Unpacking Bitcoin: before and after Regulations 📜

Imagine a world where Bitcoin buzzed around, free like a butterfly, fluttering from one investment to another without anyone saying much about where it could or couldn’t go. This was Bitcoin in the early days, a digital treasure that belonged to the world of the tech-savvy and adventurous. No rules meant endless possibilities, and the sky was the limit. Investors hopped on this exciting ride, not knowing where it would take them but thrilled about the potential for unparalleled gains.

Fast forward to today, and the landscape has shifted dramatically. Picture walking into a room where every move you make is watched; that’s Bitcoin with regulations. Governments and financial watchdogs have pulled up a chair at the Bitcoin table, introducing rules that aim to tame the wild beast of cryptocurrency investments. These changes have brought a mix of reactions. Some investors feel safer, knowing there’s a semblance of order in a previously unpredictable space. Others miss the untamed wilderness of the early days, feeling like the essence of Bitcoin as a borderless, free-spirit currency is being diluted.

| Aspect | Before Regulations | After Regulations |

|---|---|---|

| Investor Sentiment | High excitement, high risk | Mixed feelings, seeking stability |

| Market Behavior | Wild, unpredictable | More structured, but with constraints |

| Governance | None | Increasing, with national and international oversight |

Through these changes, the essence of Bitcoin is being tested. Will it continue to be the digital gold for the modern investor, or will it evolve into something more controlled, less wild but possibly safer? Only time will tell.

Navigating the Waves: Bitcoin’s Price Rollercoaster 🎢

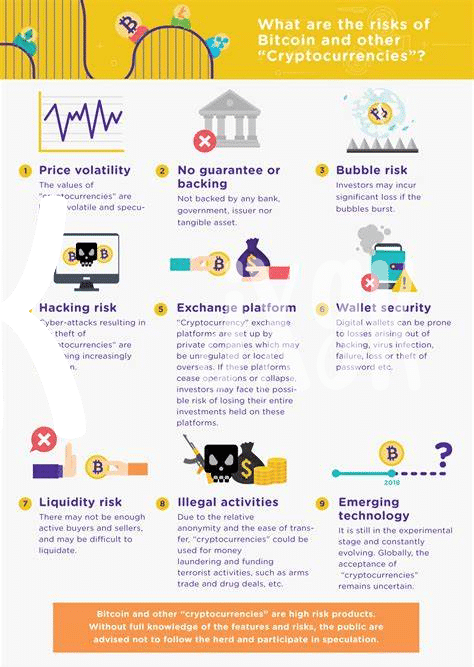

Riding the Bitcoin investment train can feel a bit like being on a wild ride at an amusement park. Imagine climbing to breathtaking heights, only to suddenly plunge into valleys, all within a matter of days, or even hours. This unpredictable journey is influenced by a variety of factors, from groundbreaking technological updates to tweets from influential figures, and, significantly, the shifting sands of regulatory decisions. Each new rule or guideline introduced can send waves across the Bitcoin landscape, causing seasoned investors and newcomers alike to hold their breath as they watch the ripple effect on their digital wallets.

In stepping through this ever-changing world, it’s crucial for investors to stay informed and adapt. With new regulations emerging around the globe, knowing the playing field has never been more important. To keep pace with these changes, an updated playbook is essential. A good starting point is this comprehensive guide that delves into the importance of staying compliant within the ever-evolving Bitcoin investment framework. Check it out here: https://wikicrypto.news/bitcoin-and-irs-ensuring-compliance-in-your-investments Understanding these regulations not only helps investors navigate the market more effectively but also opens up new opportunities for growth, even in uncertain times.

Making Sense of Rules: Investors’ New Playbook 📚

Investing in Bitcoin used to be a straightforward affair. You bought some digital coins, held onto them, and hoped their value would go up. But now, with new rules coming into play around the world, investors need a brand-new approach. Think of it like getting a new rulebook for a board game you thought you knew by heart. This doesn’t mean the game is over; it just adds different strategies to winning. Adapting to these changes means staying informed and understanding how different countries’ rules can affect your investments. Whether it’s stricter regulations calling for more paperwork or new opportunities opening up in other regions, staying agile is key.

