cooking. That’s a bit like dealing with Bitcoin regulations around the world. Different countries view Bitcoin in various ways: some embrace it, others are cautious, and a few are outright against it. This means when you’re involved in Bitcoin lending, you need to be a bit of a world traveler, at least in a legal sense. Knowing which laws apply where can be like navigating through a maze, but it’s crucial for keeping your operations smooth and safe.

Understanding this global patchwork is not just about avoiding trouble; it’s also about finding opportunities. Some countries offer more favorable conditions for crypto businesses, acting as beacons of innovation. Yet, diving into Bitcoin lending without a map can lead to choppy waters. Here’s a simple guide to keep you sailing smoothly:

| Country | Status of Bitcoin | Impact on Bitcoin Lending |

|---|---|---|

| USA | Legal, regulated | Strict compliance required |

| China | Illegal | Lending operations are risky |

| Germany | Legal, considered private money | Favorable environment for lending |

| India | Legal but heavily regulated | Compliance is key to operations |

As shown, while the opportunity is vast, the landscape is fraught with challenges. But with careful planning and a keen eye for detail, navigating the global landscape of Bitcoin regulation can be rewarding.

🔍 Understanding Key Legal Terms in Crypto Lending

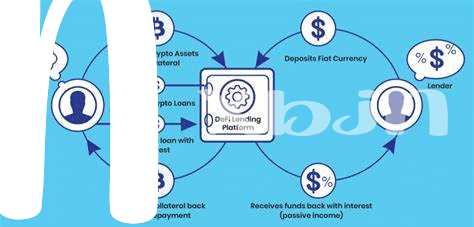

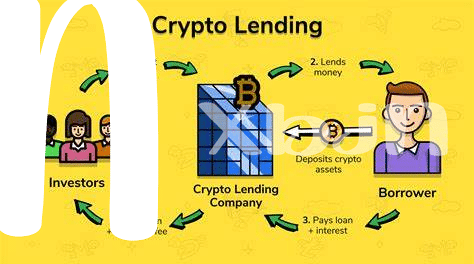

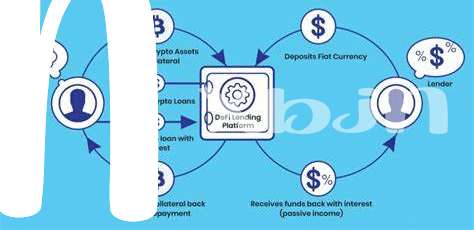

When diving into the world of Bitcoin lending, think of it like entering a new country. Just like each country has its rules, Bitcoin lending has its own language of laws and regulations you need to understand to move around safely. Words like ‘smart contracts,’ ‘collateral,’ and ‘liquidation’ are not just fancy jargon but signposts that guide you through the process, ensuring you don’t get lost. Knowing what they mean is crucial to navigate this landscape successfully and keep your investments protected.

Now, imagine you have a map that helps you understand these rules better, much like a guide that simplifies the intricacies of legal terms in a fun way. Speaking of simplifying the complex, do check out this guide to get a grip on integrating Bitcoin payments online, as it’s similarly pivotal in mastering the art of Bitcoin lending. Just as you’d wear armor in a battle, understanding these terms armors you against potential missteps, ensuring your journey in the crypto world is not just safe but also rewarding.

🛡️ Protecting Your Assets: Compliance as a Shield

In the world of Bitcoin lending, playing by the rules isn’t just about keeping the peace; it’s about safeguarding your financial future. Think of compliance as a sturdy shield, one that protects you and your assets from potential threats lurking in the shadows of the digital realm. It’s not unlike having a strong castle wall that keeps the dangers outside while you remain safe, engaging in transactions within the secure confines of regulations. Following these rules might seem like a daunting task, but it’s an essential strategy to ensure that your venture into the world of cryptocurrency lending is both profitable and protected.

