🌟 the Enduring Luster of Gold as an Asset

Gold has always had a special place in people’s hearts and wallets. For thousands of years, this shiny metal has been a symbol of wealth and stability. Imagine the kings and queens of old, their treasure chests overflowing with gold coins. Even today, in our modern world, gold hasn’t lost its glamour. It’s like that reliable friend who’s always there, especially when times get tough. When the stock market feels like a rollercoaster or when currencies seem as flimsy as paper, gold stands firm. People trust it to keep its value, making it a go-to choice for saving and passing down through generations.

What makes gold so magical? It’s not just its beauty. Gold is rare, which makes it valuable. It’s also tough. It doesn’t rust or tarnish, sitting pretty in a vault or around your neck for ages. Here’s a bit of fun fact in a table form to show why gold continues to shine across ages:

| Feature | Impact |

|---|---|

| Rarity | Makes gold valuable as it’s not easy to find |

| Durability | Gold lasts forever, never losing its luster or corroding |

| Trust | Generations have relied on gold as a stable store of value |

Moreover, gold’s ability to keep its cool while other investments zigzag has always made it a favorite during uncertain times. It’s this enduring appeal that ensures gold continues to play a central role in investment strategies, embodying a blend of tradition, beauty, and financial security that few other assets can match.

💡 the Birth of Cryptocurrency: a Digital Revolution

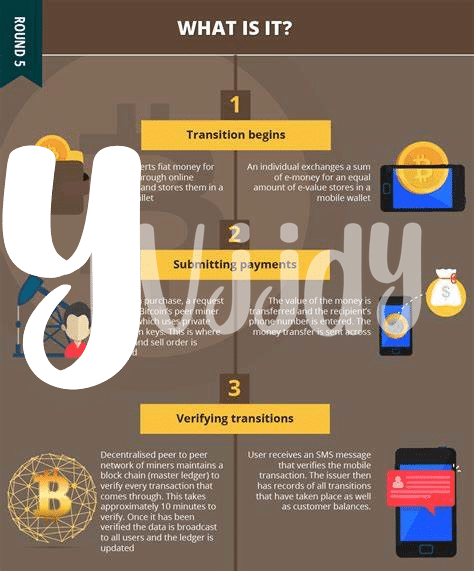

Once upon a time, in a not-so-far past, money went digital, and it changed everything. Imagine a world where you can send money across the globe without waiting days for it to arrive or paying hefty fees. That’s what happened when cryptocurrency made its grand entrance. It was like magic – money that exists purely online, secured by complex puzzles instead of locked in a physical vault. This new kind of money isn’t just a trend; it’s a revolution in how we think about and use money.

But how did it all start? It began with Bitcoin, the first of its kind, creating waves as the pioneer of this digital treasure. People worldwide began to see its potential not just as another way to pay for things but as a new type of investment. Think of it like planting a digital seed and watching it grow into a money tree. To know more about navigating this new digital finance landscape, especially regarding investments and ensuring you’re playing by the rules, check out innovating finance: how Bitcoin payment channels enhance efficiency. This leap into the digital world isn’t just about making payments easier; it’s about reimagining the future of money.

🏦 Traditional Vs. Digital: Shifting Investment Paradigms

For years, the idea of investing felt like a world reserved for gold coins and stock market ticks, solid and tangible, or at the very least, paper-based and filed away in a physical vault or folder. But then came a wave of zeros and ones, a digital revolution that turned the concept of value on its head. Imagine a world where your safest assets live not in a bank or under your mattress, but in the cloud, protected by complex codes rather than locks and keys. This shift from the traditional to the digital has sparked a lively debate among investors, both young and old.

On one side, gold stands as the steadfast guardian of wealth, its value shining through centuries of economic changes and upheavals. On the other, cryptocurrencies, led by the trailblazing Bitcoin, offer an exciting, if somewhat unpredictable, frontier of investment possibilities. These digital currencies represent not just a new way to store value but also a radical shift in how we think about money itself. As we stand at this crossroads, the conversation between past and future investments becomes ever more fascinating, shaping the way we plan for tomorrow, today.

📈 Analyzing Volatility: Gold and Bitcoin’s Wild Ride

Imagine going on a roller coaster, but instead of seats, you’re riding with your investments in gold and bitcoin. Gold has always been like a well-trained horse, steady and dependable. It might have its moments of excitement, but it doesn’t stray too far from the path. Then there’s bitcoin, the new kid on the block—more like strapping yourself to a rocket. Its price can skyrocket or plummet before you’ve had your morning coffee. This unpredictability, or volatility, makes both gold and bitcoin fascinating. Gold’s long history offers a sense of security, a haven in stormy economic times. But for those craving adventure and potentially huge rewards, bitcoin calls. It’s digital, borderless, and represents a shift from traditional assets. However, this wild ride comes with its risks. As you dive deeper into the world of digital investments, it’s wise to arm yourself with knowledge. A great starting point is understanding bitcoin taxation guidelines investment strategies, ensuring that you’re not only riding the waves but doing so safely, with your eyes wide open to the ups and downs ahead.

🌍 Global Perspectives: Acceptance and Regulation

Around the world, different countries have varying attitudes towards gold and Bitcoin, shaping how people see and use these assets. Gold has long been embraced for its stability and is often seen as a safe bet during turbulent times. Bitcoin, however, is the new kid on the block. Its digital nature means it can quickly move across borders, making it an attractive option for those looking to invest without the constraints of traditional banking. But, not every country is ready to welcome Bitcoin with open arms. Regulation of this digital currency is a hot topic, with some governments implementing strict rules to control its use, while others are still trying to figure it out.

| Country | Gold Acceptance | Bitcoin Regulation |

|—————-|—————–|———————-|

| USA | High | Moderately Regulated |

| China | Very High | Strictly Regulated |

| Switzerland | High | Moderately Regulated |

| India | Very High | Emerging Regulations |

| Australia | High | Moderately Regulated |

This table reflects how gold is generally accepted worldwide due to its long history as a valuable asset. On the other hand, Bitcoin’s regulation varies significantly, indicating a split in global perspectives on digital currencies. The tug-of-war between embracing innovation and ensuring security is at the heart of the debate on Bitcoin regulation. As we move forward, how countries navigate these waters will significantly impact the global acceptance of digital currencies and their potential as modern safe-haven investments.

🚀 Future Projections: Emerging Trends in Safe Havens

As we catch sight of the horizon, the landscape of safe haven investments is changing before our eyes. Once upon a time, the sheer mention of a secure investment would bring images of shimmering gold bars to mind. Today, however, the digital revolution introduced by cryptocurrencies like Bitcoin is challenging traditional views and molding new ones. The enchanting journey from physical assets to digital treasures has paved the way for bitcoin and payment channels and the blockchain, reflecting a blend of tradition and innovation in the investor’s toolkit. Navigating through this evolution, one can’t help but wonder about the nature of future safe havens. Will digital assets continue to rise and shape the backbone of secure investing? Or will a new form of asset emerge, one that combines both the tangible assurance of gold and the agile potential of Bitcoin? As global acceptance and regulatory landscapes evolve, these questions edge closer to answers, promising a future rich with diverse and dynamic safe havens for investors around the world.