🌍 Understanding Sanctions in Simple Terms

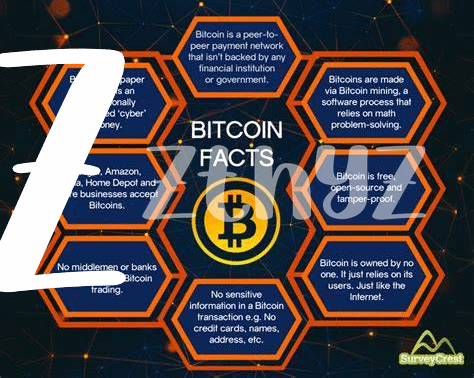

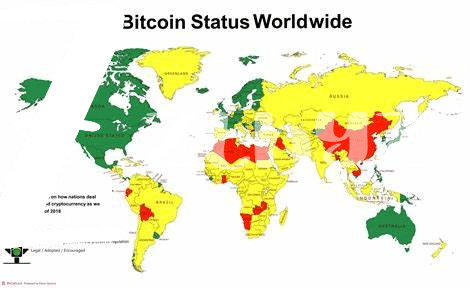

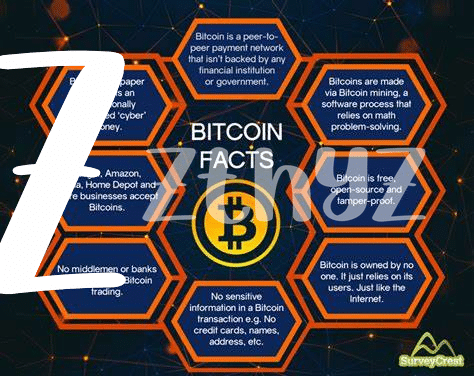

Imagine a playground where kids trade stickers, and one day, the teacher decides that the kid who breaks the rules can’t trade stickers with anyone else. This is a bit like what happens with sanctions on a big adult scale. Countries set rules, and when one doesn’t play nice, others might decide to stop trading with them. This isn’t just about goods like toys or stickers but involves money too. Now, enter Bitcoin, a digital form of money that isn’t controlled by any country or bank. It’s like a secret handshake that lets people trade without needing permission from the teacher, per se. But when sanctions happen, even Bitcoin feels the tremors. People might rush to buy Bitcoin to keep their savings safe or to get around trade restrictions, causing its value to dance like a leaf in the wind.

| Impact Aspect | Description |

|————————–|———————————————————————————————–|

| Economic Sanctions | Countries restrict trading to enforce rules, impacting how traditional and digital money moves.|

| Bitcoin’s Role | Acts as a digital handshake, allowing people to trade under the radar of sanctions. |

| Impact on Bitcoin’s Value| Fluctuations in demand due to sanctions can cause Bitcoin’s value to rise or fall unpredictably.|

💸 How Sanctions Shake the Bitcoin World

When countries decide to give each other the cold shoulder through sanctions, it’s not just the traditional markets that feel the chill; Bitcoin and other cryptocurrencies catch a cold too. Imagine Bitcoin as a bustling marketplace. Now, suddenly, some of the biggest spenders have to tighten their belts or are blocked from entering this market altogether because of these sanctions. This causes ripples across the pond, affecting everyone from the big fish to the smallest minnows in the Bitcoin world. It’s like watching a suspenseful seesaw game where the value of Bitcoin can swing unexpectedly based on who’s in or out of the sanctions club. Amidst this high-stakes game, the global Bitcoin community stays glued to its screens, ready to react at a moment’s notice. This dynamic scenario demonstrates just how intertwined the fate of cryptocurrencies is with global economic movements. For those keen on diving deeper into how policies shape the future of cryptocurrency, especially Bitcoin’s role beyond being just a digital currency, consider exploring this insightful piece — https://wikicrypto.news/election-campaigns-join-the-digital-age-accepting-bitcoin. It sheds light on Bitcoin’s evolving landscape amidst changing political winds.

📉 the Ripple Effect: Bitcoin’s Price Rollercoaster

Imagine you’re on a roller coaster, climbing up slowly and then zooming down fast. That’s a bit like what happens to Bitcoin when countries introduce sanctions. Sanctions are like big, unseen hands that can push the price of Bitcoin up or down. When a country faces sanctions, people there might try to use Bitcoin as a kind of financial lifeboat, hoping it will be stable and safe. This can send the Bitcoin price climbing up, just like our roller coaster. But then, there might be news that other places are tightening their rules on Bitcoin, adding their own kind of sanctions. Suddenly, it’s like our roller coaster has reached the top and is racing down again, making the price of Bitcoin drop.

