🏁 Ethereum Vs Bitcoin: the Starting Lineup

Imagine stepping into a world where you have two superheroes: Ethereum and Bitcoin, each wielding unique powers. On one side, Bitcoin, launched in 2009, shines as the first of its kind, a digital gold that introduced the idea of money you can send over the internet without needing a bank. It’s like having a treasure chest that only you have the key to. On the other side, Ethereum enters the scene in 2015, not just as money but as a magic book that lets you write spells (smart contracts) to create anything from games to voting systems. It’s a whole new world beyond just sending money.

| Feature | Bitcoin (BTC) | Ethereum (ETH) |

|---|---|---|

| Launch Year | 2009 | 2015 |

| Main Use | Digital Gold | Smart Contracts & DApps |

| Key Strength | Store of Value | Flexibility & Innovation |

From their first steps, both have bloomed into giants, each offering something unique. Bitcoin, with its unparalleled security and status as the first, became the go-to for investors looking for a digital store of value. Meanwhile, Ethereum opened doors to endless possibilities with its platform, enabling developers to build a new digital world. As we stand today, both are titans in their realm, but their true worth comes from understanding what each brings to the future’s table.

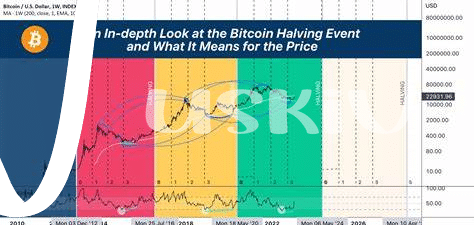

📈 Tracking Their Performance: a Financial Snapshot

Imagine you’re at a race, and in one lane, you have the seasoned champion, Bitcoin, revered by many as the gold standard of digital currency. In the other, Ethereum, the innovative challenger, known not just for its currency but also for its revolutionary platform that enables all sorts of digital agreements, what we call smart contracts. Over the years, both have had their moments in the spotlight, with prices that have soared and dipped, thrilling and chilling investors. Bitcoin has long been the poster child of the cryptocurrency world, with its value reaching astonishing peaks, making headlines and drawing in investors from all corners. However, Ethereum has shown it’s no underdog, with its own impressive surges and a robust platform that goes beyond just transactions, aiming to change how we interact online. Their financial journeys tell tales of triumphs, challenges, and boundless potential, drawing a roadmap of what the future might hold. For a closer look at how these technologies are tackling some of the most pressing issues of our time, including digital fraud and environmental impacts, check out https://wikicrypto.news/environmental-impact-assessing-the-eco-risks-of-bitcoin-vs-ethereum.

💡 Technology and Usability: More Than Just Money

When we peek under the hood, Ethereum and Bitcoin are more than just digital wallets swelling with virtual coins. Imagine Bitcoin as the gold standard of digital currency – easy to understand, a solid investment, a bit like gold in the digital world. It’s like having a vault in your pocket, but instead of gold bars, you’ve got digital coins. Ethereum, on the other hand, is like the Swiss Army knife of the crypto world. It doesn’t just hold value; it’s a tool for creating apps, contracts that automatically do what they’re supposed to do (think vending machines dispensing snacks after you put money in), and even new kinds of digital coins.

🚀🔧 The magic behind Ethereum is what we call “smart contracts.” These aren’t contracts written on paper but codes that run on the blockchain, which is a fancy way of saying a super secure digital ledger that keeps track of everything. It’s like having a robot that never sleeps, making sure everything runs smoothly. Meanwhile, Bitcoin keeps things simpler. Its main job is to be digital money. You can send it, store it, or invest it. It’s less about building new digital toys and more about being a solid, dependable form of digital cash. Both have their strengths, but when it comes to versatility, Ethereum takes the lead, opening up a world of possibilities beyond just buying and selling.

🌍 Community and Support: Who Backs Them Up?

Imagine standing in a grand arena where two champions are surrounded by legions of supporters; that’s a bit like the scene in the world of digital currency, with Ethereum and Bitcoin each boasting a vast network of followers, developers, and investors ready to sing their praises. But it’s not just about who shouts the loudest; the strength of their communities plays a crucial role in driving innovation, security, and adoption. Ethereum thrives due to its ever-evolving technology platform that excites developers and entrepreneurs alike. They see it as a playground for creating applications that could change how we interact with the digital world. Bitcoin, on the other hand, has a fortress of supporters who value its pioneering role in creating a decentralized currency and see it as a digital gold standard. Both communities offer various channels for support and learning, whether through forums, social media, or global meetups, showing that backing these technologies goes far beyond mere investment. If you’re curious about how these technologies vie for the crown in advancing financial inclusivity and pioneering new digital frontiers, dive deeper into the discussion at the future of digital identity verification with bitcoin versus ethereum. It’s not just about the financials but the powerful backing that could sway your investment decision for 2024.

🚀 Potential for Growth: Looking into the Future

When peering into the crystal ball to predict the growth horizon for Ethereum and Bitcoin, it’s like comparing the potential of an innovative tech startup to that of a well-established blue-chip company. Bitcoin, the first and most well-known cryptocurrency, has a rock-solid reputation that speaks of stability and trust, making it a darling among investors seeking a digital version of gold. On the other hand, Ethereum is the young tech whiz, brimming with potential thanks to its flexible platform that hosts a myriad of applications, from games to complex financial transactions. This adaptability could make Ethereum more appealing to a broader audience over time. Both have their paths illuminated by the increasing adoption of digital currencies, but the terrain they tread on could shape their growth remarkably differently. Here’s a snapshot comparison:

| Aspect | Bitcoin | Ethereum |

|---|---|---|

| Foundation | Digital Gold | Smart Contracts Platform |

| Adoption Rate | High among investors | Growing in varied applications |

| Potential Catalysts | Institutional Investment | Technological Advancements |

| Risk Profile | Lower | Higher with greater potential rewards |

Given these facets, diving into either requires one to weigh the promise against the perils, but the allure of being part of the next big wave in finance and technology could tip the scales.

🛡️ Safety Concerns: Keeping Your Investment Secure

When thinking about where to park your hard-earned money, the elephant in the room is always safety. Imagine Ethereum and Bitcoin as two castles. Each has its walls and moats, but the question remains – which one keeps the treasure safer? Ethereum, with its ever-evolving technology, introduces new safety features, making it akin to a castle that reinforces its defenses with every potential threat. On the other side, Bitcoin, with its unmatched track record, stands like an ancient fortress, tested by time and countless sieges, yet still standing. Both have their armies of developers and enthusiasts, continuously working to patch up any vulnerabilities and fend off any attackers. However, like any fortress, there’s always a risk. The digital realm is no stranger to clever invaders. This brings us to the importance of understanding these risks intimately before making a decision. Dive deeper into the nuances with a thorough examination at the role of bitcoin in bolstering emerging market economies versus ethereum, which presents an informed perspective on balancing safety with potential growth, tailored for anyone looking to secure their investment in these digital age marvels. Remember, in the ever-shifting landscape of cryptocurrency, staying informed is your best shield.