🌍 Digging into the World of Bitcoin Mining

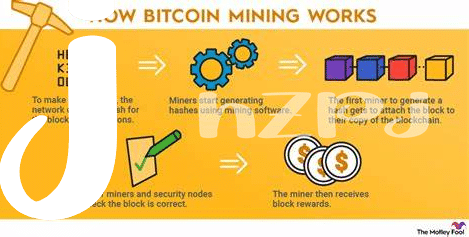

Imagine a huge global treasure hunt where instead of digging the ground with shovels, people use powerful computers. This is the exciting world of Bitcoin mining. Miners from all corners of the Earth compete to solve complex puzzles using their computers. The first one to solve the puzzle gets rewarded with Bitcoin. It’s a digital gold rush that attracts many because of the potential rewards.

The journey into Bitcoin mining isn’t just about the thrill of the chase. It’s also a tale of electricity, as these powerful computers need a lot of it to run. Imagine all the lights in a big stadium turned on at once—that’s how much energy a mining setup can use. Despite the high energy need, the allure of mining Bitcoin continues to grow, drawing more people into its digital embrace.

| Aspect | Description |

|---|---|

| 🔍 Process | Miners solve complex puzzles using powerful computers. |

| 💡 Energy Consumption | High, akin to powering a large stadium. |

| 💰 Reward | Bitcoin, awarded to the first solver of the puzzle. |

⛏ Unearthing the Secrets of Ethereum Mining

Digging a bit deeper into how Ethereum mining works, it’s like being an archaeologist but in the digital world. Instead of shovels and brushes, Ethereum miners use powerful computers to solve complex puzzles. This process is crucial because it helps secure the network and verifies transactions. Every time a miner solves a puzzle first, they get rewarded with Ethereum, kind of like finding a hidden treasure.

Comparatively, Ethereum mining is evolving, especially when we look at how much energy it uses. The energy consumption has been a hot topic, pushing for more environmentally friendly methods. One interesting move is Ethereum’s shift from proof-of-work (PoW) to proof-of-stake (PoS), which significantly reduces its energy footprint. This shift not only makes Ethereum mining greener but also opens up the conversation about sustainable practices in the crypto world. For those curious about how Bitcoin is tackling similar challenges, check out https://wikicrypto.news/behavioral-economics-and-bitcoin-understanding-market-sentiments for some eco-friendly Bitcoin mining innovations and what might lie ahead in mining’s future landscape.

💡 Comparing Energy Use: Bitcoin Vs Ethereum

When we peek behind the curtain to compare the energy munching habits of Bitcoin and Ethereum, it’s a bit like comparing a giant to a smaller giant. 🌍 Both need a lot of power, but Bitcoin, with its older technology, is like a hungry beast, gobbling up more energy than Ethereum. This is because Bitcoin uses a process called “proof of work” that’s like a massive, complex puzzle requiring loads of computer brainpower (and thus, electricity) to solve. 🧠 Ethereum, on the other hand, is moving towards a “proof of stake” method which is like holding a ticket to a lottery for the right to validate transactions, a system that dreams of being greener. ⚡️ This transition aims to drastically reduce the power consumption, making Ethereum’s energy appetite a lot smaller. So, while both are energy-hungry in their quests to keep digital transactions safe and secure, Ethereum is on a path to being a bit friendlier to our planet.