This up and down movement creates a lot of buzz. People start to talk about it, journalists write stories, and it’s all over social media with lots of 🔄 and 🔍 emojis, trying to figure out what will happen next. This buzz itself can affect the price, sort of like how people screaming on a roller coaster can make it feel even more exciting or scary. Everyone is watching Bitcoin’s every move, trying to guess where the next turn will take us. Through all of this, Bitcoin shows it’s like a boat in a stormy sea, riding the waves of the global economy, sometimes smoothly and sometimes with big, surprising jumps.

🌐 Global Economy Tango with Bitcoin

Imagine a world where money dances to a new tune, and in this rhythm, Bitcoin is a leading partner, swirling across the global economic stage. Countries around the globe, each with its unique beat, make decisions impacting their currencies and how they trade with each other. Enter Bitcoin, a digital currency with a beat of its own, not tied to any single country’s decisions or economic health. This independence makes it an interesting player in the global economy. When traditional markets dip or dive due to policy changes, economic downturns, or unforeseen events, Bitcoin often moves to a different rhythm, sometimes rising in value as investors look for alternatives to traditional safe havens like gold or the US dollar.

However, Bitcoin’s dance is complex and influenced by many factors, including regulatory changes. These changes can either bolster Bitcoin’s position in the global market or challenge it. For a deeper dive into how such regulatory changes, especially those related to Bitcoin forks, can influence the cryptocurrency market, consider reading more about the effects of bitcoin forks on the cryptocurrency market regulatory outlook. Bitcoin’s unique position and the innovative responses from the tech community highlight its resilience and potential to adapt. Its relationship with the global economy continues to evolve, often in surprising ways, influencing not just investors but the financial landscape at large.

🚀 Bitcoin: the Safe Harbor Debate

In the vast ocean of finance, where waves of market trends and economic policies constantly merge and clash, a significant debate emerges around Bitcoin’s role as a potential safe haven, much like a lighthouse in stormy seas. Amidst fluctuating global economies and uncertain times, investors and everyday folks alike have found themselves questioning whether Bitcoin can truly serve as a shelter against financial tempests. This digital asset, born from the depths of technological innovation, presents a peculiar case. It operates outside traditional banking systems, free from the direct influence of governmental policies or sanctions that often stir the waters of the global economy. Yet, its value can swing wildly, influenced by a variety of factors including investor sentiment, regulatory news, and market dynamics. It sparks a conversation: Can Bitcoin be considered a reliable harbor for one’s assets in times of economic uncertainty? This is not merely a theoretical question but a practical issue that impacts decision-making for millions around the globe. As debates continue, it’s clear that Bitcoin and cryptocurrencies represent a new chapter in the saga of financial safety and investment strategy, highlighting the ongoing evolution of money in our interconnected world.

| Aspect | Impact on Bitcoin as a Safe Harbor |

|---|---|

| Market Volatility | Questions Bitcoin’s reliability during economic instability. |

| Decentralization | Offers a potential shield against localized economic policies and sanctions. |

| Global Perception | Varies widely, influencing Bitcoin’s acceptance as a safe investment. |

| Technological Evolution | Strengthens Bitcoin’s position as a modern safe haven asset over time. |

🤖 Tech Response: Crypto’s Innovative Resilience

When the going gets tough, the tough get going, right? That’s exactly how the tech world behind cryptocurrencies like Bitcoin has responded to the challenges thrown their way, including sanctions. Imagine a group of super-smart folks who love puzzles; now, give them a giant puzzle that keeps changing – this is what developers and technology experts are dealing with. They are continuously innovating, creating more secure, stable, and efficient systems for Bitcoin and other cryptocurrencies. This innovation isn’t just about making things better for the sake of it; it’s about ensuring that cryptocurrencies remain a reliable option for everyone, everywhere, regardless of what’s happening in the traditional financial systems or the geopolitical landscape.

One of the most exciting developments? The growth of political campaigns accepting Bitcoin donations. This is not just a novelty; it’s a sign of cryptocurrencies becoming more mainstream, accepted, and importantly, more integrated into everyday activities. For those interested in digging deeper into how this plays out, including the rules and technology that make it possible, you can learn more by exploring the understanding Bitcoin software updates and forks regulatory outlook. This move towards accepting Bitcoin in political campaigns and the ongoing software updates showcase the incredible resilience and adaptability of cryptocurrencies. Through innovation, they’re not just surviving; they’re thriving, making a strong case for being the financial system’s future.