The Birth of Bitcoin and Ethereum 🌱

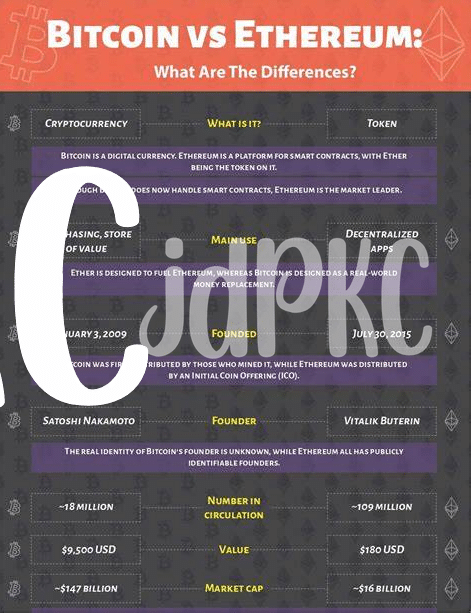

Once upon a time, in a digital world far, far away, Bitcoin emerged as the first successful digital currency. It was introduced in 2009 by someone, or some people, going by the name Satoshi Nakamoto. The idea was simple yet revolutionary: allow anyone anywhere to send and receive money, bypassing traditional financial institutions. This new form of money was built on a technology called blockchain, a digital ledger that records all transactions across a network of computers. Bitcoin’s birth marked the beginning of a new era in finance, aiming to make money more accessible to people around the globe, especially those left out by traditional banks.

Not long after, in 2015, Ethereum was born, conceived by a young programmer named Vitalik Buterin. Ethereum took the idea of blockchain and kicked it up a notch. Instead of just recording transactions, Ethereum’s blockchain is a platform where developers can build their own applications. Think of it as not just a digital currency but an entire digital economy. Its vision was to go beyond Bitcoin’s initial promise, creating a more inclusive financial ecosystem where innovation could flourish, and more services beyond mere transactions could be offered, making the financial system even more accessible.

| Feature | Bitcoin | Ethereum |

|---|---|---|

| Launch Year | 2009 | 2015 |

| Primary Purpose | Digital Currency | Digital Platform & Currency |

| Key Innovation | Blockchain Technology for Transactions | Smart Contracts & Decentralized Applications |

Understanding Financial Inclusion Basics 📖

Before diving deep into the world of digital currencies, let’s unwrap the idea of financial inclusion. Picture a world where everyone, no matter where they live or how much they earn, can access and afford basic financial services. This isn’t just about having a bank account; it’s about ensuring people can save for the future, invest in new opportunities, and protect themselves against tough times without being pushed to the side. In a nutshell, financial inclusion aims to bring everyone into the economic fold, allowing them to participate fully in their economies. This goal might sound ambitious, but with the help of technologies like Bitcoin and Ethereum, we’re witnessing exciting strides toward making money management a possibility for all. For a deeper dive into how these platforms are reshaping financial landscapes, consider exploring more at https://wikicrypto.news/global-tax-trends-for-bitcoin-and-ethereum-explained.

Bitcoin’s Role in Making Money Accessible 💵

Imagine a world where sending money to a friend in another country is as simple as sending a text message, without the need for a bank account or hefty fees. This is the promise that Bitcoin brought into the spotlight. As the first of its kind, Bitcoin opened the door to a new way of thinking about money. No longer did you need to go through traditional, sometimes exclusive financial systems to save, send, or invest your money. With just a smartphone and an internet connection, anyone, anywhere, could become their own bank. This idea was revolutionary because it meant that people who were previously left out of the financial system – maybe because they lived too far from a bank, or didn’t have enough money to open an account – suddenly had access. This aspect of Bitcoin is like finding a hidden path in a walled garden that lets everyone in, not just those with the key to the gate. By empowering individuals to manage their finances independently of traditional banking institutions, Bitcoin has sparked a global conversation on what true financial inclusion looks like. 🌍💡🔑

Ethereum’s Vision for a More Inclusive Economy 💡

Imagine stepping into a world where your digital wallet does more than hold money—it empowers you to create, to share, and to grow alongside a community that values more than just wealth. This is the dream Ethereum brings to the table. By building a platform that’s not just about sending and receiving money but about building and using applications that can change how we work, play, and interact, Ethereum aims to make the economy more inclusive. Anyone with an internet connection can access these applications, breaking down barriers to financial services and giving people the tools they need to build their futures. This vision echoes through its support of decentralized finance (DeFi) applications, aiming to sidestep traditional banking systems and provide direct financial empowerment to individuals. For a deeper dive into how Ethereum’s approach compares, don’t miss this detailed exploration on the history of bitcoin prices and what drives changes versus ethereum, shedding light on the nuances of its strategy for financial inclusion. Through Ethereum, the world of finance isn’t just about transactions; it’s about creating opportunities and access for all 🌏💡.

Comparing Their Global Impact on Finances 🌍

When we look at the world, we see Bitcoin and Ethereum as two giants stepping in very different shoes. Think of Bitcoin as a trailblazer for digital money, a beacon for those who’ve felt left out by traditional banks. It’s simplified cross-border transactions and given people everywhere a new way to store their wealth. On the other side, Ethereum is like a vast playground, allowing for not just money transfer, but also for creating and executing contracts without needing a middleman. This opens doors to finance in ways we’re just beginning to explore, potentially revolutionizing lending, borrowing, and even voting. But who’s making the bigger splash in the global finance pool? Here’s a glance:

| Aspect | Bitcoin | Ethereum |

|---|---|---|

| Market Cap | Larger | Smaller |

| Innovation Scale | Money Transfer | Diverse Financial Tools |

| Accessibility | High | Requires more technical knowledge |

| Global Reach | Broad | Expanding |

So, which promotes financial inclusion more? It’s not just about reaching far but reaching deep into the heart of what makes an economy truly inclusive.

Future Predictions: Who Will Lead in Inclusion? 🔮

Peering into the crystal ball to predict which of these digital financial giants, Bitcoin or Ethereum, will lead the charge in making finance more inclusive is like trying to catch lightning in a bottle. Both have their unique strengths and communities driving adoption. Bitcoin, with its widespread recognition and growing network of users, has made significant strides in offering an alternative to traditional banking systems. On the other hand, Ethereum, with its flexible platform for developing applications, promises not only to revolutionize how we access money but also how we interact with the digital economy at large. The race towards financial inclusion is not just about accessibility but also about building systems that offer equitable opportunities to everyone, everywhere. As we look ahead, it may not be a question of Bitcoin versus Ethereum, but rather, how their combined efforts could redefine the landscape of global finance. For those intrigued by how these platforms navigate the complex world of digital finance regulations, a deep dive into latest updates on bitcoin regulations worldwide versus ethereum can shed light on the evolving space, offering insights into how each is paving the way towards a more inclusive financial future. 🌐💡🔗