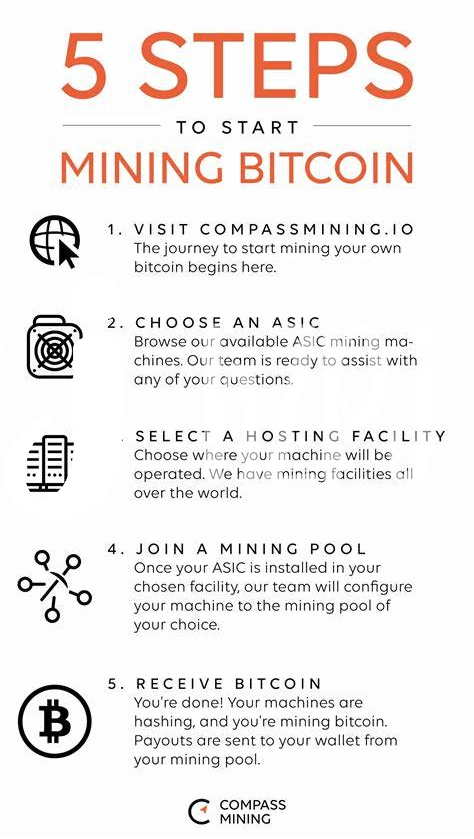

🛠 the Tools of the Trade: Mining Equipment

When we explore the world beneath the surface of cryptocurrency mining, we discover a toolbox that’s as diverse as it is sophisticated. Imagine Bitcoin miners as the old-time prospectors, not with pans in rivers, but armed with powerful computers solving complex puzzles. These tools come in various shapes and sizes, tailored to the job at hand. For Bitcoin, specialized equipment known as ASICs (Application-Specific Integrated Circuits) dominate, designed solely to mine Bitcoin and do it very well. On the other hand, Ethereum miners have typically used GPUs (Graphics Processing Units). These are the same pieces of hardware used to bring to life the most demanding video games, but they can also hunt for Ethereum efficiently.

As we dig deeper, the importance of choosing the right tools can’t be overstated. In this dynamic landscape, staying updated with the latest advancements is crucial. For those who are looking toward sustainable bitcoin mining practices for the future in 2024, keeping an eye on the evolution of mining equipment is essential. Whether it’s ASICs becoming more energy-efficient or GPUs being repurposed for new types of cryptocurrencies, the gear you select impacts not just profitability but sustainability. As we move forward, the mining community’s ingenuity in adapting to these changes will chart the course for how efficiently and responsibly we can unearth these digital treasures.

💰 Calculating the Costs: Profitability Analysis

Digging into the treasure chest of Bitcoin and Ethereum mining isn’t just about finding the most efficient way to get those digital gold nuggets. It’s also a balancing act, where you juggle the initial cash you throw in to set up your mining rig, the electricity that keeps it humming, and the cool tools and tech you need. Imagine setting up a lemonade stand: you’ve got to buy cups, lemons, and sugar, and maybe pay a little to set up your stand in a prime spot. Now, switch lemons for mining rigs and sugar for electricity; that’s your basic mining operation cost. But here’s where it gets interesting: both Bitcoin and Ethereum mining can be like two different lemonade stands in the same neighborhood, each with its own recipe and costs, trying to make the most profit. By crunching some numbers, you can see which stand—or in our case, mining operation—can potentially give you a sweeter deal. Let’s peek at a simple breakdown of some of the costs involved:

| Expense Category | Bitcoin Mining | Ethereum Mining |

|---|---|---|

| Initial Setup | High (Specialized hardware) | Moderate (More versatile hardware) |

| Electricity Usage | High | Moderate |

| Maintenance | Variable | Variable |

| Overall Profitability | Depends on Bitcoin’s market price | Depends on Ethereum’s market price and staking options |

Every miner dreams of hitting it big, but it’s essential to remember that the market can be as unpredictable as guessing tomorrow’s weather. So, while we gear up with our digital pickaxes, keeping an eye on these expenses against the backdrop of fluctuating market prices is key to understanding the real gold mine.

📈 the Future Landscape: What’s Next for Mining

As we look ahead, the buzz around mining is not just about digging deeper into the digital earth but also how we can do so more smartly and sustainably. With the spotlight firmly on Bitcoin and Ethereum, two giants in the cryptocurrency world, the race is on not just for riches but for finding greener ways to reach them. Innovations in technology mean mining equipment is getting more efficient, using less energy to uncover more value. But the real game-changer might just be in the blockchain technology itself, evolving to make mining less of a power-hungry process. It’s a journey from brute force to brainpower, transforming the way we mine and manage our digital treasures.

As this evolution unfolds, staying informed and making savvy decisions becomes crucial for miners and investors alike. Whether it’s about picking the right tools or strategies, knowledge is key. For those looking deeper into Bitcoin and its role in the financial world, understanding bitcoin and its interpretations in economic theories in 2024 can offer valuable insights. This exploration not only sheds light on current trends but also guides choices in securing digital assets, effectively bridging the gap between the mining of today and the digital treasure hunts of tomorrow.