What Is Bitcoin Arbitrage? 🌍

Imagine walking into a market where you can buy apples at one stall for a dollar each and sell them at another for two dollars. That’s essentially what happens in the world of digital currency, where Bitcoin, the star player, can be bought and sold across different online markets at varying prices. This unique opportunity, known as arbitrage, lets savvy traders make a profit by buying Bitcoin where it’s cheaper and selling it where it’s pricier. But, just like any marketplace, the world of Bitcoin trading is vast and filled with its own challenges. To navigate it successfully, you’ll need a keen eye for detail, a bit of tech-savviness, and a dash of daring. 🌎⚙️💼 This process might seem simple at first glance, but it’s a dance that involves quick steps, as Bitcoin prices can change in the blink of an eye. Imagine trying to catch a fluttering butterfly – that’s how fast you need to be. Armed with the right tools and know-how, anyone can attempt to master this digital arbitrage dance, turning the volatility of Bitcoin prices into an opportunity for profit. 🦋💰

| Key Elements | Description |

|---|---|

| Bitcoin | Digital or virtual currency that uses cryptography for security. |

| Arbitrage | The simultaneous purchase and sale of an asset to profit from a difference in the price. |

| Platforms for Trading | Online markets where Bitcoin can be bought and sold. |

| Volatility | Rapid and significant price changes in the market. |

Finding the Right Platforms for Trading 🕵️♂️

Imagine you’re on a treasure hunt, but instead of a map, you’ve got the whole internet at your fingertips. That’s pretty much what it’s like when you’re searching for the perfect places to trade Bitcoin and catch those arbitrage opportunities. Arbitrage, in simple terms, means buying something at a low price in one market and selling it at a higher price in another. Now, finding where to buy low and sell high is like finding hidden gems in a vast digital ocean. Each trading platform has its own set of rules, fees, and, most importantly, prices for Bitcoin. So, your mission, should you choose to accept it, involves diving deep into these digital marketplaces to uncover where the best deals are hiding.

Of course, this treasure hunt is more exciting when you have the right gadgets, or in this case, understanding of what makes each platform tick. Some platforms are known for their lightning-fast transactions, while others might offer lower fees or more security. It’s like choosing the right tools for a mission impossible—every detail matters. Remember, knowledge is power, especially when it comes to navigating the digital seas of cryptocurrency trading. For a deeper dive into understanding the intricacies of Bitcoin’s economics, including its inflation resistance, check out this informative read at https://wikicrypto.news/bitcoin-themed-novels-bridging-finance-and-fiction. It’s a treasure trove of insights that might just give you the edge in your arbitrage adventures.

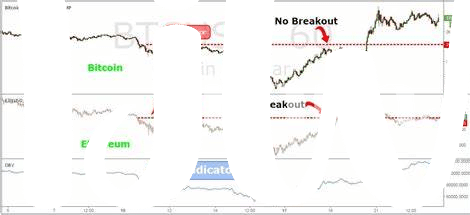

Understanding Bitcoin Price Differences 💸

Ever wondered why the price of Bitcoin seems like it’s jumping up and down like a kangaroo every time you check different places to buy or sell? Well, it’s all about the playground – or in grown-up speak, the market. You see, Bitcoin doesn’t have a price tag that’s the same everywhere. It changes from one online shop (we call them exchanges) to another due to many reasons, like how many people want to buy or sell at that moment, or how fast the exchange can share news of price changes. Think of it as buying ice cream from different shops; one might sell it cheaper because they bought a lot in bulk or another might charge more because they’re the only shop in town. The trick is to find where you can buy low and sell high. Like finding a pair of sneakers cheaper online than in the store at the mall, you can make some extra change if you’re smart about where you buy and sell your Bitcoin. Just remember, prices can change quick as a flash, so keeping a close eye on them is key to catching the best deals. 🏃♂️💨🔍

Essential Tools for Arbitrage Success 🛠️

To dive deep into the world of Bitcoin trading, especially when eyeing the sought-after arbitrage opportunities, one must be well-equipped with a toolkit that promises not just success but also efficiency. At the heart of this venture lies a mix of both high-tech and basic tools; from powerful software that tracks price differences across exchanges in real time 🕵️♂️, to simple spreadsheet programs for record-keeping. Crucial to your arsenal is a dependable cryptocurrency wallet that supports swift transactions, ensuring that you can move quickly when the moment arises. Moreover, an understanding of bitcoin and inflation explained can enlighten you on how broader market dynamics might influence your arbitrage strategy. Access to reliable news sources and market analysis can be your eyes and ears in the fast-paced crypto market, helping you stay one step ahead. Remember, the aim is not just to possess these tools but to master their use, combining speed with savvy to spot and act upon lucrative opportunities before they vanish 💡. Armed with the right tools, navigating the Bitcoin arbitrage landscape can become a more approachable and rewarding journey 🚀.

Managing Risks and Rewards 💡

In the world of Bitcoin, the phrase “no risk, no reward” takes on a whole new meaning. Think of yourself as a surfer. Each wave represents an opportunity to ride towards profit, but there’s always the risk of wiping out. The key? Knowing the waters. Just like surfing, timing and tools are everything in Bitcoin arbitrage. It’s not just about spotting the big waves; it’s about knowing when to paddle out and when to dive under. Tools like real-time data feeds, automated trading bots, and a solid exit strategy can act as your surfboard and lifeguard, helping you navigate the choppy waters.

Here’s a simple breakdown of risk management in Bitcoin arbitrage:

| Risk Factor | Management Strategy |

|---|---|

| Market Volatility | Use stop-loss orders, and set profit targets |

| Transaction Delays | Select fast-executing trading platforms |

| Security Concerns | Implement strong security measures; use reputable exchanges |

| Fees | Calculate fees as part of profit and loss estimations |

Remember, the journey towards mastering Bitcoin arbitrage is a marathon, not a sprint. Equip yourself with the right tools, stay vigilant about the risks, and always be prepared to adjust your strategies. By doing so, you’ll turn those potential risks into stepping stones towards your rewards, one successful trade at a time. 🚀💼

Real-life Examples of Bitcoin Arbitrage Wins 🏆

Imagine a world where you can buy low and sell high all day, every day, taking small bits of profit that add up to big wins. That’s exactly what happened for Alex, a college student who stumbled upon the golden opportunity of Bitcoin arbitrage. Armed with nothing but a sharp eye and a faster-than-average internet connection, Alex began buying Bitcoin on a platform where the prices were slightly lower, and then immediately selling it on another platform where prices were higher. Over the course of a year, with patience and consistency, Alex turned his initial small investment into a sizeable nest egg. Then there’s the tale of Sarah, who utilized automated trading bots to sift through the noise and find arbitrage opportunities 24/7. Her bots worked tirelessly, making small trades that added up, allowing her to fund her dream trip around the world. These real-life stories show how, with the right tools and a bit of savvy, Bitcoin arbitrage can turn the dream of passive income into reality. For those intrigued by the intersection of cryptocurrency and emerging tech, diving deeper into bitcoin and artificial intelligence explained could offer fascinating insights into how AI might further revolutionize this space. 🚀💼🌐