Yet, navigating the maze of regulations might feel like trying to solve a puzzle with pieces constantly changing shapes. The key here is to not just understand the current laws but to anticipate changes and adapt swiftly. By staying compliant, you’re not just avoiding the pitfalls that have ensnared others; you’re also building a reputation as a trustworthy partner in the crypto space. This trust is invaluable, attracting more clients to you and opening doors to opportunities that were previously locked. In this fast-paced industry, thinking of compliance as your ally can transform it from a challenge into your biggest asset in securing a prosperous future.

🚦 Red Flags in Bitcoin Lending: What to Avoid

When venturing into the world of Bitcoin lending, it’s crucial to keep an eye out for warning signs that could threaten your investments. First off, dealing with platforms that lack transparency about their operations or where their funds are stored is a huge no-no. Imagine lending your toys to someone without knowing if you’ll ever get them back – that’s a risk you don’t want to take. Also, watch out for lending sites that promise returns that sound too good to be true. Remember the old saying, “if it seems too good to be true, it probably is”? Well, it applies here too. High returns with no risk simply don’t exist in the real world. Moreover, always be wary of lenders who aren’t keen on adhering to local laws. It’s like playing a game without following the rules – eventually, someone’s going to get in trouble. Keeping these pointers in mind, and staying informed about the ever-changing regulatory landscape, like understanding the nuances of mastering bitcoin technical analysis for profitable trading regulatory outlook, can set you on a path away from these red flags and towards a safer investment journey.

📈 Ensuring Success: Best Practices in Regulatory Compliance

To ensure your journey in the world of Bitcoin lending is not only successful but also on the right side of the law, embracing compliance is key. 🌟 Imagine navigating a complex maze; similarly, the regulatory landscape can seem daunting at first. However, by adopting a mindset where compliance is viewed as a protective shield rather than a hurdle, you can safeguard your operations and, more importantly, your reputation. Adopting clear and transparent practices, thorough record-keeping, and ensuring all transactions are above board can turn the daunting task of compliance into your strongest ally.

Equipping yourself with the latest tools and knowledge is crucial. 🛠️ Stay one step ahead by engaging with communities and experts who are also navigating this landscape. Consider the following best practices as foundational pillars for your compliance strategy:

| Practice | Description |

|---|---|

| Regular Audits | Conduct frequent reviews of your transactions and compliance measures to identify and rectify any potential issues early. |

| Education | Keep your team informed about the latest regulatory developments and compliance requirements. |

| Technology Use | Leverage technology to streamline compliance processes, making them more efficient and less prone to errors. |

By embedding these practices into your daily operations, you not only ensure that your Bitcoin lending activities remain compliant but also build a strong foundation for sustainable success. Remember, in the ever-evolving landscape of digital currencies, staying adept and compliant isn’t just about following rules—it’s about setting a standard of excellence and trust.

🔄 Staying Updated: Adapting to Regulatory Changes

In the ever-evolving world of Bitcoin lending, staying agile and informed is key. Imagine you’re navigating a constantly shifting landscape, where new rules and regulations pop up like obstacles in an obstacle course. It’s like playing a video game where the rules change mid-game, and you must adapt quickly to avoid falling behind. This dynamic environment means one has to be on their toes, always ready to embrace change. It’s crucial to think of regulations not as hurdles but as signposts guiding us toward safer and more reliable ways of lending and borrowing. Keeping abreast of the latest developments isn’t just about compliance; it’s about seizing opportunities and dodging pitfalls. Implementing strategies such as regular training for your team, engaging with legal experts, and subscribing to regulatory updates can make this daunting task manageable. It’s akin to having a map and compass in the world of Bitcoin lending, ensuring you can navigate through the regulatory landscape confidently. Embedding a culture that prioritizes staying informed ensures that your practices are not just compliant for today but future-proofed against tomorrow’s challenges. For further insights into integrating cutting-edge practices within regulatory frameworks, consider the bitcoin and its interpretations in economic theories regulatory outlook, which explores how new technologies can be harmonized with existing regulations, ensuring your venture remains on the right side of the law while pushing the boundaries of innovation.