The Birth Stories: Bitcoin Vs. Ethereum 🐣

Once upon a time, in the vast world of digital innovation, two groundbreaking ideas were born. Bitcoin, the first of its kind, emerged in 2009, crafted by an enigmatic figure known only as Satoshi Nakamoto. Its creation sparked a revolution, establishing the first form of digital money that operated without the need for a central authority. Fast forward to 2015, and the digital landscape saw the arrival of Ethereum, brainchild of a young prodigy named Vitalik Buterin. Unlike its predecessor, Ethereum was not just about digital money. It introduced a platform designed to execute smart contracts – agreements that run exactly as programmed without any possibility of downtime, censorship, fraud, or interference. The table below paints a vivid picture of their inception stories:

| Feature | Bitcoin | Ethereum |

|---|---|---|

| Year of Birth | 2009 | 2015 |

| Creator | Satoshi Nakamoto | Vitalik Buterin |

| Main Purpose | Digital Currency | Smart Contracts & Decentralized Applications |

This beginning set the stage for two distinct paths in the quest to reshape the digital and financial world.

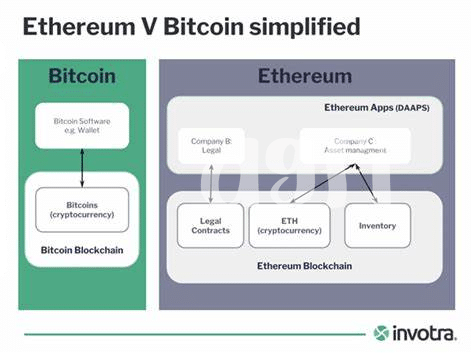

Purpose: Bitcoin’s Money Vs. Ethereum’s World Computer 💡

Imagine two siblings with similar roots but vastly different dreams. The elder, Bitcoin, aspired to revolutionize the way we view and transact with money, envisioning a future where digital currency is king. It’s like having a virtual piggy bank, but instead of coins and notes, you have bits and bytes swirling around the globe, offering a new form of financial freedom. Its creation story is one of mystery and ambition, aiming to remove the need for middlemen in financial transactions and put the power back into the hands of the people.

On the other hand, Ethereum dreamt bigger, seeking to become the world’s computer. Its purpose extends beyond transactions, offering a platform where anyone can create and run programs that execute contracts automatically and securely. This isn’t just about sending and receiving digital money; it’s about building a decentralised internet, where applications aren’t controlled by a single entity but run on a blockchain. This futuristic vision has catalyzed a wave of innovation, leading to developments in decentralized finance and digital art, which you can explore in more depth here.

