Unpacking Game Theory: Why It Matters for Bitcoin 🎲

Imagine a world where everyone is playing a giant board game, making moves to win more treasure. Now, let’s swap that treasure with Bitcoin, and you’ve got a simplified view of what’s happening in the cryptocurrency world. Game theory is like the rulebook for this game, explaining why people, or players, make certain decisions when they’re up against others, trying to protect their treasure or grab more. It’s a bit like playing chess, where you try to think two steps ahead of your opponent.

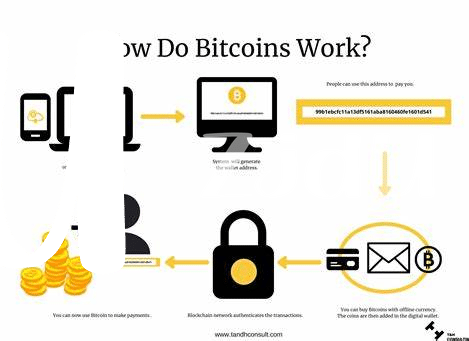

In the realm of Bitcoin, this theory helps us understand the invisible tug-of-war between different players: miners securing the network, traders betting on price moves, and even regular folks deciding whether to buy a piece of the action. Each decision affects Bitcoin’s journey, a bit like choosing whether to move forward, retreat, or protect your position in a strategic game. Here’s a fun way to visualize the key players in the Bitcoin game:

| Player | Role | Motivation |

|---|---|---|

| Miners | Secure the network | Earn Bitcoin rewards 🏆 |

| Traders | Buy and sell Bitcoin | Profit from price changes 💹 |

| Users | Hold or spend Bitcoin | Participate in the new economy 🌍 |

Every move these players make, guided by game theory, not only affects their own fortunes but shapes the future of Bitcoin itself.

Predicting the Moves: How Bitcoin Players Behave 🕹️

Imagine a giant digital game where everyone tries to guess each other’s next move. In the world of Bitcoin, people act like strategic players on a giant game board. Some are holding onto their bitcoins, waiting for the perfect moment to sell when the price skyrockets. Others may try to buy more when prices dip, betting that they will rise again. It’s a bit like a giant poker game where everyone keeps their cards close, trying to outsmart the other players. What makes it fascinating is how different people react to the same information – some may panic sell at the slightest rumor of regulation, while others see it as an opportunity to buy more. This behavior shapes the future of Bitcoin, much like players navigating a complex maze, each move influenced by the actions of others. Understanding this can give us a glimpse into where Bitcoin might head next, especially when strategic moves can change the game overnight. For more insights into how regulation might shape the future of cryptocurrencies, including bitcoin, check out this detailed blueprint https://wikicrypto.news/the-future-of-cryptocurrency-regulation-amidst-dark-web-transactions.

Cooperation Vs. Competition: Bitcoin’s Evolutionary Path 🤝

In the world of Bitcoin, think of a giant playground where everyone has the choice to either share their toys or compete to have the most. On one side, we have individuals and groups who believe that working together can make the Bitcoin ecosystem stronger, safer, and more valuable for everyone involved. This is like creating a big, fun game where everyone plays by the rules and, in the end, everyone wins more. 🤝

On the other side, there’s fierce competition. Just like any game, some players try to outsmart the others to win bigger for themselves. This isn’t always bad; it can actually push innovation and make Bitcoin even more robust. However, finding the right balance is key. Imagine a seesaw, where too much weight on one side could tilt everything. Now the big question is, how do we keep this playtime fair and fun for everyone while still encouraging those big wins? 🏆🚀

The Nash Equilibrium: Finding Bitcoin’s Stable Future ⚖️

In the world of Bitcoin, finding a stable future might sound like walking a tightrope, but imagine if there was a way for everyone to balance just right, ensuring nobody falls off. This is where our story takes us into a realm called Nash Equilibrium, a concept from game theory that sounds fancy but is really about finding a spot where everyone is doing their best and no one wants to change their strategy because it just works. When applied to Bitcoin, this means reaching a point where all the participants, from miners to traders, find their groove in a way that keeps the system humming along smoothly, benefiting everyone involved.

As Bitcoin continues its journey, the strategies of those involved evolve, considering both the carrots and the sticks of the game – the incentives and penalties. This balance is crucial in steering Bitcoin towards a future where it’s not just surviving but thriving. For those looking to dive deeper into aligning their business with these emerging digital currencies, a visit to adopting bitcoin payment solutions for small businesses regulatory outlook might provide valuable insights 🧭🚀. Finding that equilibrium might seem like a challenge, but it’s the key 🔑 to avoiding pitfalls and ensuring Bitcoin’s journey is one of prosperity and stability for all.

Incentives and Penalties: the Bitcoin Game Rewards 🏆

In the world of Bitcoin, players are driven by a system of rewards and penalties, much like the points scored in a game. Imagine you’re playing a video game where you earn coins for making smart moves, and lose some if you take a wrong turn. Similarly, in the Bitcoin universe, miners are rewarded with new Bitcoins when they successfully solve complex puzzles to validate transactions and add them to the blockchain. This incentive is like a golden trophy urging players to keep playing and contributing to the network’s security and growth. However, there’s a catch. As the puzzles become harder over time, the rewards decrease, pushing miners to continuously innovate to stay profitable. This delicate balance keeps the network thriving.

On the flip side, penalties in the form of transaction fees keep everyone honest. Just as you’d spend coins in a game to unlock special abilities, users pay fees to get their transactions prioritized. High fees can deter spam transactions, much like penalty cards in a game discourage unfair play. This system of rewards and penalties ensures that both miners and users act in ways that benefit the entire ecosystem. Below is a table that breaks down this intricate system:

| Action | Bitcoin Game Reward 🏆 | Penalty 🚫 |

|---|---|---|

| Mining (validating transactions) | New Bitcoins + Transaction Fees | Increased difficulty + Lower rewards over time |

| Transaction Processing | Faster transaction verification | Transaction fees (higher fees for prioritization) |

This system not only fuels the competitive spirit but also fosters cooperation among players, encouraging them to work together towards a stronger, more secure Bitcoin network.

Escaping the Traps: Overcoming Bitcoin’s Challenges 🚀

Navigating through Bitcoin’s labyrinth might seem like a daunting task at first. But just like any quest, it’s equipped with its fair share of dragons to slay. Think of Bitcoin’s ecosystem as a vast, complex maze. Within, miners, traders, and investors are not just participants but adventurers seeking treasure. The dragons? They are the challenges Bitcoin faces: from scalability issues that slow down transactions to security threats that loom like shadows. To shine in this digital odyssey, it’s crucial to adapt and arm oneself with knowledge and tools. Understanding the corporate giants investing in bitcoin: a trend analysis regulatory outlook provides insight into navigating these threats and discovering opportunities for stability and growth. 🚀🛡️

As adventurers in the Bitcoin realm, overcoming these challenges requires a mix of bravery and smarts. It’s about learning to anticipate the market’s whims and building a strategy that includes not just the pursuit of profit but also the maintenance of the ecosystem’s health. By promoting transparency, encouraging education, and fostering community collaboration, the Bitcoin network can transform challenges into stepping stones toward a resilient future. Each participant plays a vital role in this collective quest, contributing to a system where incentives align with the well-being of the network. This is the journey toward escaping the traps, where cooperation lights the path and innovation secures the legacy of Bitcoin. 🌐💡