As the regulatory landscape evolves, so too does the need for investors to be savvy and flexible. The days of one-size-fits-all Bitcoin strategies are behind us. Now, it’s about customizing your investment approach to navigate these changes effectively. Think of it as tailoring your investment wardrobe to fit the season’s latest trends. Keeping up with regulatory news and understanding its global impact can help investors avoid pitfalls and identify new opportunities. Whether it means diversifying holdings or using more advanced tools for managing investments, the goal remains the same: stay ahead in the game by playing smarter, not harder. 🌐💼🚀

Globetrotting with Bitcoin: Impact Across Borders 🌍

As Bitcoin dances across the global stage, its movements are not solo. Various countries are stepping in with their own set of rules, making the Bitcoin journey a diverse experience depending on where you are. 🌍 Imagine you’re a traveler, each country you visit has its own customs and language; similarly, Bitcoin faces unique regulatory climates as it crosses borders. Some countries welcome it with open arms, seeing it as a path to innovation and financial inclusion, while others approach with caution, imposing strict regulations to safeguard their economies and citizens.

In this light, investors and enthusiasts must stay informed and agile. The different regulatory environments influence Bitcoin’s acceptance and value, creating a patchwork quilt of challenges and opportunities. For those looking to understand more about how regulatory landscapes shape the investment scene, bitcoin versus fiat currency investment strategies offer a deep dive into navigating these complexities. As rules evolve, so too must the strategies of those looking to invest in Bitcoin, making a keen understanding of international perspectives crucial. 📚💡

Future Forecasts: Predicting Bitcoin’s Regulatory Path 🧐

As we gaze into the crystal ball of Bitcoin’s future, regulatory landscapes appear to be as shifting and diverse as the countries that attempt to tame this digital beast. The journey of Bitcoin from a niche internet oddity to a mainstream financial asset has caught the eyes of regulators worldwide. Some countries may go the route of embracing Bitcoin, seeing it as an opportunity for innovation and economic growth, weaving favorable laws that encourage its adoption. Others might tread cautiously, tightening the regulatory leash to ensure strict oversight, fearful of potential risks to financial stability and consumer protection. This dichotomy creates a global patchwork of regulations that could significantly influence Bitcoin’s accessibility and attractiveness to investors.

| 🌍 Country | 📈 Approach |

| Country A | Friendly, with tax incentives |

| Country B | Restrictive, with heavy scrutiny |

Amid these regulatory ebbs and flows, savvy investors are recalibrating their compasses. They are learning to read the signs, understanding that being aware of upcoming regulations could mean the difference between catching a favorable tide or being caught in a storm. It is becoming increasingly clear that the future of Bitcoin investment will not just be shaped by market forces but by how effectively investors navigate the regulatory waves that lie ahead. Adapting to this evolving legal landscape will require a mix of vigilance, flexibility, and, perhaps most importantly, a willingness to venture into uncharted waters.

Adapting Strategies: Smarter Investing in Uncertain Times 💡

In the ever-shifting sands of the Bitcoin market, investors are constantly looking for solid ground. With the introduction of new regulations, the playbook for investing in Bitcoin has changed, and staying ahead means adapting quickly. 🌍💡🎢 Understanding the complex landscape of Bitcoin investment now requires a keen eye on global regulatory trends and a flexible approach to investment strategies. For those looking to navigate these uncertain waters, arming yourself with knowledge is key. This includes getting familiar with how different regions are shaping the future of Bitcoin trading and the impact these changes may have on your investment choices. It’s not just about what to invest in, but how to protect those investments from unforeseen regulatory shifts. A great place to start is by exploring bitcoin and payment channels and the blockchain, which offers insights into managing your Bitcoin investments wisely, taking into account the latest tax implications and strategic moves to maximize returns. Adapting your investment strategy in these uncertain times means staying informed, flexible, and ready to pivot your approach as the landscape evolves. This not only helps in safeguarding your investments but could also open up new opportunities in the ever-exciting world of Bitcoin.