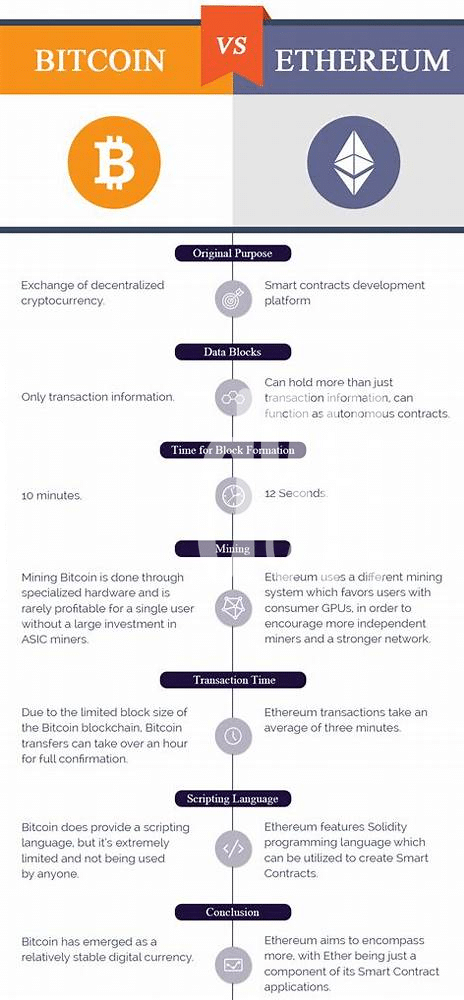

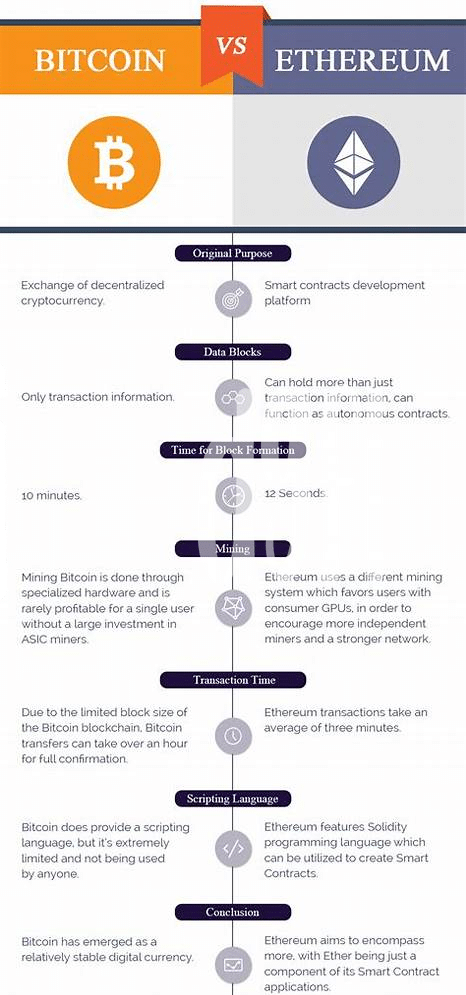

How Transactions Work: Simple Vs. Smart 🔄

In the world of digital money, think of Bitcoin like sending cash through email. Simple and straight to the point. You have a digital wallet, you send Bitcoin to another, and that’s about it. There’s no middleman or extra steps. Just like handing over cash, but in a digital form. Ethereum, however, takes this concept a big step further. Imagine you can not only send money but also attach conditions to it, like a smart contract. For example, “I will pay you this if you do that by this time.” It’s like programming money to act a certain way under certain conditions, making transactions not just exchanges of value but also of agreements and operations.

This difference is significant because it opens up a world of possibilities. Ethereum’s system allows for complex agreements that can automatically enforce themselves once conditions are met. It’s like having an automated middleman making sure everyone sticks to their end of the deal. Meanwhile, Bitcoin keeps things straightforward, focusing on being a secure and easy way to exchange value. Both serve important but very different roles in the digital landscape. As we watch them evolve, their unique approaches to transactions highlight the versatility and innovation within the world of cryptocurrency. 🔄💼🚀

Speed and Scalability: the Race 🏃

In the world of digital currencies, Bitcoin and Ethereum are like race cars on tracks made of the internet – both designed to go fast but in different ways. Think of Bitcoin as a sleek sports car, optimized for one thing: getting from point A to point B as securely as possible. It’s like a well-oiled machine, specifically built for securely transferring value quickly over great distances. However, its emphasis on security and simplicity means it can get bogged down when too many transactions hit the network at once.

On the other side of the race track, Ethereum zips around like a versatile SUV equipped with the latest tech. Its network not only handles transactions but can also run complex contracts and applications. This makes it a bit more flexible than Bitcoin, allowing it to handle a larger variety of tasks. Yet, this versatility comes with its own set of challenges in keeping the race smooth and fast, especially as more cars (or in this case, applications) join in. For a deeper dive into how each platform is gearing up to enhance their speed and tackle the scalability hurdle, take a look at the potential of the bitcoin lightning network in 2024. As we look towards the future, it’s clear both Bitcoin and Ethereum are pushing the pedal to the metal, exploring innovations that may soon allow them to handle more transactions, faster than ever before. 🚀🌍

Security Measures: Locks and Keys 🔒

In the digital playground, where Bitcoin and Ethereum dash around, both networks take their game of hide-and-seek with hackers quite seriously, employing unique strategies to keep their valuables safe. Imagine if your digital money and contracts were kept in a treasure chest; Bitcoin uses a super sturdy lock, a system tried and tested, focusing on keeping that chest as secure as possible from any would-be thieves. Its mantra is simple – fewer moving parts mean fewer chances for things to go wrong.

Ethereum, on the other hand, opts for a more intricate approach, like having a chest with many different compartments, each with its own lock. This setup enables not just money but also smart contracts – deals that self-execute when certain conditions are met – to be stored. However, the more complex the system, the harder it is to keep every lock in check. Both networks are constantly on their toes, upgrading their security measures to outsmart the cleverest of criminals. Here’s a quick comparison in numbers:

| Feature | Bitcoin | Ethereum |

|---|---|---|

| Security Model | Proof of Work | Transitioning to Proof of Stake |

| Known Vulnerabilities | Less, due to simplicity | More, due to complexity |

| Contract Complexity | Limited | High |

Future Visions: Paths Forward 🔮

As we gaze into the crystal ball, it’s clear that Bitcoin and Ethereum are setting off on bold paths into the future. Bitcoin, the digital gold, continues to polish its system, aiming for even more stability and wider acceptance. Imagine walking into your favorite coffee shop and paying for your daily brew with Bitcoin – it’s becoming more possible every day. On the other side of the fence, Ethereum is transforming into a supercharged platform where not only currency but ideas, contracts, and even virtual worlds can live and breathe autonomously. Think of a global computer that anyone anywhere can use, a space where new businesses and services can grow without the need for traditional gatekeepers. Both these visionaries are not just content with the status quo; they are constantly evolving, seeking technologies like the Lightning Network for Bitcoin and Ethereum’s move to a proof-of-stake model to make transactions faster, cheaper, and greener. For those eager to dive deeper and blend the innovative worlds of Bitcoin and Ethereum with the budding universe of non-fungible tokens (NFTs), a step-by-step guide to bitcoin mining for newcomers versus ethereum serves as your digital compass. It offers a sneak peek into navigating the intricacies of mining and collaborations that 2024 holds, opening doors to endless possibilities. As we stand at this technological crossroads, the journey ahead for Bitcoin and Ethereum is not just about competing but about enriching the digital era, crafting a legacy that might one day be as revolutionary as the invention of the internet itself.