🌍 How Global Regulations Shape Bitcoin’s Journey

Think of Bitcoin as a digital boat sailing the vast ocean of finance. Much like oceans have rules governed by different countries, Bitcoin faces a variety of regulations across the globe. These rules aren’t just signs on the shore; they shape the boat’s course, making sure it sails safely but sometimes making the journey a bit more complicated. For instance, when one country decides to tighten its grip, requiring more information from Bitcoin users, the way Bitcoin operates in that region might change. Developers might need to tweak the software, ensuring it complies with these new rules, much like a captain adjusts the sails to the changing wind. This dance between regulation and operation isn’t just about following rules. It’s about ensuring that Bitcoin remains a trusted and viable option for everyone, from those who use it to buy their morning coffee to the big investors looking for a safe harbor in the stormy seas of the financial market.

| Country | Regulation Example | Impact on Bitcoin |

|---|---|---|

| USA | Requirement for more detailed user information | Changes in software to ensure compliance |

| China | Ban on cryptocurrency transactions | Shift in global Bitcoin trading volumes |

| EU | Introduction of anti-money laundering directives | Implementation of additional verification processes |

This interplay has made Bitcoin’s journey an intriguing tale of innovation, adaptation, and resilience, constantly influenced by the shifting winds of global regulations.

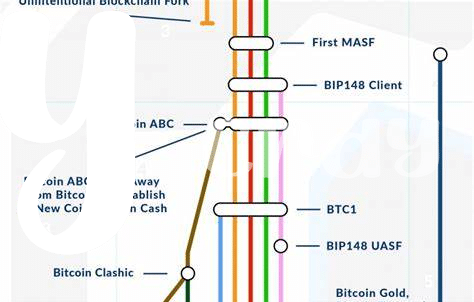

💻 the Evolution of Bitcoin Software and Rules

As the world of Bitcoin grows, so does the need to adapt its underlying software to meet new rules and regulations. Imagine having a rulebook that keeps getting new rules – that’s what Bitcoin developers face. They have to be nimble, constantly tweaking the code to ensure it aligns with the laws of different lands. This isn’t just about keeping Bitcoin running smoothly; it’s about ensuring it stays on the right side of the law. With each change, there’s a ripple effect: improved security measures to protect users’ investments and a potential impact on Bitcoin’s value. It’s a complex dance of code and compliance, where every update is a step toward maintaining Bitcoin’s credibility and trustworthiness. Amidst these shifts, the community plays a vital role, shifting from initial resistance to embracing innovation for a stronger, more resilient Bitcoin. For an in-depth look at how Bitcoin and central banks are interacting in this dynamic environment, check out this article for insights into an unlikely hedge against inflation.

🛠️ Adapting to Change: Technical Challenges for Developers

When rules around Bitcoin shift, think of it like a surprise pop quiz for the people who build Bitcoin’s tools and software. Suddenly, they have to race against time to figure out how to make their creations follow these new rules, sort of like updating a favorite game so it can run on the latest phone models. This isn’t a small task. It means digging deep into the code, the very DNA of Bitcoin software, and sometimes rewriting huge parts of it to ensure everything ticks just right. Plus, these changes aren’t just about checking boxes; they’re about making sure Bitcoin stays secure, efficient, and reliable no matter what. For developers, it’s a challenge that requires both brainpower and creativity. They have to be quick on their feet, ready to learn, and adapt, transforming obstacles into opportunities to make Bitcoin even better. 🧠💡🔄

🔒 Security Enhancements Prompted by Regulatory Standards

As governments around the world start paying closer attention to Bitcoin, they’re making rules to make sure everything is safe and above board. Think of it like setting up guidelines for a playground to ensure everyone plays nice and stays safe. These new rules have pushed the people who create Bitcoin software to add better security measures. It’s a bit like when your phone updates to protect against viruses – but for Bitcoin. This means that everyone from big-time investors to everyday users can breathe easier knowing their digital coins are more secure. Moreover, these upgrades have a cool side benefit: they make Bitcoin more robust against online robbers. For those looking to understand or recover lost digital treasure, detailed guides like recovering lost bitcoin: techniques and advice regulatory outlook can be incredibly helpful, offering insights into safeguarding our digital wallets adding an extra layer of protection in this ever-evolving landscape. From vault-like security to shields against hackers, this is a leap towards making everyone’s Bitcoin journey a bit safer and more reliable.

📈 Impact on Bitcoin’s Price and Investor Confidence

When changes come knocking on Bitcoin’s door through new rules set by folks in charge around the world, it’s like throwing a stone into a pond – ripples spread far and wide. For starters, these regulations can either make Bitcoin’s value shoot up like a rocket or dip like a rollercoaster. 💸🎢 This mostly happens because people buying and selling Bitcoin feel more or less confident depending on what the new rules say. If the rules are strict, some might think, “Hmm, this is serious business,” making Bitcoin seem like a safer bet. On the other hand, if the rules are too tight, people might worry about getting their hands tied, making them less eager to jump in. It’s a delicate balance, like trying to walk a tightrope. 🎪 The fascinating part is watching how this dance between new regulations and Bitcoin’s value plays out, impacting not just seasoned investors but also newcomers eager to join the fray. Below is a simple look at how this dynamic can pan out:

| New Regulation Impact | Bitcoin Price Reaction | Investor Confidence Level |

|---|---|---|

| Positive / Supportive | Potentially Increase | Higher |

| Negative / Restrictive | Potentially Decrease | Lower |

Essentially, this is a story of adaptation, where both Bitcoin and its community of supporters learn to navigate the ever-changing seas of global finance. 🌊 It shows how, in the world of cryptocurrencies, being alert and ready to adapt can mean the difference between thriving and just surviving.

🗣️ Community Response: from Resistance to Innovation

In the world of Bitcoin, change is as constant as the ebb and flow of the tide. Initially, many enthusiasts viewed regulations with a wary eye, fearing they might choke the freedom and innovation that cryptocurrencies are known for. However, this skepticism gradually shifted towards a more constructive attitude. The community began to recognize that, with the right kind of rules, Bitcoin could grow even stronger and more reliable. This realization sparked a wave of creativity among developers and users alike, leading to the development of new software and tools designed to ensure both compliance and security. Such tools not only help in how bitcoin acts as a hedge against inflation regulatory outlook, but they also reinforce the cryptocurrency’s legitimacy in the global financial landscape.

This shift from resistance to innovation wasn’t overnight but a testament to the Bitcoin community’s resilience. As developers dug into the technical challenges, they shared knowledge, creating a ripple effect of improvements across the network. These efforts brought about enhanced security measures, making Bitcoin more robust against threats. Users, on the other hand, started viewing regulations as a shield rather than a sword, leading to increased confidence and broader adoption. The journey from skepticism to embrace showcases the community’s drive to refine and adapt Bitcoin in the face of regulatory challenges, ensuring its place in the future of finance.